Bitcoin Futures Market Crumbles With Price Slump

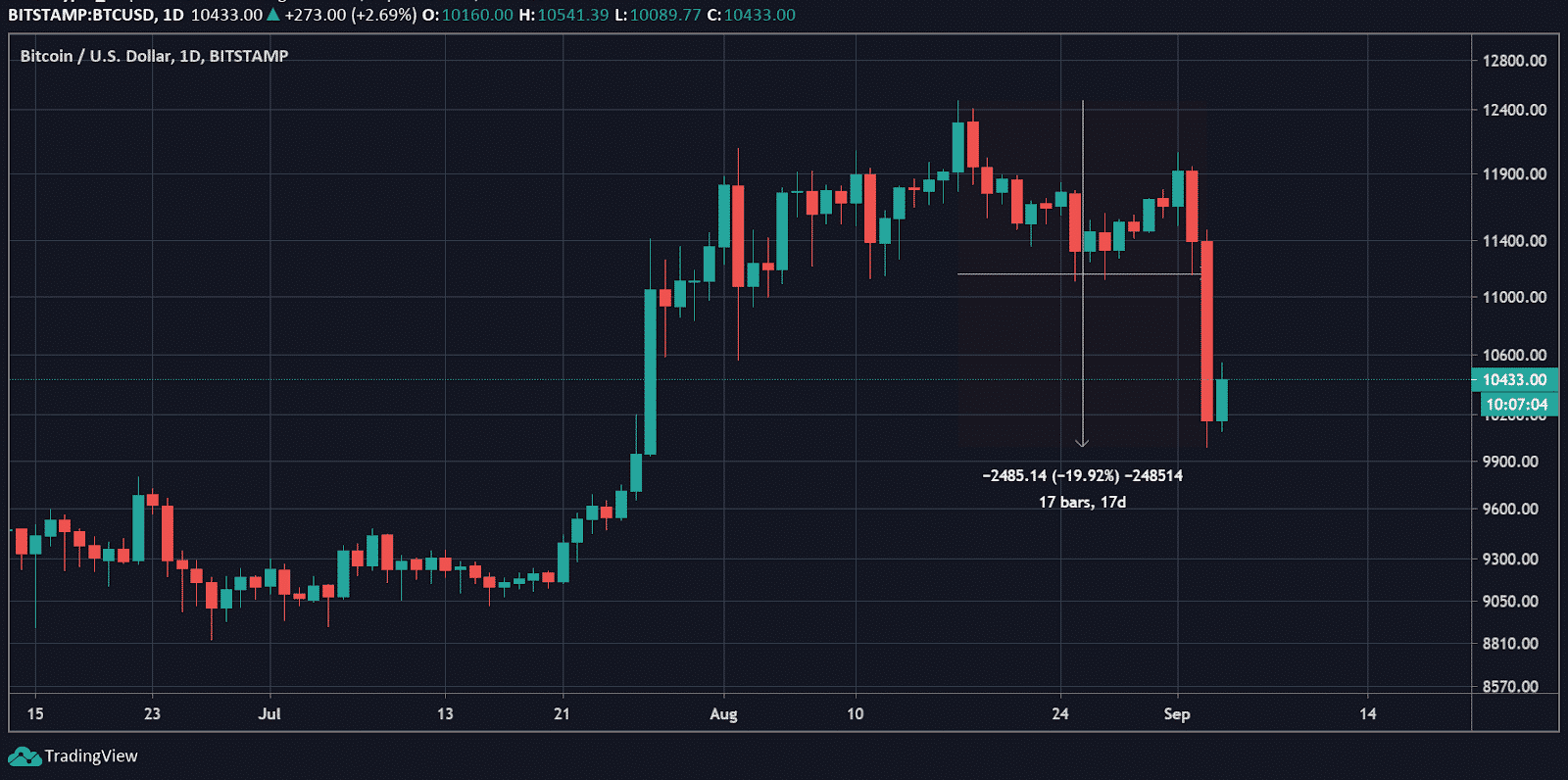

The extreme volatility in the cryptocurrency market caused a wavelike motion in the Bitcoin [BTC] market. BTC was cruising at its annual peak of $12.473 on 17 August and the selling pressure seeped in, causing the price to descend from this peak. However, on 2 and 3 September BTC market saw massive liquidations of longs as the price reached $9,987.86. This was the first time in seven weeks, BTC slipped under the $10k mark, but many traders expected for this to happen.

