Bitcoin Crash Incoming? Tom Lee Backs Peter Brandt’s 50% Decline Prediction Despite Strong ETF Inflows

Highlights

- BitMine’s Tom Lee and veteran trader Peter Brandt both warn that Bitcoin could face a 50% correction.

- Tom Lee cautions that BTC remains a high-volatility asset despite record ETF inflows.

- He noted that a 20% stock market pullback could trigger a 40–50% Bitcoin drop.

BitMine’s Tom Lee and veteran trader Peter Brandt have both warned of a potential 50% correction in BTC. This has led to speculation of a possible Bitcoin crash despite record inflows into its ETFs.

Tom Lee Warns Bitcoin Could Still Halve in Value

In a recent interview with crypto investor Anthony Pompliano, Tom Lee, chairman of BitMine and head of research at Fundstrat Global Advisors, cautioned that Bitcoin remains highly volatile despite its strong inflows.

I sat down with @fundstrat to discuss whether AI is a bubble, why this may be the most hated stock market rally in history, and how misleading economic data shapes investor sentiment.

Tom also shares his latest views on Bitcoin, Ethereum, and why innovation in crypto markets is… pic.twitter.com/5GSKz5V1X0

— Anthony Pompliano 🌪 (@APompliano) October 24, 2025

“I’m sure there will be 50% drawdowns,” Lee said. He emphasized that crypto remains a high-beta asset, amplifying stock market movements.

He explained that while the S&P 500 has seen several 20–25% pullbacks in recent years, the coin’s historical tendency is to move roughly twice as much. “If the S&P is down 20%, Bitcoin could be down 40%,” he added.

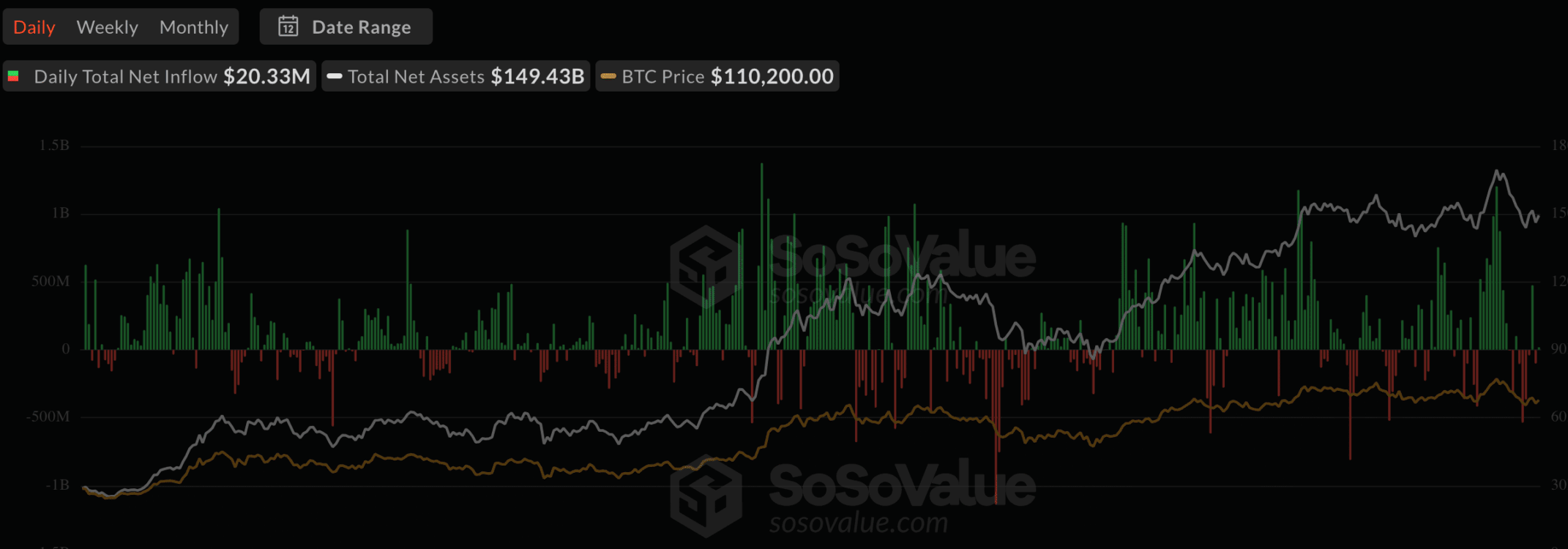

Lee’s comments come as some analysts argue that the spot Bitcoin ETFs could make the market more stable over time. Notably, BTC ETFs recorded $20 million in net inflows, while Ethereum saw net outflows of $128 million.

As CoinGape previously reported, Peter Brandt drew parallels between BTC’s current chart structure and the 1977 soybean crash. This was a historical event that saw agricultural commodity prices collapse by more than 50%. According to Peter Brandt, the coin is showing signs of forming a similar broadening top pattern that preceded that dramatic decline.

He also added that Strategy’s stock (MSTR), which holds billions in BTC, could face major downside if the Bitcoin crash materializes.

A 50% fall from current levels near $110,000 would bring the token down to around $55,000. This revisits prices last seen in September 2024.

Lee Maintains a Broader Bullish Outlook

While Tom Lee acknowledges the likelihood of a Bitcoin crash, he remains fundamentally bullish on the crypto market. Lee recently backed an Ethereum rally projection to $5,500.

Meanwhile, BitMine has reportedly added over 379,000 ETH worth roughly $1.5 billion over the past week. This brought its total holdings to more than 3 million ETH, or around 2.5% of the total supply. The company has set its sights on controlling 5% of Ethereum’s circulating supply.

However, both Tom Lee and Peter Brandt agree that another Bitcoin crash cannot be ruled out, especially if equity markets correct.

It is also worth noting that a Standard Chartered analyst projected a short-term decline for BTC driven by trade-war concerns. He also emphasized that any dip would likely be temporary. He noted that such a pullback could present a strong buying opportunity for investors.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Why Experts Are Warning Bitcoin Rally Could Be A “Dead Cat Bounce”

- Bitcoin & Gold Bounce as Trump Admin Brokers US-Venezuela 1000 Kg Gold Deal

- SEC Advances Major Crypto Securities Plan to White House for Approval

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs