Bitcoin ETF Records Huge Net Inflow of $542 Million, Experts Reveals What’s Next?

Highlights

- Spot Bitcoin ETFs recorded second-largest net inflow of $542 million on February 9

- BlackRock (IBIT), Fidelity (FBTC), and Ark 21Shares Bitcoin ETF recorded the largest inflows

- GBTC records the lowest outflow day yet

- Traders await CPI data for further cues on BTC price rally

Retail and institutional investors flock to buy spot Bitcoin ETFs as BTC price rallied nearly 7% to over $48,000 on Friday. BTC price extends upside momentum after Friday’s options expiry, recording a 12% rally in the last three days. Experts Share What’s Next.

Spot Bitcoin ETFs Saw $542 Million Inflow

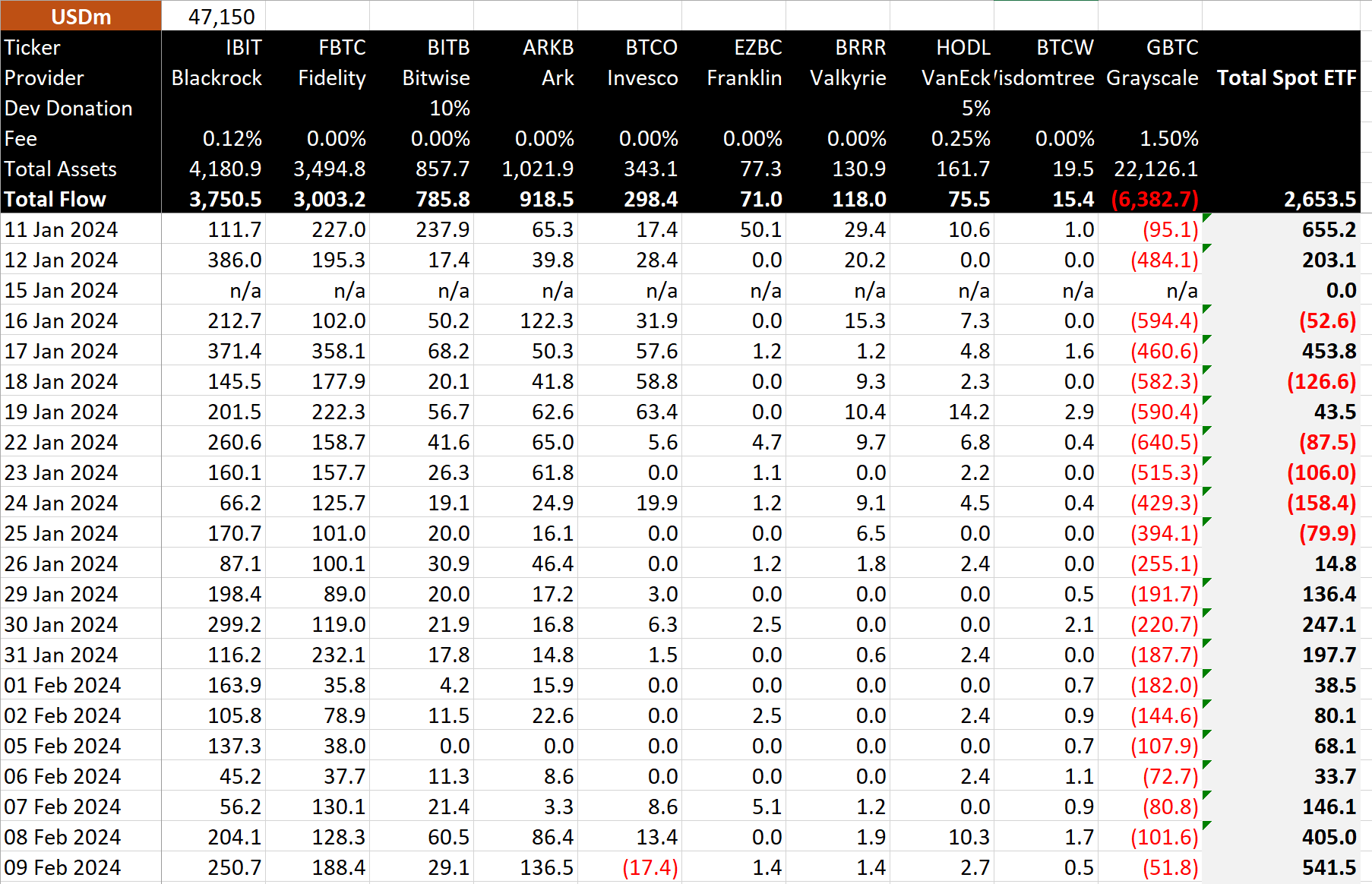

According to the latest Bitcoin ETF inflow data, the new nine and Grayscale’s GBTC spot Bitcoin ETF saw a net inflow of $541.5 million on Friday, as United States investors FOMO before the market closes.

BlackRock (IBIT), Fidelity (FBTC), and Ark 21Shares (ARKB) Bitcoin ETF recorded the largest inflows of $250.7, $188.4, and $136.5 million, respectively. Bitwise (BITB), VanEck (HODL), and others also saw significant inflows. However, Invesco Galaxy Bitcoin ETF (BTCO) witnessed a $17.4 million outflow.

Notably, GBTC saw a $51.8 million outflow, the lowest outflow day yet for Grayscale’s spot Bitcoin ETF. Bloomberg ETF analyst James Seyffart reacted to the drop in GBTC outflow as the market awaits a paradigm shift in the spot Bitcoin ETF market. GBTC net outflow rises to $6.38 billion.

Net inflow for spot Bitcoin ETF since the launch, excluding GBTC, reaches more than $9 billion. BlackRock and Fidelity Wise Origin Bitcoin ETFs leading with $3.7 billion and $3 billion inflows, respectively.

Also Read: GBTC Records Lowest Outflow Yet at $51.8 Million

