Bitcoin (BTC) whales continue to increase their holdings amid market bloodbath

Bitcoin (BTC) price tumbled below $42,000 to record a new four-month low. The market sentiments have turned red as retail buyer seems to be panic selling. Market analysts have predicted a price bottom at around the $40K mark, but that hasn’t deterred whales from accumulating more Bitcoin amid the market blood bath. BTC made a minor recovery above $42K and currently trading at $42,304 with a 1.78% decline in the past 24-hours.

Bitcoin whales have added over 8,000 Bitcoin in the past 24-hours.

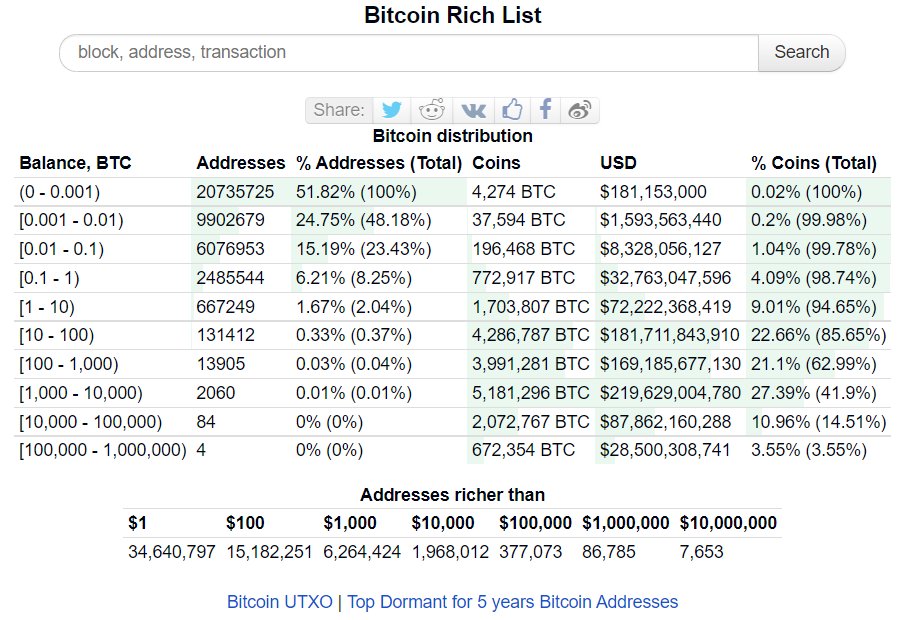

According to the BTC accumulation data by Bitinfocharts top 100 addresses on the Bitcoin rich list (a single address holds between 9,867 and 265,000 BTC), three of them have net increased their holdings of more than 1,000 BTC today.

Bitcoin had a rough bearish patch post-October all-time-high, and as prices continue to tumble to nearly 40% from the top, critics have come out to claim $69K to be market top of the bull cycle. However, looking at the current whale accumulation and the fact that the retail market’s impact on the market has been deteriorating, whales buying should be a perfect indicator of the price momentum.

Crypto analyst predicts $100K price top

A prominent crypto analyst who goes by the name of Credible Crypto released an analysis amid market turmoil yesterday explaining why BTC is yet to hit a market top and why it could be months away at this point. While he acknowledged the point that every bull cycle in history has seen a market top by December followed by a bear cycle, he pointed that looking at the price retraction pattern over the years, the downfall from the ATH never touches the previous cycles ATH. However, currently, if we consider $69K as the market top and expect an average 80% decline it will be lower than 2017 ATH.

He also pointed that with each bull cycle and the new influx of investors the market has become relatively stable so the decline from the top is also retracing. He went on to point that BTC could see another price surge up to $100K before making a retrace.

- XRP News: Ripple Expands Custody Services to Ethereum and Solana Staking

- Bernstein Downplays Bitcoin Bear Market Jitters, Predicts Rally To $150k This Year

- Breaking: Tom Lee’s BitMine Adds 40,613 ETH, Now Owns 3.58% Of Ethereum Supply

- Bitget Partners With BlockSec to Introduce the ‘UEX Security Standard’ Amid Quantum Threats to Crypto

- Breaking: Michael Saylor’s Strategy Buys 1,142 BTC Amid $5B Unrealized Loss On Bitcoin Holdings

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks

- Pi Network Price Outlook Ahead of This Week’s 82M Token Unlock: What’s Next for Pi?

- Bitcoin and XRP Price Prediction as China Calls on Banks to Sell US Treasuries

- Ethereum Price Prediction Ahead of Feb 10 White House Stablecoin Meeting

- Cardano Price Prediction as Midnight Token Soars 15%

- Bitcoin and XRP Price Outlook Ahead of Crypto Market Bill Nearing Key Phase on Feb 10th