Bitcoin Futures ETF Surges Past $1 Billion Amid Spot ETF Race

In a significant development for the cryptocurrency market, the Bitcoin Futures ETF, $BITO, has experienced a substantial increase in inflows, reaching over $1 billion in assets once again. This surge comes as investors show renewed interest in Bitcoin derivatives, with growing anticipation surrounding the potential approval of a spot Bitcoin ETF by the Securities and Exchange Commission (SEC).

$BITO’s Strong Performance

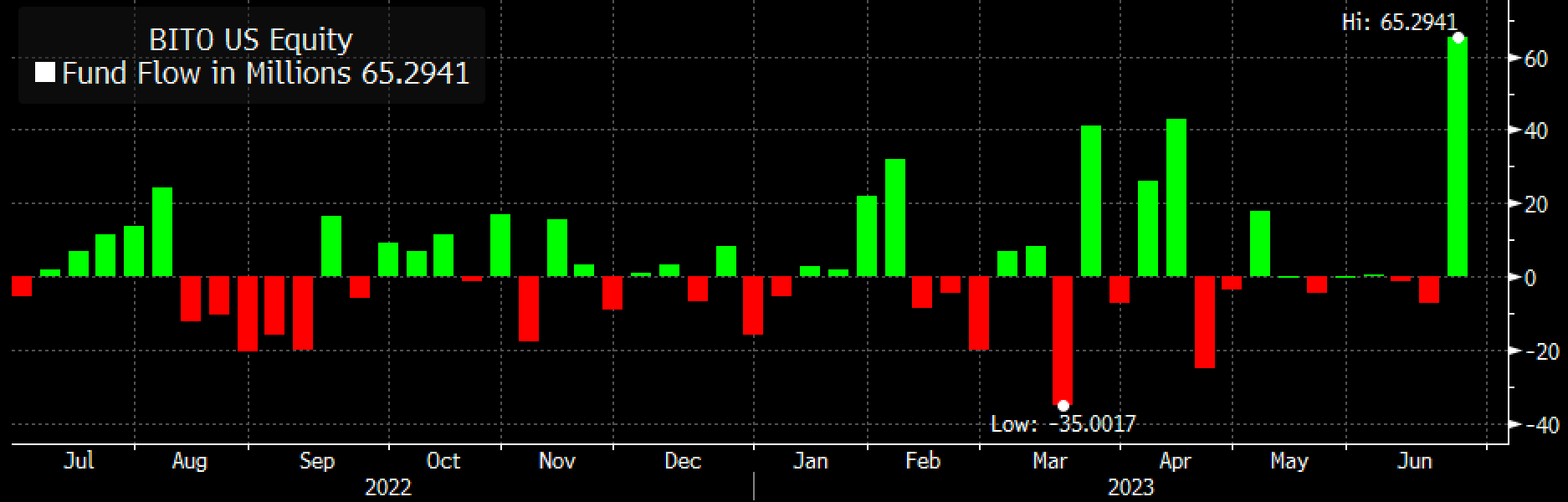

According to Eric Balchunas, Senior ETF Analyst for Bloomberg, $BITO had its largest weekly inflow in a year, accompanied by a notable trading volume of half a billion shares on Friday. Despite concerns about the impact of futures roll costs on $BITO’s performance, it has demonstrated an impressive ability to track the price of Bitcoin closely.

Adding to it, Eric said:

It’s lagged spot by 1.05% ann, but it’s fee is 0.95% = only 10bps of roll (extra) costs, which is rounding error. Many predicted >5% a yr.

According to ProShares, Year-to-date, $BITO has been a standout performer, delivering impressive returns of 59.58% in market price and 59.62% in NAV. Looking at the three-month and six-month performance figures, $BITO has demonstrated substantial growth. With returns of 14.04% over both periods, investors who have held the fund for these durations would have experienced positive gains.

The Race for a Spot Bitcoin ETF

The recent surge in interest in Bitcoin derivatives can be attributed, at least in part, to the filing of a Bitcoin ETF by BlackRock on June 15. While it remains uncertain whether the SEC will approve a spot Bitcoin ETF, BlackRock’s move has triggered a race among various firms to file their own applications.

CoinGape reported that WisdomTree, for the third time, has filed with the SEC to create a spot Bitcoin ETF, and Invesco has renewed its application for a similar product.

The approval of a spot Bitcoin ETF would provide institutional and retail investors with a more accessible and regulated avenue for investing in cryptocurrencies.

- Will Bitcoin Crash Again as ‘Trump Insider’ Whale Dumps 6,599 BTC

- XRP News: Ripple’s RLUSD Gets Boost as CFTC Expands Approved Tokenized Collateral

- Crypto Markets Brace as Another Partial U.S. Government Shutdown Looms Next Week

- $40B Bitcoin Airdrop Error: Bithumb to Reimburse Customer Losses After BTC Crash To $55k

- ETH Price Fears Major Crash As Trend Research Deposits $1.8B Ethereum to Binance

- Cardano Price Prediction as Midnight Token Soars 15%

- Bitcoin and XRP Price Outlook Ahead of Crypto Market Bill Nearing Key Phase on Feb 10th

- Bitcoin Price Prediction as Funding Rate Tumbles Ahead of $2.1B Options Expiry

- Ethereum Price Outlook as Vitalik Buterin Sells $14 Million Worth of ETH: What’s Next for Ether?

- Solana Price at Risk of Crashing Below $50 as Crypto Fear and Greed Index Plunges to 5

- Pi Network Price Prediction Ahead of PI KYC Validator Reward System Launch