Bitcoin Exchange Balances on the Decline, Where are the Funds Going to?

The Bitcoin (BTC) balance on exchanges is on the decline, at least, for the past few weeks, as highlighted by Glassnode’s on-chain data. There seems to be an increase in the demand for accumulated BTC on trading platforms, a trend that brings into question where the funds are going into.

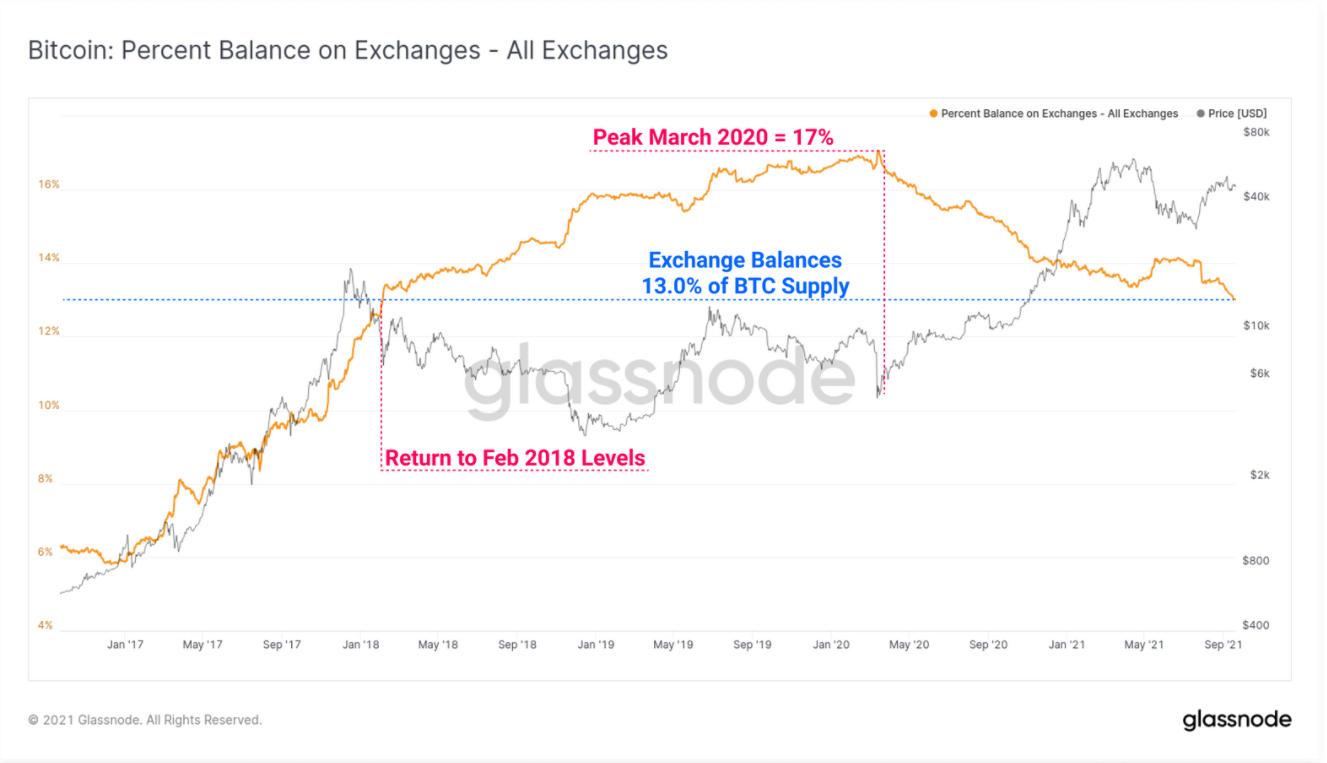

Bitcoin has seen a tumultuous 1 year, and the current balance on exchanges has reached a new multi-year low of 13.0% of circulating supply this week. This level has not been seen since February 2018 where the price of Bitcoin was hovering around $6,000 to $10,000. According to Glassnode, the turning point which defined the current valuation of Bitcoin began following the broad market crash of March 2020, in which prices were lowered to $3,800.

The crash at the time also affected the mainstream financial market, and it gave a number of institutional investors the needed impetus to consider investing in the premier cryptocurrency. The adoption by the institutional investors pushed the price of Bitcoin to a high of $64,000, with consistency amongst the investors to date.

The current Bitcoin exchange outflows trend is also reflective in the imbalance in the negative (outflows) exchange net-flow reading this week, with current BTC outflows occurring at a rate of -92k BTC/month. Per the Glassnode data, the market clearly shifted paradigm after March 2020, from a regime of net exchange inflow dominance to outflow dominance.

So Where are the Funds Going?

Cryptocurrency exchanges are typically the major way laymen acquire their Bitcoin assets, and many often use the exchange wallets to keep custody of the purchased digital coins. However, Glassnode pointed out that most of these funds are going into investor wallets.

“Overall, the net balance across exchanges has continued to decline as the inflows observed in May are absorbed by the market and moved to investor wallets.”

Additionally, the rollout of custodial services is on the rise across the board. Typically, employing the services of platforms with custodial products offers a certain level of confidence to investors, as funds are notably secure from exploitation by cybercriminals. In all, there was modest profit-taking amongst investors in the previous week, a trend that also contributed to the outflow of Bitcoin from trading platforms.

- Crypto Market Crash: Here’s Why Bitcoin, ETH, XRP, SOL, ADA Are Falling Sharply

- Missouri Joins Bitcoin Reserve Push as U.S. States Race to Accumulate BTC

- Bitcoin vs Gold Feb 2026: Which Asset Could Spike Next?

- Top 3 Reasons Why Crypto Market is Down Today (Feb. 22)

- Michael Saylor Hints at Another Strategy BTC Buy as Bitcoin Drops Below $68K

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible