Bitcoin Faces Slide Towards $70K as Japan Rate Hike Odds Spike

Highlights

- Bitcoin has come under pressure due to an increasing possibility of a rate hike by Japan, which would contribute towards further price decline.

- Traders pay close attention to the December policy meeting as open sell positions by whales adding to the uncertainty.

- However, some other analysts reckon that Bitcoin may pick up as soon as macro uncertainty ends.

Bitcoin is under renewed pressure as markets price in a near-certain Bank of Japan (BOJ) rate hike next week. Traders now expect Japan to raise rates to 0.75%, tightening global liquidity conditions and negatively impacting risk assets.

Is Bitcoin Priced for BOJ Rate Hike?

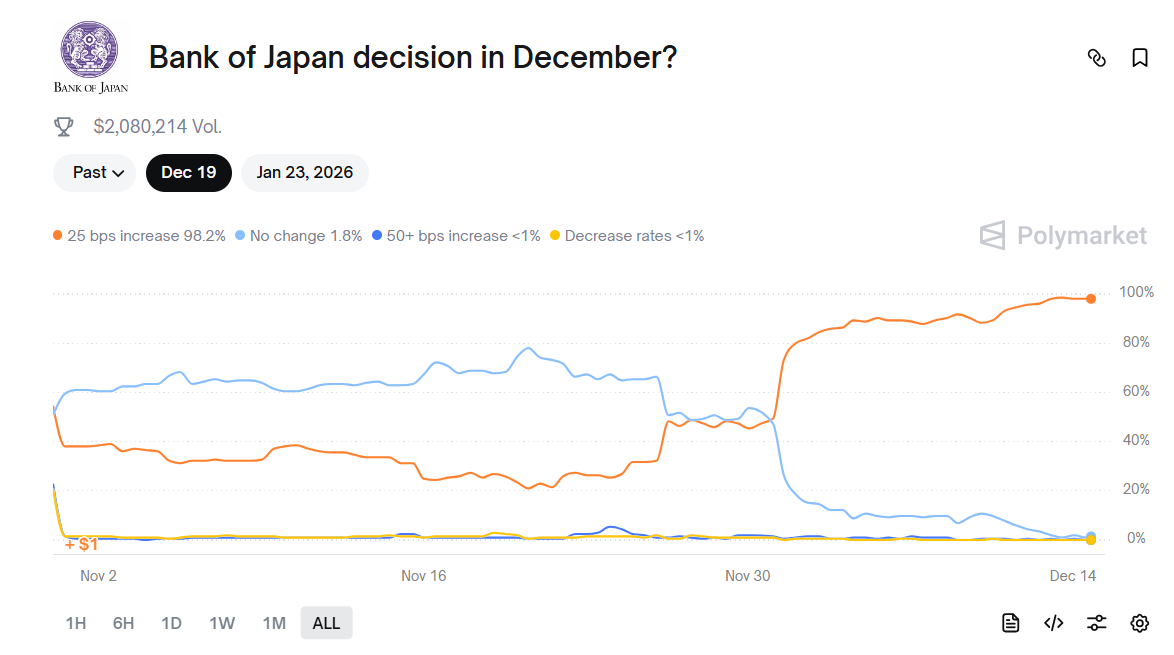

A Bloomberg chart shared by analyst Ted Pillows show more than a 90% probability of a 25-basis point hike at the December 18–19 meeting. That expectation has surged after comments from Bank of Japan policymakers as highlighted by Reuters.

The probability of the BOJ doing a 25 bps rate hike next week is 91.4%

It seems like a rate hike is imminent now. pic.twitter.com/elfZ5Kiu4l

— Ted (@TedPillows) December 14, 2025

An analyst has predicted that Bitcoin may trade around the $70,000 area. Past Bank of Japan hikes have coincided with 20% to 25% Bitcoin drawdowns. The theory centers on the yen carry trade.

When Japan raises rates, borrowing yen becomes more expensive. Hence, investors often sell riskier assets, including cryptocurrencies. However, long term investors will keep on buying even during volatility. For instance, Michael Saylor has signaled more Bitcoin purchases for Strategy despite extreme fear in market sentiment.

Still, market data suggests that the increase is already reflected in current market expectations. Polymarket odds that the increase will be 25 basis points in December is currently 98%. But expectations of bigger increases are low.

Will Bitcoin Selloffs Happen After BOJ Rate Hike?

An increment to 0.75% will put Japan’s policy rates to its highest in thirty years. It would also bring rates closer to estimates of a neutral policy range.

Officials want to signal that monetary conditions will remain accommodative even after the move. Hence, Bitcoin traders will be watching events on December 19 closely.

A decisive break could accelerate downside momentum. Still, some strategists see recovery after volatility fades, as Tom Lee predicts new Bitcoin all-time high (ATH) early next year.

On-chain data also show rising bearish positioning among large traders. Crypto analyst Ted Pillows reported that a whale opened an $89 million Bitcoin short using 3x leverage. The same trader has generated more than $23 million in profits over the past two months.

Will Bitcoin Fall Below $80K This Year?

Also, prediction market data shows traders are increasingly preparing for deeper downside. Kalshi contracts now place a 28% chance that Bitcoin falls below $80,000 before year-end.

BTC price is $88,805 on CoinMarketCap. Sentiment is still weak since crypto prices are being influenced by macro-economic events.

Another important factor is the increase in rates by the Bank of Japan. The result of the meeting is expected to establish the trend for Bitcoin price till the end of the year.

- Wall Street Giant Signals XRP Price ‘Long Winter’ After Cutting Target By 65%

- Shark Tank Kevin O’Leary Warns Bitcoin Crash as Quantum Computing Threats Turns Institutions Cautious

- Japan’s SBI Clears XRP Rumors, Says $4B Stake Is in Ripple Labs Not Tokens

- 63% of Tokenized U.S. Treasuries Now Issued on XRP Ledger: Report

- Will Bitcoin & Gold Fall Today as Trump Issues Warning to Iran Before Key Nuclear Talks?

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano