Bitcoin ETF Notes $200M Outflux, Further BTC Decline Ahead?

Highlights

- U.S. Spot Bitcoin ETF recorded an outflux of $190 million on June 14.

- Fidelity's FBTC lead the outflux on Friday, followed by Grayscale's GBTC.

- Bitcoin price risks of falling to $61K, if it fails to hold above a key level.

The U.S. Spot Bitcoin ETF noted a gloomy trading week, with a significant single-day outflow of nearly $200 million on June 14. Fidelity’s Bitcoin ETF FBTC led the outflux with an $80.1 million outflow, followed by Grayscale GBTC at $52.3 million.

Notably, as Bitcoin price shows signs of volatility amid the gloomy U.S. Spot Bitcoin ETF trading, a prominent expert weighs in on the potential implications for the future of the crypto.

Bitcoin ETF Records $200M Outflow

The U.S. Spot Bitcoin ETF faced a challenging week, with persistent outflows totaling $581.4 million over the past five days. On Friday alone, outflows reached $189.9 million, with Fidelity’s FBTC and Grayscale’s GBTC being the main contributors.

Notably, Fidelity’s ETF saw the largest single outflow, amounting to $80.1 million. Grayscale’s ETF followed closely, losing $52.3 million in assets.

Meanwhile, this week’s trend shows Bitcoin ETFs struggling to maintain investor interest. Outflows occurred on four of the past five trading days, suggesting a shift in market sentiment. However, it’s worth noting that these withdrawals come after a period of robust inflows, marking a sudden reversal in investor behavior.

In addition, the rapid outflows reflect broader market concerns and increased volatility in Bitcoin price. This sentiment shift has led to increased caution among investors, weighing on the risk-bet appetite of the investors. However, the question now is whether these trends will continue or stabilize as the market adjusts to recent price fluctuations.

Also Read: Bitcoin Price Bull Run Is Intact As Per These Five On-chain Metrics

What’s Next For Bitcoin Price?

Despite the recent positive signs in the market, Bitcoin continued to record a significant decline over the last few days. In other words, the significant ETF outflows have coincided with notable volatility in Bitcoin’s price. BTC has struggled to maintain stability, fluctuating around key levels.

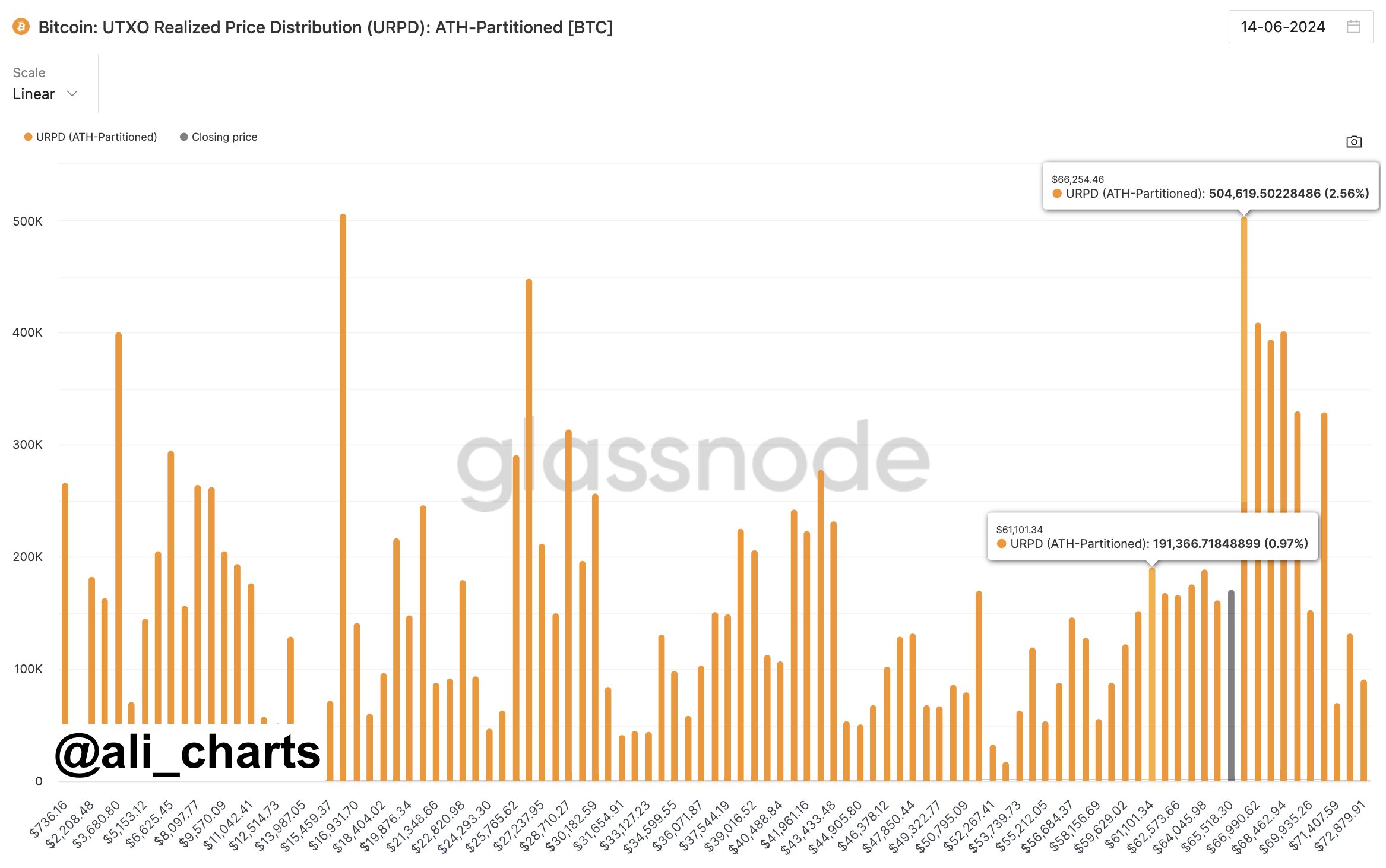

Amid this, prominent crypto market analysts highlighted a key point that Bitcoin must hold to avoid a further dip to $61,000. In a recent analysis shared on the X platform, Martinez said that Bitcoin needs to stay above the $66,254 mark, otherwise BTC price witness a potential correction down to $61,100.

As of writing, Bitcoin price exchanged hands at $66,242.59, noting a drop of 1.01% over the last 24 hours. Besides, the trading volume also dropped slightly, while its price saw a 24-hour low of $65,049.23.

Despite the recent dip, the CoinGlass data showed that Bitcoin Futures Open Interest recorded a slight recovery in the last four hours while dropping more than 2% in the 24-hour timeframe.

Also Read:

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin News: VanEck CEO Projects Gradual BTC Rally in 2026 as ETFs Sees $458M Inflows

- Bitcoin, Gold Slip as Donald Trump Says “Unlimited Munition Stockpiles” for US-Iran War

- Crypto Prices Today: BTC, ETH, XRP Prices Surge Despite Iran’s Strait of Hormuz Closure

- Nasdaq Brings Prediction Markets to Wall Street with New SEC Filing

- Is the Bitcoin Price Correction Really Over or Is This a Bear Market Trap?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

Buy $GGs

Buy $GGs