Bitcoin Looks Strong

As Coingape reported, Bitcoin price rose beyond $48,000, with high odds of breaking $50,000, which corresponds with a notable $405 million flow into Bitcoin ETFs on Thursday. The sentiment is higher as signaled by the Fear and Greed index value of 74 (greed).

Crypto stocks such as Coinbase (COIN) and MicroStrategy (MSTR) opened over 6%, and Robinhood Markets (HOOD) up 2% amid BTC price rally, closing much higher. Coinbase closed 7.12% high at $141.99 and MicroStrategy closed 9.95% high at $646.32 on Friday.

BTC price is trading at $47,308 paring some gains due to profit booking by traders in the last 24 hours. The 24-hour low and high are $46,136 and $48,152, respectively. Furthermore, trading volume has increased by more than 30%.

Traders, especially in the U.S., anticipate a continued rally until the US CPI data release on February 13. Top analyst Michael van de Poppe predicts BTC price to hit $55K before Bitcoin halving at this pace. He added that there is apparent resistance at $49-51K, but confirms it’s a bull market.

Meanwhile, some such as CredibleCrypto and Skew remain skeptical of an immediate upside above $50k, saying the bleeding could continue a bit longer.

Also Read: SEC Chair Gary Gensler Seeks $2.4 Bln Budget Amid Staff Exodus

- CLARITY Act: Crypto Group Challenges Banks Proposal With Its Own Bill Suggestions

- Trump’s Truth Social Files For Bitcoin, Ethereum, Cronos Crypto ETFs Amid Institutional Outflows

- Trump Tariffs: U.S. Supreme Court Sets February 20 for Potential Tariff Ruling

- Brazil Targets 1M BTC Strategic Reserve to Rival U.S. Bitcoin Stockpile

- Breaking: U.S. CPI Inflation Falls To 4-Year Low Of 2.4%, Bitcoin Rises

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15