BTC Price Fears Dropping 13%; Sell or Hold?

Bitcoin is nowhere close to an immediate recovery now that declines have started a new phase below $29,000. Its trading volume soared to $16 billion on Thursday, but largely due to a bearish wave sweeping across the crypto market.

Down 2.3%, Bitcoin price is trading at $28,230 on Thursday and starting at a possible drop below $25,000 before the next major rebound occurs.

Bitcoin Could Breakout of Sideways Trading

Bitcoin and the crypto market have once again been spooked by inflation in the United States after the Federal Reserve released minutes of the meeting in July used to deliberate how the monetary policy would play out in the coming months.

In the minutes, the Federal Open Markets Committee (FOMC) opined that without interest rate hikes, inflation was likely to stay elevated. After pausing the rate hikes in June, the bank resumed with a 25-basis point hike in July – a factor that does not sit well with investors in risk assets like BTC.

“With inflation still well above the Committee’s longer-run goal and the labor market remaining tight, most participants continued to see significant upside risks to inflation, which could require further tightening of monetary policy,” the minutes read in part.

Bitcoin and altcoins encountered headwinds following the release of the FOMC minutes despite the regulator seeming uncertain about the impact of the longstanding tight monetary policy.

Looking at a Potential 13% Crash

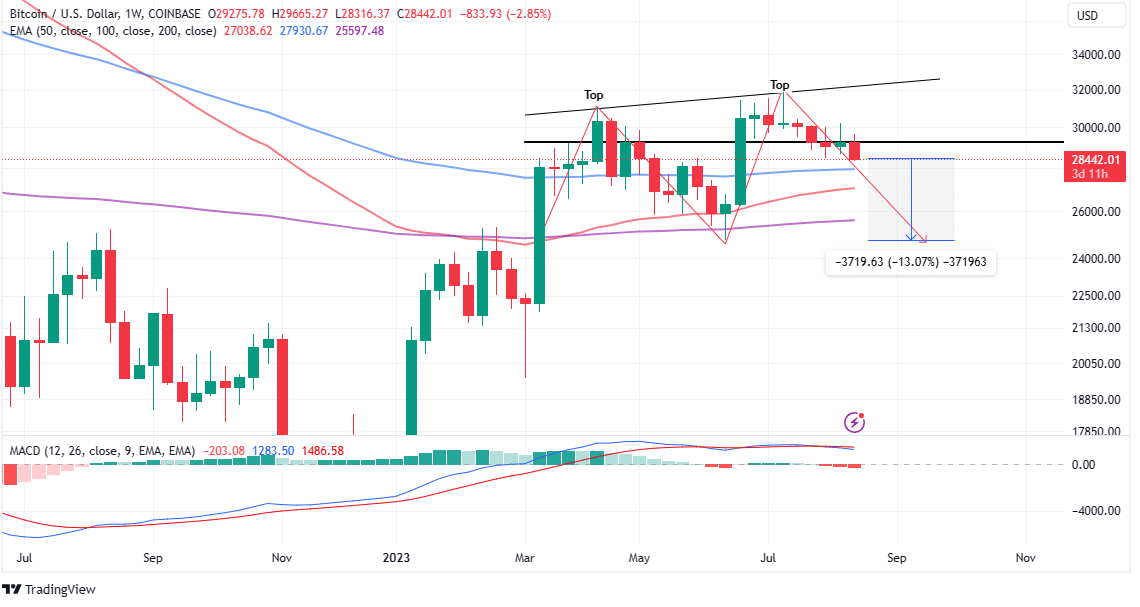

The daily chart reveals the formation of a double-top pattern, which would call for a 13% drop in BTC price to complete.

This is a bearish reversal signal that occurs when an asset reaches a high price twice with a moderate decline in between. It shows that the BTC price faced resistance at the high level of around $32,000 and failed to break through.

The pattern is confirmed when the price falls below a support level equal to the low between the two highs. With the pattern, traders anticipate a downward trend and sell-off or short BTC before it drops further.

According to analysts at Rekt Capital, “BTC would need to drop an additional -9% to -13% from current prices to complete its potential Double Top.”

The Moving Average Convergence Divergence (MACD) indicator shows that sellers have the upper hand and Bitcoin could carry on with its downward trip toward the major support at $25,000.

A sell signal from the momentum indicator manifests with the MACD line in blue crossing below the signal line in red. The red histograms add credence to the bearish outlook.

If support by the 100-day Exponential Moving Average (EMA) (blue) comes in handy at $27,931, Bitcoin could witness a knee-jerk reaction – abandon the drop to $25,000 and launch another attack at $30,000 and $32,000 resistance level, respectively.

Related Articles

- Breaking: Shiba Inu Lead Dev Dispels Shibarium FUD, Denies Any Bridge Issue

- Binance To Delist Litecoin (LTC) And Dogecoin (DOGE) Perpetuals, But There’s A Catch

- Shiba Inu Nosedives 8% After Shibarium Mainnet Launch, Here’s Why

Recent Posts

- Crypto News

Will Crypto Market Crash as Over $27B in Bitcoin, ETH, XRP, SOL Options Expire Today?

The crypto market has recovered slightly to $3 trillion amid sentiment towards a potential Santa…

- Altcoin News

Trust Wallet Hack Update: CZ Speaks Out on $7M Loss, Promises Support

In the wake of the $7 million Trust Wallet hack, Binance founder Changpeng Zhao has…

- Crypto News

Trust Wallet Hack: Users Hit as Hacker Drains BTC, ETH, BNB

The Chrome extension updated to version 2.68.0, and reports of a Trust Wallet hack soon…

- Crypto News

Binance Founder CZ Reacts as BNB Chain Dominates Ethereum, Solana In This Metric

BNB Chain has the largest average of active wallets per day in the year 2025.…

- Crypto News

Mike Novogratz Credits XRP Army for Token’s Relevance as ETFs Maintain Inflow Streak

XRP has remained visible in the crypto market because of its committed community, according to…

- Crypto News

Aave DAO Saga Update: Majority Votes Against Token Alignment Proposal as Voting Nears End

The AAVE token alignment proposal looks unlikely to pass, as the majority of DAO members…