Bitcoin (BTC) Sees Another Hash-Ribbon Inversion, Why Investors Need to be Cautious?

Over the last month and more, the Bitcoin (BTC) hashrate has been on the downturn with miners struggling to continue their operations amid the strong correction. The Bitcoin network is likely to see its largest mining difficulty adjustment in over a year.

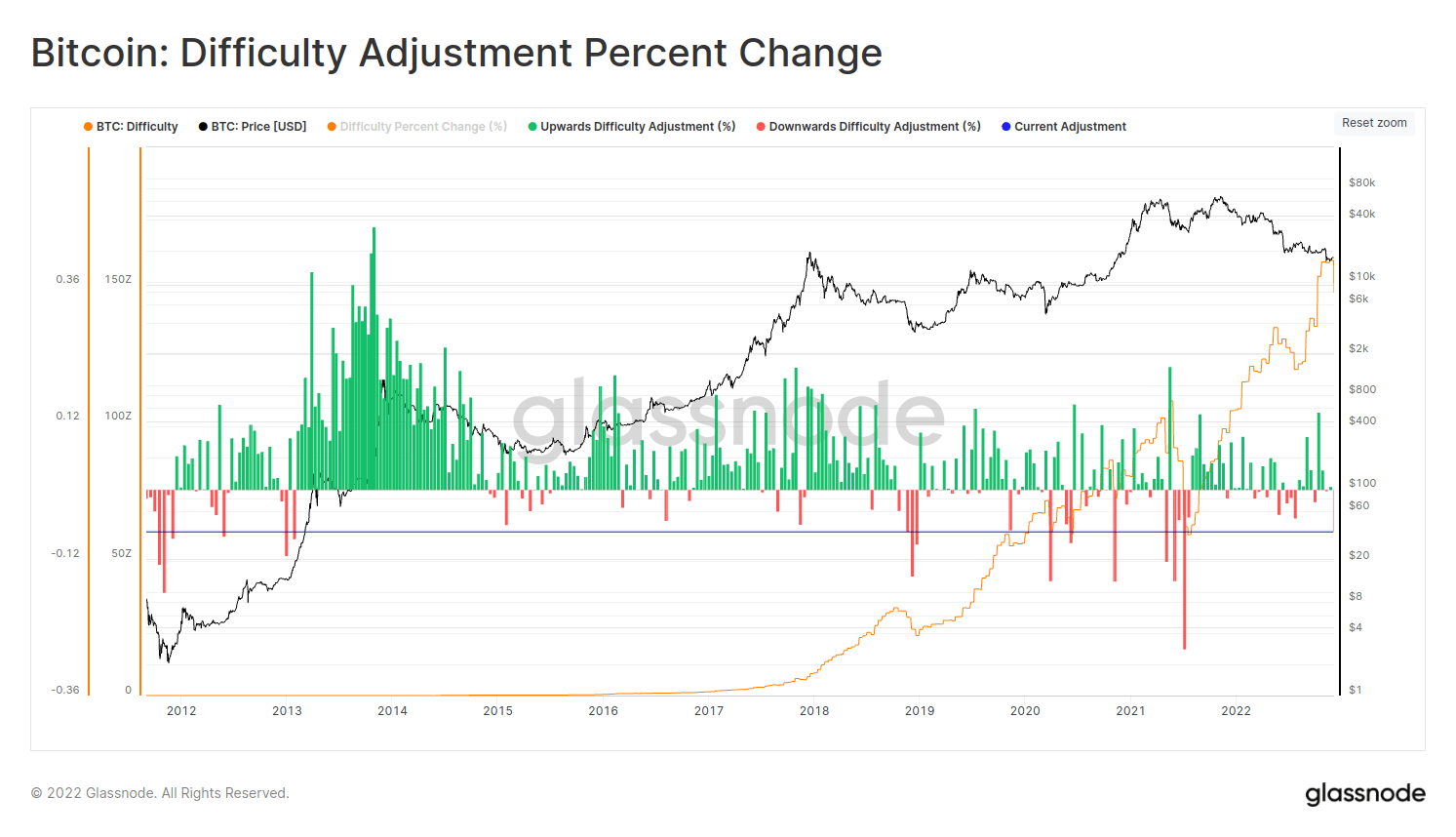

On-chain data provider Glassnode reports: “The #Bitcoin protocol has just decreased mining difficulty by -7.3%, the largest downwards adjustment since July 2021. Given depressed coin prices, rising energy costs, and debt burdens, the mining industry is under extreme stress”.

Additionally, the has-ribbon indicators suggest that Bitcoin might be in for another major correction. In its report, Glassnode mentions:

“This difficulty adjustment is in response to falling #Bitcoin hash-rate. This has resulted in yet another inversion of the Hash-ribbons, as the 30DMA dives below the 60DMA. The last hash-ribbon inversion occurred in early June 2022″.

As we can see from the above image, the last two times when the hash-ribbon was inverted, Bitcoin faced a significant price correction. However, that’s not always been the case.

Bitcoin Capital Inflows Flushed Out

Bitcoin saw a brief rally last week on Wednesday on the news that the Fed would be slowing down on the interest rate hikes going ahead. As a result, the BTC price surged all the way to $17,500. However, it has retraced since then and has again moved closer to $17,000.

On the downside, $16,000 is strong support. Let’s take a look at the Bitcoin realized cap which shows the net sum of capital inflows and outflows. The Glassnode report notes:

In the wake of one of the largest deleveraging events in digital asset history, the #Bitcoin Realized Cap has declined such that all capital inflows since May 2021 have now been flushed out, signaling a capital reset is underway.

On the other hand, Bitcoin micro addresses have also shown extremely unusual behavior. After showing early signs of accumulation since the news of the FTX implosion last month, the number of addresses has dropped rapidly in the last two weeks.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- $2T Barclays Explores Blockchain For Stablecoin Payments and Tokenized Deposits

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs