Are Bitcoin [BTC] and Stock Market Bears in Denial? Bulls Take Control at these Prices

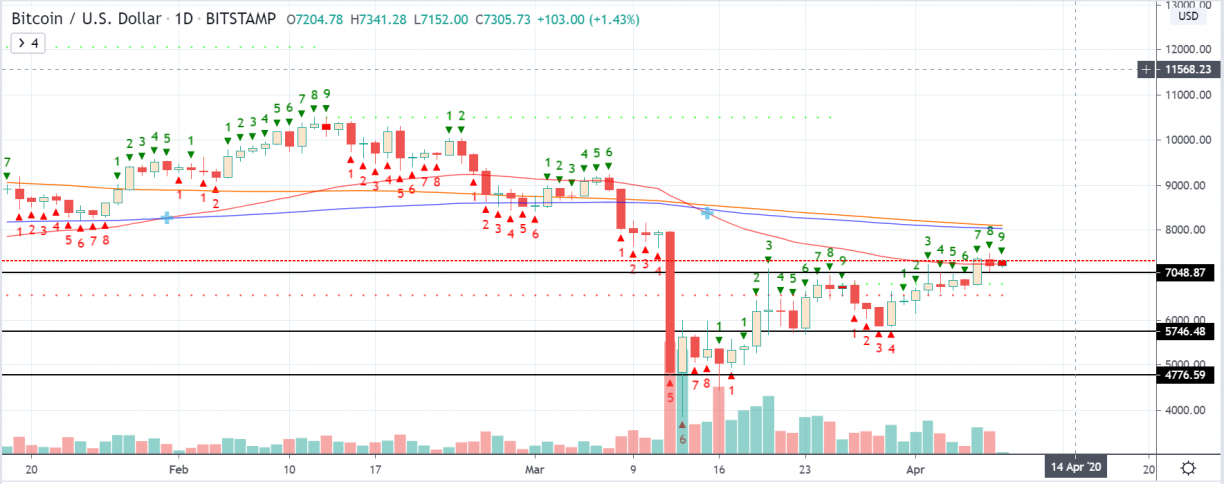

Bitcoin [BTC] price continues to its’ uptrend as it breaks above the previous range resistance around $7000. The price is in a short-term bullish trend with higher-highs and higher-lows.

Currently, we are not a daily green 9 w.r.t. TD sequential analysis. Hence, the probability of a reversal is strong as we head into Wednesday with more than 18 hours left.

If it continues to hold support above $6,900, the trend is likely to remain intact. The next area of resistance for bulls is around $7,800-$8,200.

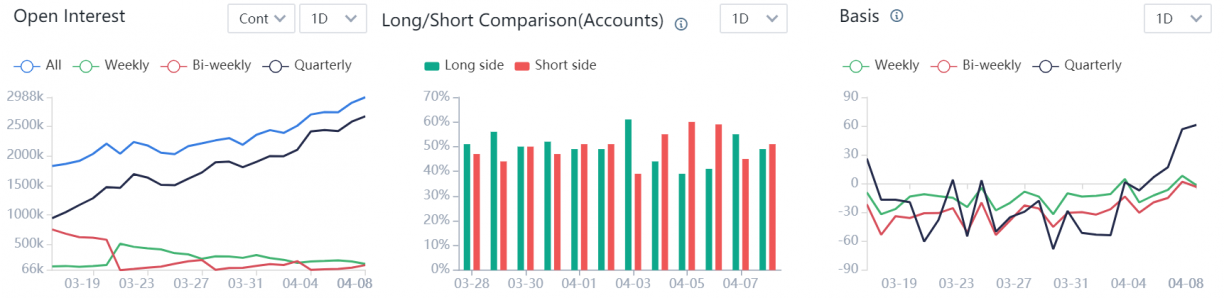

Nevertheless, the bears on BitMEX are still not convinced of a bull market as the funding rate remains negative. Moreover, on Huobi Derivatives Market, the Open Interest is increasing along with the BTC basis as well, signalling a return of long interest. However, the accounts with bear sentiments seem to be in larger numbers than bulls.

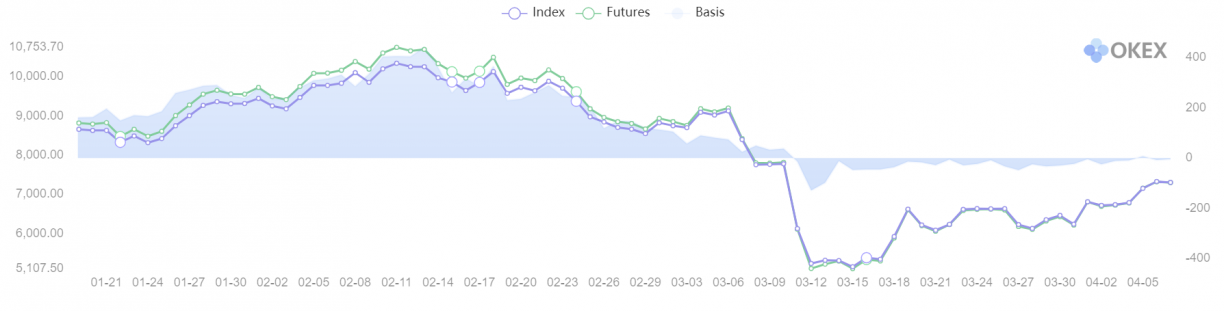

Similarly, on Okex, the BTC basis has been in an uptrend since the fall in mid-March. Nevertheless, the predominant position on the exchange on continues to bet on a correction.

On SPX Correlation

The stock markets showed signs of bearish reversal last day after days of a shocking uptrend. The bears seem to be hurt worse on the wall street than in the crypto markets. As the crisis due to COVID-19 continues to linger in the west, the economic stimulus by Governments seems to be the reason behind uptrend.

The SPX index is trading at $2650, after the swing low at $2190 in the recent panic crash. According to, Thomas Lee, financial analyst and partner at Fundstrat, the stocks are out-performing the ‘dead-cat’ bounces from the last three times.

The point of reversal of a bounce in 1987, 2002 and even in 2008 was technically below current levels. He tweeted,

S&P 500 passed 2,475 and 2,600, so stock not “repelled” by retracements ceiling (25%/33%) that led retest lows ’87, ’02 and ’08.

– but moving up 2,793 (50% retrace) is the market confirming recovery.

Fundamentally, the sentiments are inclined towards bullish safe-haven aka Bitcoin and Gold, along with bearish equity markets. Nevertheless, due to the BTC correlation with the stock markets, the price action in the next few weeks will define the true characteristics of Bitcoin.

How do you think these assets will perform in the short to mid-term? Please share your views with us.

- Jane Street and Abu Dhabi Wealth Fund Mubadala Increase Holdings In BlackRock’s Bitcoin ETF

- FOMC Minutes Drop Tomorrow: Will Crypto Market Rally or Face Fed Shock?

- BlackRock Amends Filing For Staked Ethereum ETF, Eyes 18% of Staking Rewards From ETH Fund

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k