Bitcoin ETFs Surpass Satoshi Nakamoto’s BTC Holdings

Highlights

- Bloomberg analyst Eric Balchunas revealed that the Bitcoin ETFs now hold more BTC than Satoshi Nakamoto.

- The Bitcoin ETFs hold over 1.1 million BTC while Satoshi holds 1.1 million.

- These funds have achieved this feat in just under a year since they launched.

The Bitcoin ETFs have undoubtedly enjoyed massive success since they launched at the beginning of the year. To crown a tremendous first year, these funds achieved a significant milestone as they surpassed Satoshi Nakamoto’s BTC holdings.

Bitcoin ETFs Surpass Satoshi Nakamoto

In an X post, Bloomberg analyst Eric Balchunas revealed that the Bitcoin ETFs have just surpassed Satoshi Nakamoto in total held. These ETFs hold a cumulative total of over 1.1 million BTC, while the Bitcoin creator holds 1.1 million.

He highlighted how remarkable this feat is considering that these funds aren’t even a year old yet, showing how much demand they have enjoyed since they launched on January 10. The Bitcoin ETFs achieved this feat on the back of the $770 million inflows they recorded yesterday.

SoSoValue data shows that BlackRock’s Bitcoin ETF has enjoyed the most success among these funds. IBIT currently holds $51.46 billion in assets under management, almost half of the $109.15 billion in total net assets these funds hold.

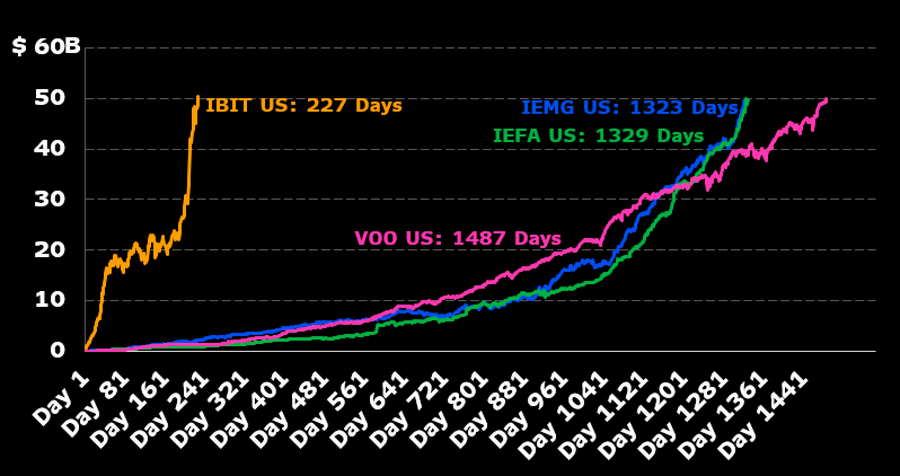

BlackRock’s IBIT just crossed the $50 billion mark, which is a record in itself. Balchunas noted that it took the world’s largest asset manager 227 days to achieve this feat, five times faster than the previous record holder, who did it in 1,323 days.

BlackRock’s Ethereum ETF is also enjoying its own success, as it recently hit a new milestone. The iShares Ether ETF (ETHA) inflows crossed $1 billion for the first time since it launched on July 23.

The Others That Make Up The Top 5 List

Balchunas also revealed the other entities that make up the top five list of the largest BTC holdings alongside the Bitcoin ETFs and Satoshi Nakamoto. Third on the list is Binance, with 633,103 BTC. MicroStrategy and the US government are fourth and fifth on the list, with 402,100 and 198,109 BTC, respectively.

MicroStrategy has been actively accumulating more BTC and could move up the list at some point. The software company recently bought 15,400 BTC, bringing its total holdings to this amount.

Meanwhile, the Chinese government, Bitfinex, Kraken, Block One, and Robinhood make up the top ten list. It is worth mentioning that both governments on this list acquired their BTC through seizures rather than actively buying the flagship crypto. For the US, that could change soon enough as Donald Trump has promised to create a Strategic Bitcoin Reserve, which could lead to them buying more BTC.

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise