Breaking: Bitcoin ETFs Saw $1.7B Net Inflow Last Week, Bloomberg Analyst Hints At Fall

Highlights

- Spot Bitcoin ETFs recorded $1.7 billion inflows this week despite $140 million net outflow on Friday

- Bloomberg analyst looks at possible subsiding inflows in the next few days amid GBTC outflows

- Bitcoin bulls strongly held BTC price above $62,000

Spot Bitcoin ETFs net flows were negative on Friday despite significant inflows recorded by BlackRock, Fidelity, Bitwise, and Ark 21Shares Bitcoin exchange-traded funds (ETFs). The Genesis and Gemini situation took a toll on the Bitcoin ETF net flows as GBTC outflow rate grew in the last few days. However, the week was great for Bitcoin ETFs with a $1.7 billion net inflow.

Bitcoin ETFs Recorded $140 Million New Outflow

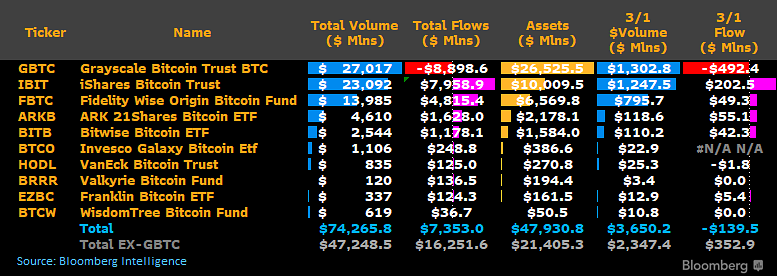

Spot Bitcoin exchange-traded funds (ETF) witnessed $140 million net outflow on March 1, according to data by Bloomberg and BitMEX Research. This came amid massive $492.2 million GBTC outflow, with Bitcoin ETFs inflow taking a hit.

Bloomberg ETF analyst James Seyffart said the big outflows from GBTC were almost certainly related to Genesis and Gemini situation. Crypto lender Genesis last month received bankruptcy court approval to sell 35 million GBTC shares worth $1.3 billion.

Spot Bitcoin ETFs recorded massive trading volumes on March 1. Eric Balchunas, senior ETF analyst at Bloomberg, noted that this was the “third-biggest day ever Wed and Thur. All told $22b traded this week, about a month’s worth of volume in 5 days.” He also looked at the possibility of inflows subsiding in the next few days.

BlackRock’s iShares Bitcoin ETF (IBIT) saw $202.5 million inflow, falling substantially from the recent largest inflows. Following the latest inflow, BlackRock’s net inflow hit over $7.95 billion and asset holdings jumped over $1o.5 billion.

Fidelity Bitcoin ETF (FBTC) and Ark 21Shares (ARKB) Bitcoin ETF saw $49.3 million and $55 million inflows, respectively. Bitwise (BITB) and other spot Bitcoin ETFs saw marginally low inflows. VanEck Bitcoin ETF (HODL) saw another outflow of $1.8 million.

Notably, GBTC recorded another major outflow of $492.4 million after a $598.9 million outflow on Thursday. GBTC net outflows reached over $8.89 billion to date.

Also Read: Bitcoin Supply Shock — Bitcoin ETFs Have Already Scooped Up 4% of Total BTC

BTC Price Rally to Sustain or a Fall Ahead?

BTC price trading sideways in the last 24 hours after a 45% gain last month. Price is currently trading at $62,046, with a 24-hour low and high of $57,093 and $63,913, respectively. Furthermore, the trading volume has decreased by 30% in the last 24 hours, indicating a decline in interest among traders.

Recent reports have hinted a potential correction in BTC price to $42K after bitcoin halving, giving investors another buy-the-dip opportunity for $100K.

Bitcoin futures and options open interests (OI) remain at record levels, with total futures OI rising over 1% to $27.26 billion, as per Coinglass data. Bitcoin price to $100K prediction remains despite Bitcoin options puts exceeding calls due to sky-high funding rates.

Also Read: Binance Burns 2.21 Billion Terra Luna Classic, LUNC Price Skyrockets Over 30%

- Will Bitcoin & Gold Fall Today as Trump Issues Warning to Iran Before Key Nuclear Talks?

- Epstein File Reveals Crypto Controversy: 2018 Emails Reference Gary Gensler Talks

- Wintermute Expands Into Tokenized Gold Trading, Forecasts $15B Market in 2026

- Bitcoin Shows Greater Weakness Than Post-LUNA Crash; Is a Crash Below $60K Next?

- XRP Tops BTC, ETH in Institutional Flows As Standard Chartered Lowers 2026 Forecasts

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?