Bitcoin ETFs Sees Second Largest Outflows in History as BTC Drops to $95k

Highlights

- U.S. Bitcoin ETFs saw its second largest withdrawal on record on Thursday.

- The previous outflow record of $1.14 billion was set on February 25, 2025.

- Bitcoin price fell below $96,000, dropping to $95,931 before slightly recovering.

Bitcoin ETFs have seen their second-largest outflows on record. This is against the backdrop of a crypto market that has continued its downturn despite bullish fundamentals. As a result, the BTC price fell below $96,000.

Bitcoin ETF Outflows Hit Historic Levels as Market Slides

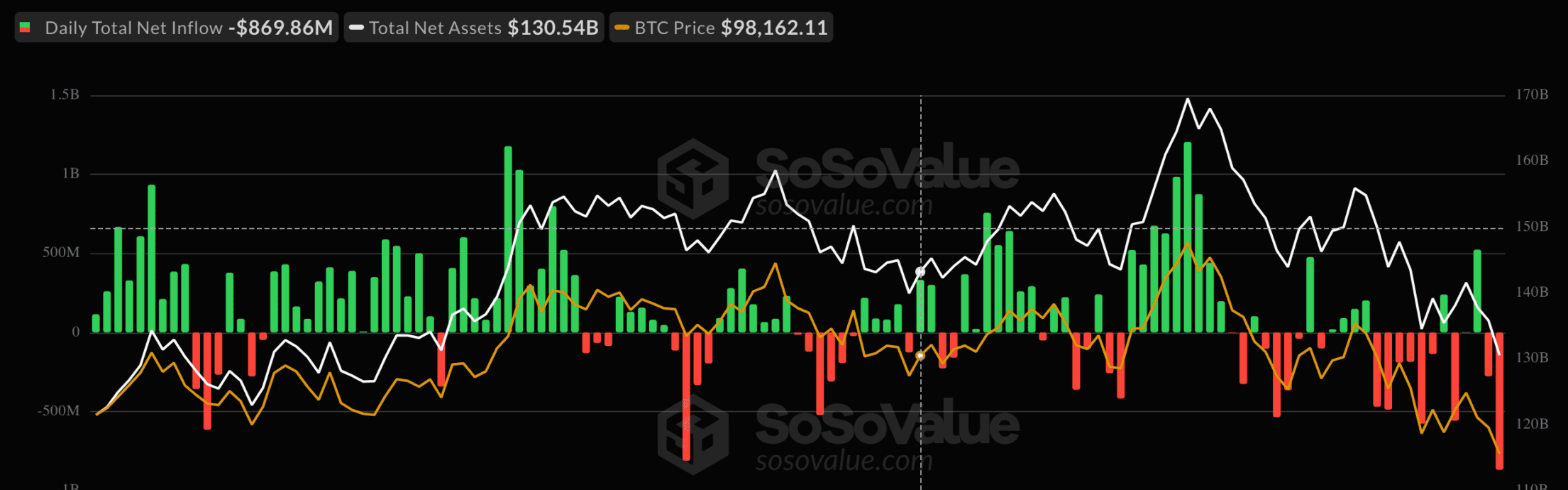

US spot Bitcoin ETFs saw net outflows of $869.9 million on Thursday. This marks the second-largest withdrawal event since the products were created. That retreat shows how wary institutions are getting as Bitcoin’s price continues to slide.

According to data from SoSoValue, Grayscale’s Bitcoin Mini Trust saw the largest outflow of $318.2 million. BlackRock’s IBIT lost $256.6 million while Fidelity’s FBTC recorded $119.9 million in withdrawals. Funds run by Bitwise, VanEck, and Grayscale also contributed to the net loss.

The largest outflows was recorded on February 25, 2025. On this day, Bitcoin ETFs collectively saw $1.14 billion leave in a single trading day.

Just days earlier, Bitcoin ETF products saw outflows of $558.4 million. This was the biggest daily drawdown since August. Fidelity and Ark were again among the biggest contributors. It also coincides with the coin’s struggle to remain above $102,000 at the time.

As Vincent Liu, CIO of Kronos Research, has explained, “The heavy redemptions point to a risk-off reset. Institutions are stepping back due to macro turbulence, but the structural bid for Bitcoin remains intact. These pullbacks typically mirror oversold territory and attract long-horizon buyers.

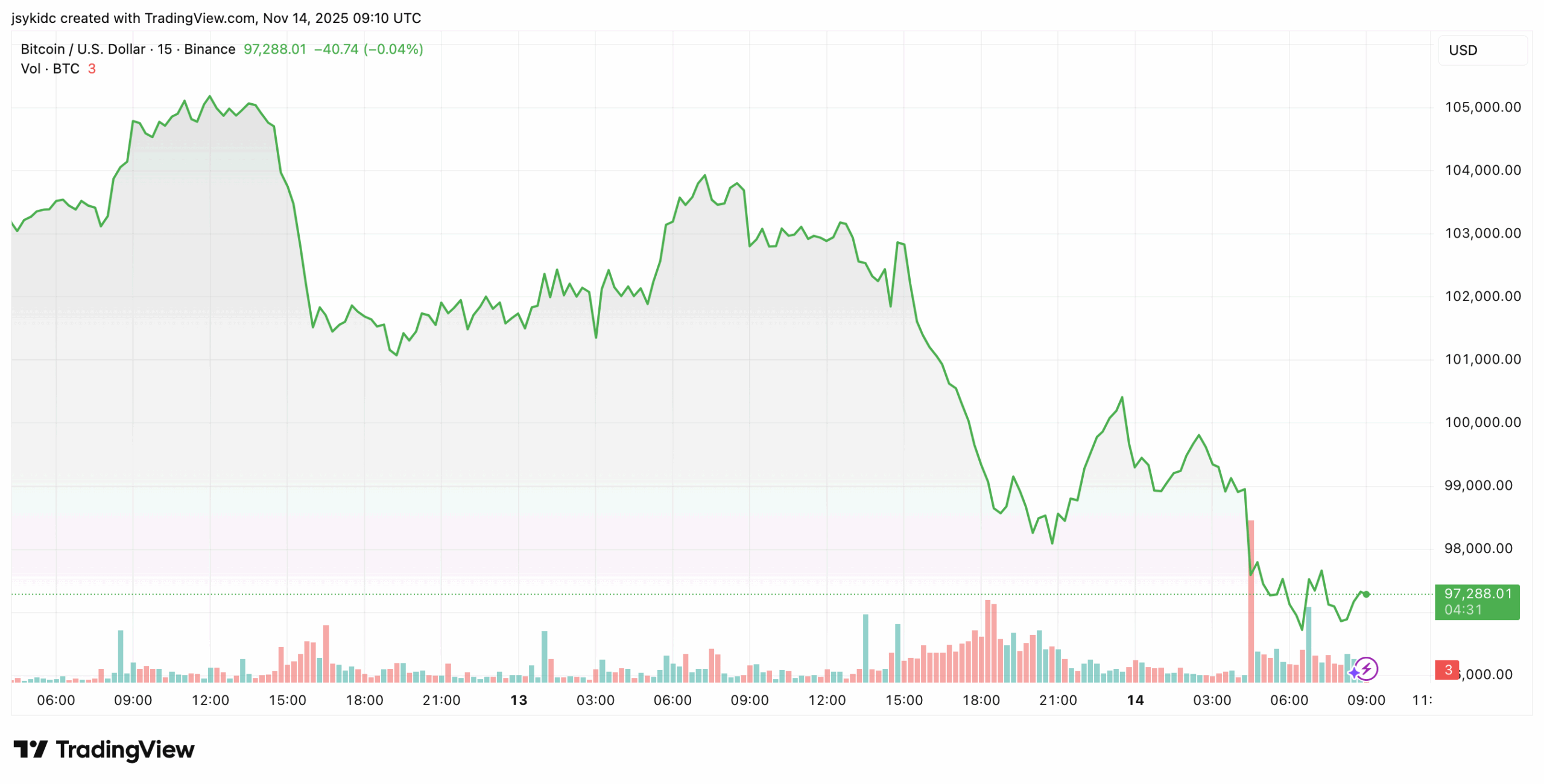

Bitcoin Breaks to $95k as Sentiment Worsens

Thursday’s losses coincided with Bitcoin dropping into a support zone of around $96,000. The coin fell to $95,931 before settling at around $97,000. The asset is currently down 14% in the last month.

Bitcoin’s latest drop below $100,000 came despite the reopening of the U.S. government after President Trump signed a temporary funding bill. It was thought to boost market confidence, but that hasn’t been the case.

Ether ETFs did not escape the losses either. It recorded $259.72 million in outflows. This was also its worst single-day result since October 13.

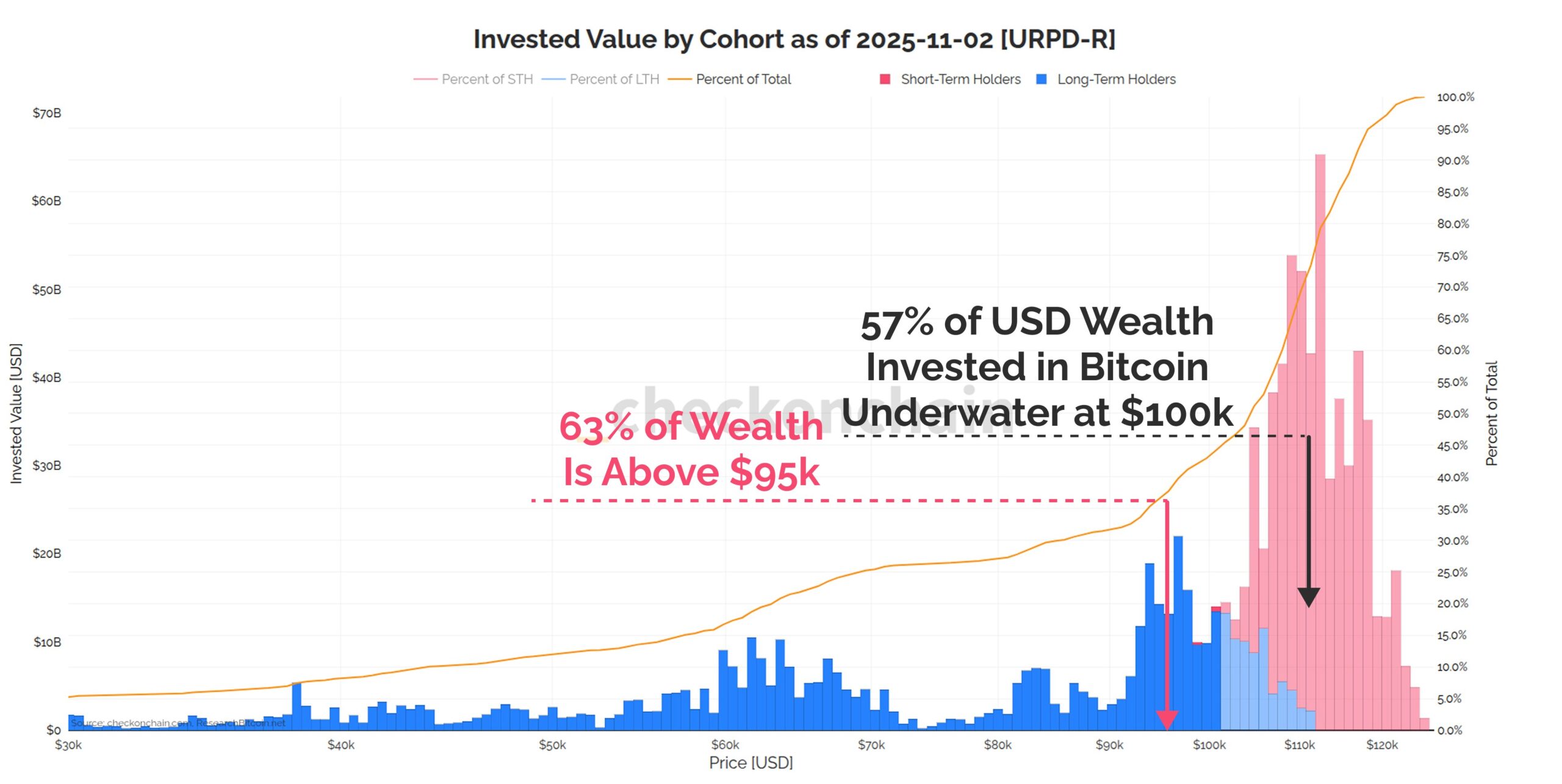

Top analyst Checkmate had already warned in a November 4 analysis of the market dip. He explained that nearly 57% of dollar-denominated Bitcoin ETFs are underwater at $100k. The end result is selling as traders focus more on recent purchases than older holdings.

Meanwhile, there have been indications that the Federal Reserve’s December policy will be negative to the market. Expectations of another 25 bps rate cut weakened when traders scaled back bets on further easing. This has kept the market in its dip.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Is Bitcoin Dead? Here’s What the Data Really Says

- US-Iran War: Meme Coin Market Plunges After Iranian Drone Hits US Embassy in Kuwait

- Arthur Hayes Sees 5x HYPE Token Rally as Oil Perps Pump on Hyperliquid Amid U.S.–Iran War

- How BTC, ETH and XRP Prices React as Crude Oil and Safe Havens Surge After Khamenei’s Death

- BREAKING: Iran Refutes WSJ’s Claims on Push to Resume Nuclear Talks with US, Bitcoin Slips

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs