Bitcoin ETFs See Heavy Outflows as Amdax Launches $23M BTC Treasury Bid

Highlights

- Spot Bitcoin ETFs record $126.6M in net outflows, marking their first daily losses since August 22.

- Fidelity’s FBTC leads exits with $66.2M withdrawn, while BlackRock’s IBIT bucks the trend with $24.6M inflows.

- AMBTS targets 1% of Bitcoin supply, aiming to acquire 210,000 BTC and list on Euronext Amsterdam.

Bitcoin markets have faced some downturn as Spot Bitcoin ETFs recorded sharp outflows. Meanwhile, Dutch crypto-asset service provider Amdax announced progress on a $23 million BTC treasury initiative.

Bitcoin ETFs Record First Daily Losses in Days

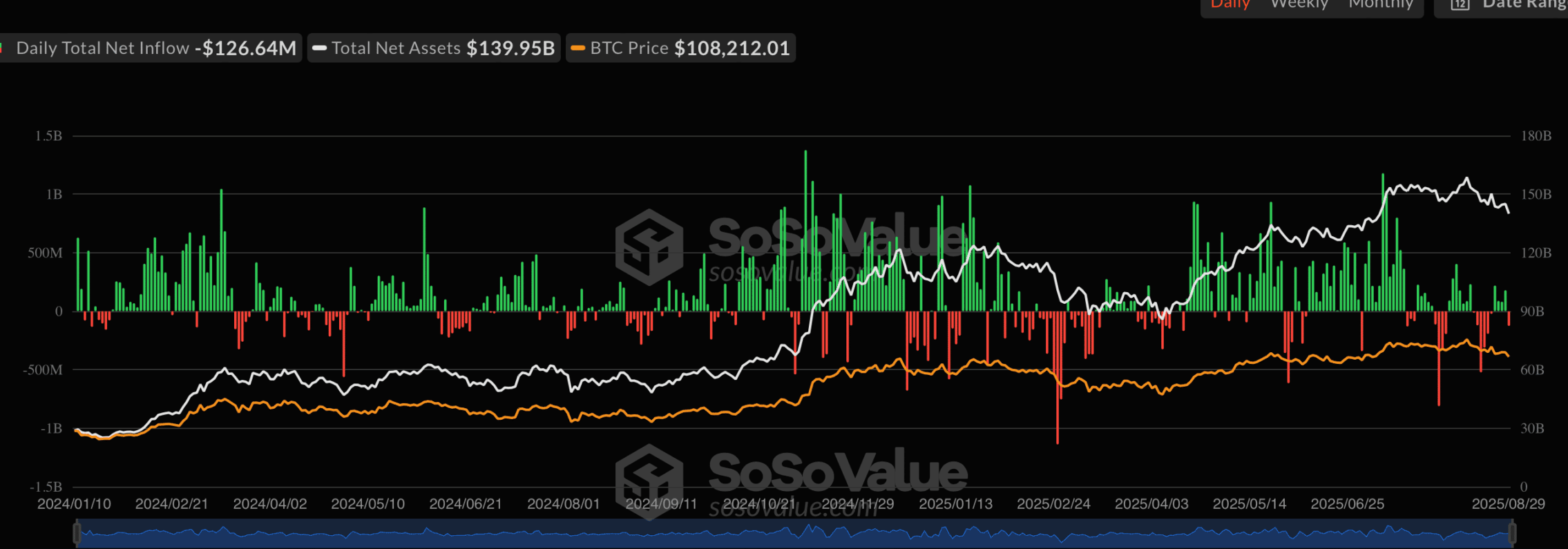

According to data from SoSoValue, Bitcoin ETFs experienced net outflows of approximately $126.6 million. This marked its first day of losses since August 22. The total assets under management also dropped to $139.95 billion for Bitcoin. Ethereum also recorded a 28.58 billion drop in its products.

21Shares’ ARKB lost $72.07 million while Grayscale’s GBTC posted outflows of $15.3 million. Fidelity’s FBTC saw $66.2 million exit in a single day, recording the highest outflow. On the other side, BlackRock’s IBIT attracted $24.63 million in inflows, with WisdomTree’s BTCW adding a modest $2.3 million.

This decline comes after BlackRock’s IBIT reached a record $91.06 billion in assets under management. It recorded cumulative net inflows topping $58.04 billion as of mid-August. IBIT closed at $69.84 recently, trading at a 0.57% premium to its net asset value.

This distance between IBIT and other Bitcoin ETFs underscores the consolidation of capital among top-tier issuers. It also shows its dominance even as the broader market navigates volatility.

Amdax Secures $23 Million for its Bitcoin Treasury

In a recent release, Amdax, through its newly created entity AMBTS B.V., announced it has secured €20 million (approximately $23 million) in its first private placement round. The funds will support the establishment of an independent Bitcoin treasury company, with plans for an eventual listing on Euronext Amsterdam.

CEO Lucas Wensing said the initiative reflects strong investor appetite for BTC-focused strategies:

“The appetite we have received for this initial financing round indicates that investors welcome the initiative, providing them an opportunity to participate in the rapidly developing market,” he said. “With the establishment of AMBTS, we aim to strengthen the European autonomous digital asset industry and thereby potentially unlock a compelling investment opportunity for institutional investors.”

AMBTS aims to close the financing round in September with a €30 million cap. The long-term vision is ambitious: to eventually control 1% of Bitcoin’s total supply, equivalent to roughly 210,000 BTC.

The push by Amdax comes at a time when institutional accumulation remains in the spotlight. BTC treasury firm, Strategy, revealed it now owns more than 3% of Bitcoin’s maximum supply of 21 million. Its latest acquisition of 3,081 BTC pushed its year-to-date yield to 25.4%.

The treasury’s adoption could offset some of the bearish sentiment surrounding the Bitcoin price’s current downturn. This move also shows that Europe is working to attract new institutional investors into its crypto ecosystem.

- Congress to Revisit Crypto Market Structure Bill in Key Meeting Tomorrow

- Trump’s World Liberty Financial Partners With Securitize in Tokenization of Real Estate

- Coinbase Adds XRP, ADA, LTC, DOGE as Collateral for Crypto-Backed Loans

- CLARITY Act Odds Spike to 90% as Coinbase CEO Confirms “Great Progress” On Crypto Bill

- OpenAI Introduces Smart Contract Benchmark for AI Agents as AI and Crypto Converge

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week