Bitcoin Exchange Supply Drops to 6-Year Low, Will BTC Price Rally?

After a recent bounce earlier this week on Wednesday, August 23, the Bitcoin (BTC) price has entered a sharp retracement and moved back once again closer to $26,000. While the sentiment around Bitcoin remains largely bearish, on-chain data provides some optimism to investors.

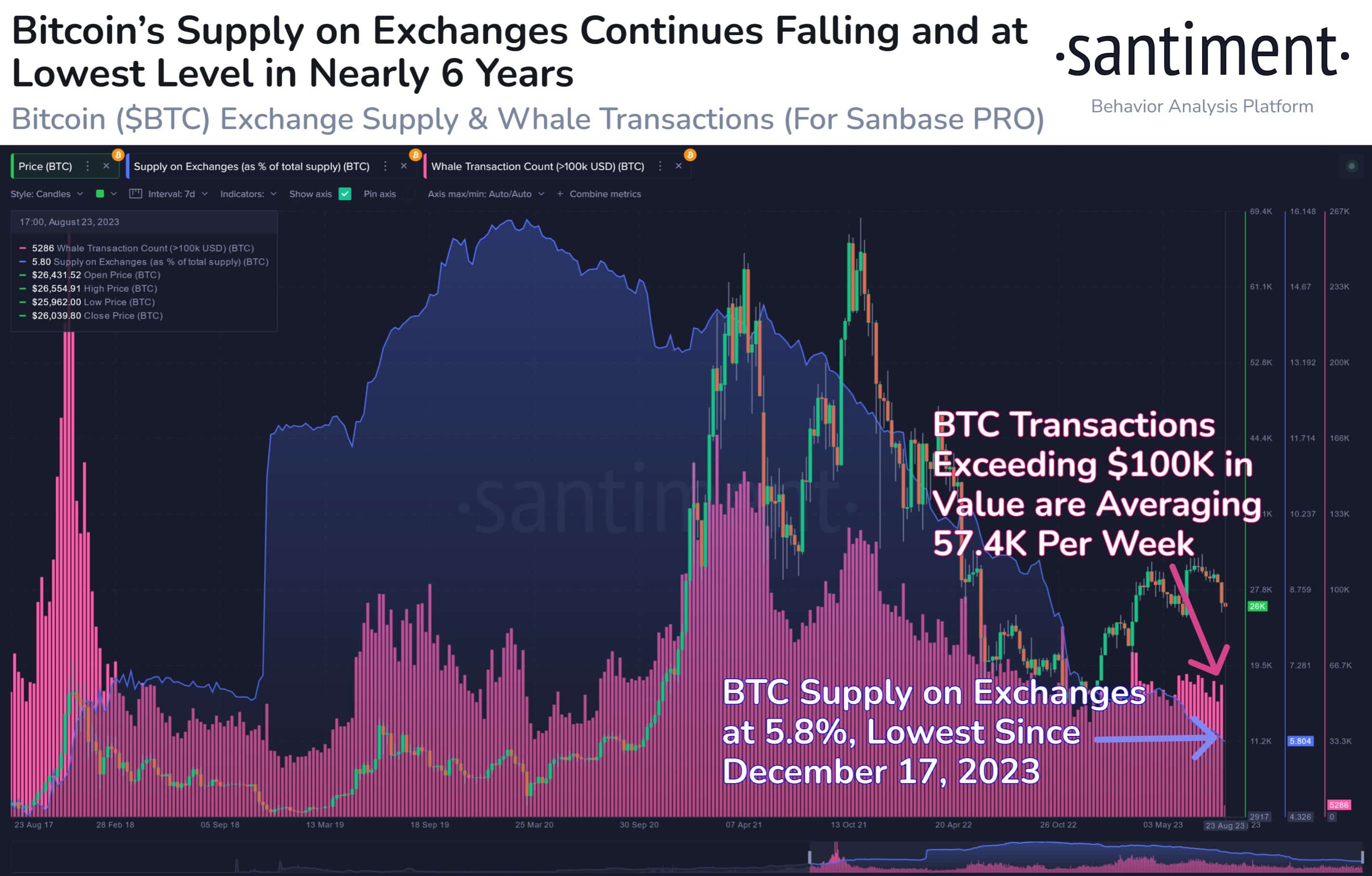

The Bitcoin supply at the exchanges has dropped to a 6-year low. Only a small portion, about 5.8%, of the total Bitcoin supply is currently held on exchanges. This marks the lowest level for the top cryptocurrency by market cap since December 17, 2017. Furthermore, there are consistent instances of significant whale transactions involving $BTC, averaging around 57.4K per week, reports Santiment.

As Exchange Reserves decrease during a market downturn, it suggests that investors are opting to hold onto their assets for potential future profits instead of selling. If this trend continues, it could lead to a substantial price increase for Bitcoin when favorable macroeconomic factors and a positive global crypto market sentiment return.

Another positive indicator is that Bitcoin whales have been accumulating recently after last week’s market crash. Since last week’s fall to $25,000, Bitcoin whales have accumulated over $300 million worth of Bitcoins so far.

#Bitcoin | Whales seem to be buying the #BTC dip. We're seeing a spike in addresses holding 1,000+ $BTC. pic.twitter.com/TXec7s8a2q

— Ali (@ali_charts) August 24, 2023

Where’s Bitcoin Moving Next? All eyes on the Fed

On the technical charts, Bitcoin continues to show weakness as it has already dropped under the 200-day moving average. For now, the immediate support zone for Bitcoin stands at $25,200-$24,800. However, breaching this could see the BTC price fall further to $20,500.

All eyes are currently on the Fed’s Jackson Hole meeting later today on Friday. U.S. Federal Reserve Chair Jerome Powell will shed light on whether or not they would be ending the interest rate hike cycle.

On the other hand, the US regulatory action on crypto firms has further dampened market sentiments. Amid the SEC action, Bitstamp decided to discontinue the Ether staking facility for US customers from next month onwards.

The cryptocurrency market might face ongoing pressure from negative sentiment in the upcoming weeks or months until there is a clear regulatory and legislative framework that governs the cryptocurrency market.

- $1B Binance SAFU Fund Enters Top 10 Bitcoin Treasuries, Overtakes Coinbase

- Breaking: ABA Tells OCC to Delay Charter Review for Ripple, Coinbase, Circle

- Brian Armstrong Offloads $101M in Coinbase Stock Amid COIN’s Steep Decline

- MSTR Stock in Focus After CEO Phong Le Signals More BTC Buys

- Cardano Founder Sets March Launch for Midnight as Expert Predicts BTC Shift to Privacy Coins

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown

- Ripple Price Prediction As Goldman Sachs Discloses Crypto Exposure Including XRP

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit