Bitcoin (BTC) Volatility Lowest Since July 2020, History Suggests Parabolic Rally

The world’s largest cryptocurrency Bitcoin (BTC) has shown almost little to no movement over the past week and so, with volatility hitting a new low. As per the on-chain data, Bitcoin’s volatility has never been this low since July 2022.

Also, as per the historical trends, the Bitcoin (BTC) price has entered a strong rally every time the volatility has been subdued. Crypto analyst CrediBULL crypto noted: “8 out of 9 times volatility was this low we saw expansion to the upside. The one time that we didn’t was after 6 months of consolidation that followed the 2017 parabolic blow-off top”.

As of press time, Bitcoin is trading 1.73% down at a price of $28,881 with a market cap of $561 billion. However, if history is to repeat itself once again, This Bitcoin price consolidation could serve as fuel for the next BTC price rally. Furthermore, new players have continued to join the Bitcoin ecosystem with 5 million wallets created over the last year.

Over the past year, more than 5 million wallets holding #Bitcoin have been created. Imagine the entire population of Costa Rica, Palestine, or Singapore buying $BTC in just 12 months. pic.twitter.com/9OrnJYEpHI

— Ali (@ali_charts) July 31, 2023

Bitcoin Price Drop Likely Ahead?

The major exploit of DeFi platform Curve Finance has led to negative sentiment and selling pressure across the broader crypto market. Along with Bitcoin (BTC), altcoins have also been seeing selling pressure correcting 2-5% more in the last 24 hours.

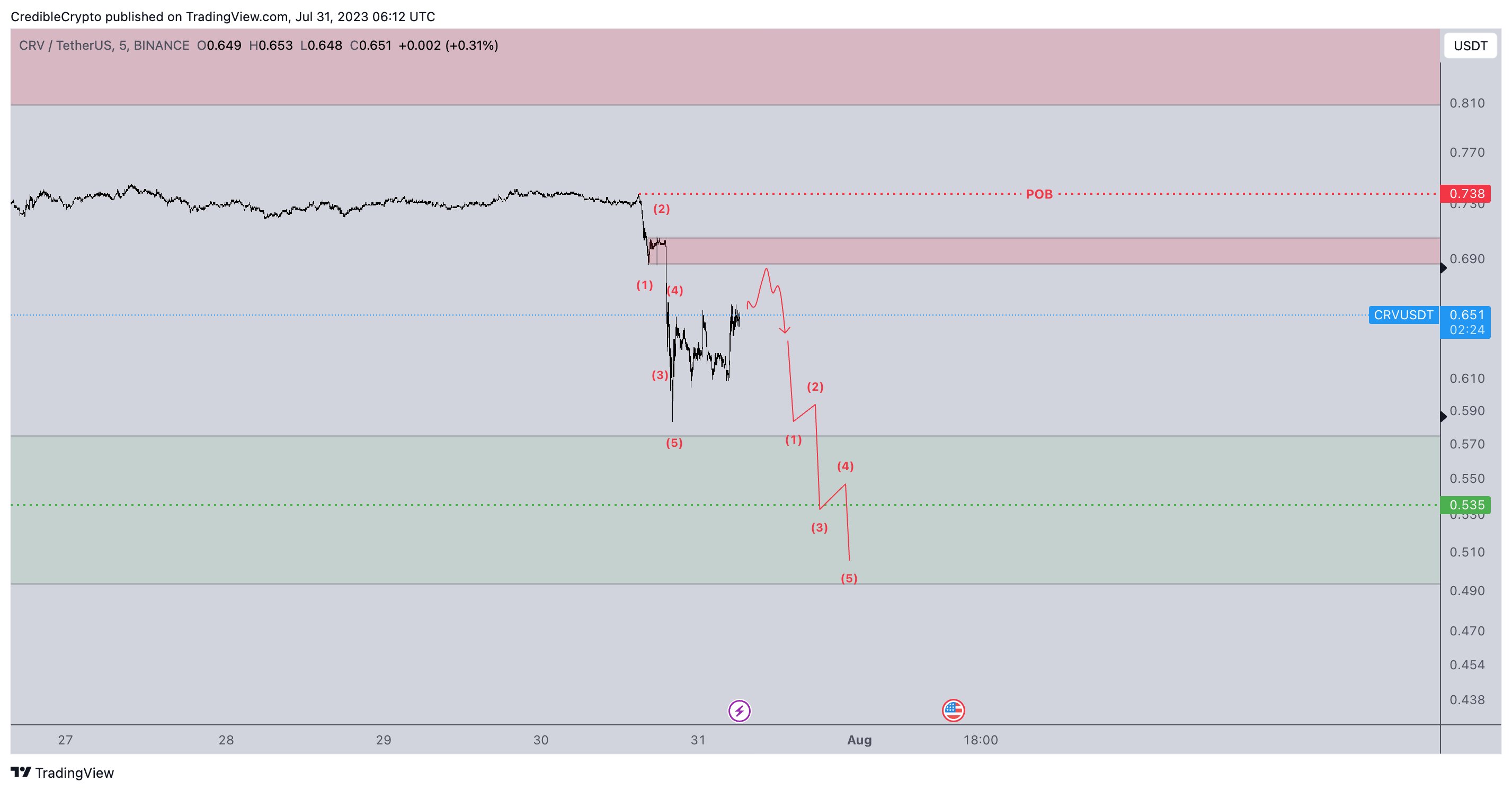

On the other hand, with the BTC price slipping under $29,000, the selling pressure is obvious which can push Bitcoin to its next support level of $27,500. CrediBuLL Crypto explains: As of now, the recent $CRV events seem to be settling down, but there are still a couple of wild cards that need addressing within the next 48-72 hours before the focus can return solely to the charts. From a purely technical perspective, the drop isn’t over yet.

If the price manages to rise above the RED ZONE and the point of breakdown (POB), then it might signal the completion of the drop. However, until then, there’s an expectation of further downward movement into the GREEN zone.

- Bitcoin Shows Greater Weakness Than Post-LUNA Crash; Is a Crash Below $60K Next?

- XRP Tops BTC, ETH in Institutional Flows As Standard Chartered Lowers 2026 Forecasts

- Bitcoin vs. Gold: Expert Predicts BTC’s Underperformance as Options Traders Price in $20K Gold Target

- CLARITY Act: White House to Hold Another Meeting as Crypto and Banks Stall on Stablecoin Yield Deal

- Bitcoin as ‘Neutral Global Collateral’? Expert Reveals How BTC Price Could Reach $50M

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?