Price dump spikes liquidations

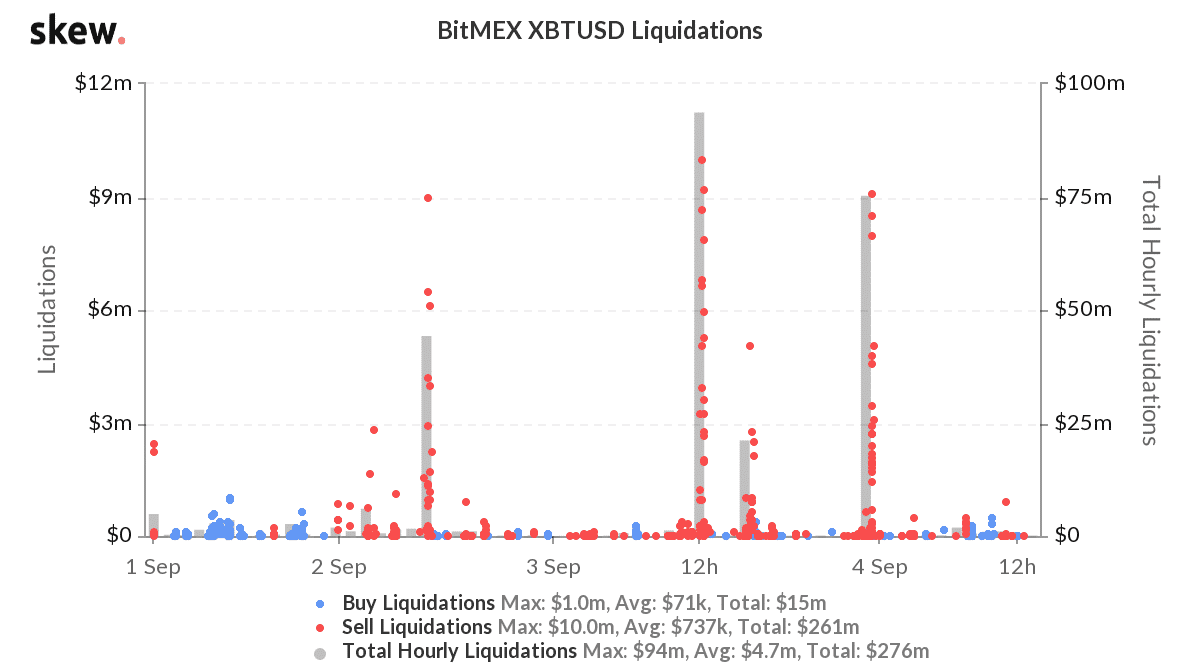

The high volatility has given rise to high liquidation in the BTC market. According to data provider Skew, BitMEX witnessed total hourly liquidations of $276 million within the past three days. Out of the total liquidations, $261 million were sell-liquidations, whereas the remaining $15 million accounted for buy liquidations. However, there has been higher liquidation that has taken place in the market like in July 2019.

BTC continued devaluating on September 4 too, as approximately $75 million longs were liquidated within a single hour on BitMEX.

Interest decreases as the market shrinks

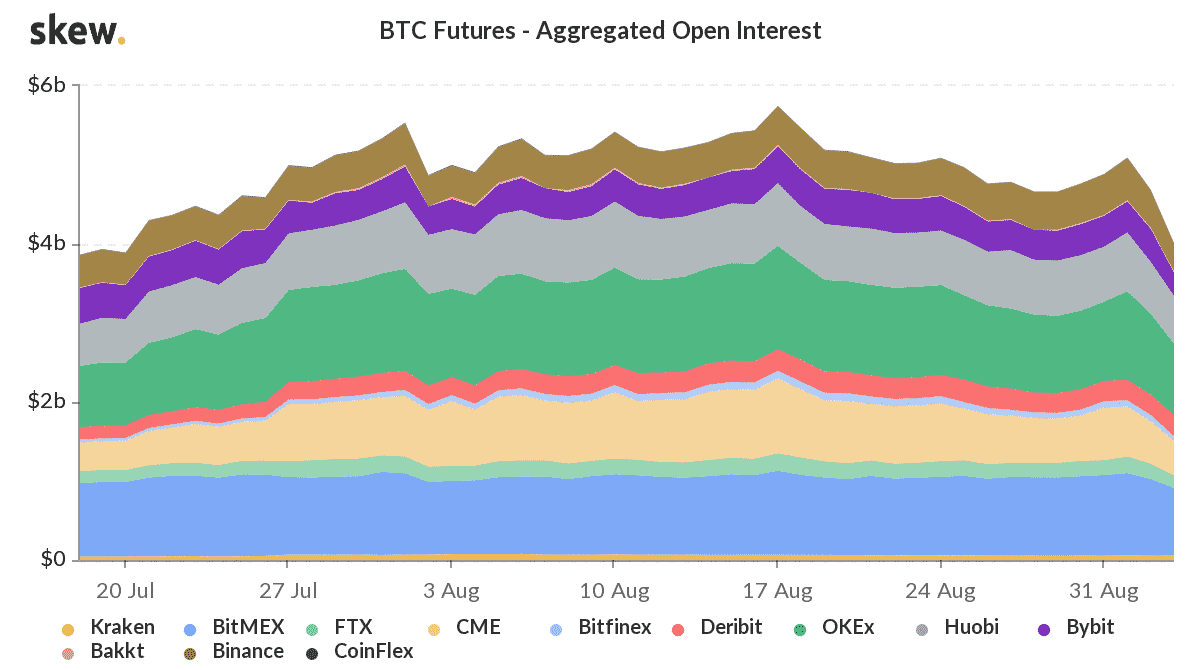

The selling pressure also resulted in the overall open interest to collapse from an ATH of $5.689 billion to $$3.602 billion within a month.

As the sell-offs escalated on 3 September, BitMEX’s XBTUSD open interest also shrunk rapidly from $780.94 million to $622.01 million. However, despite losing interest in the market, 3 September was the most active session of the month for Bitcoin. According to Skew, BTC spot crossed $1 billion in total, while Coinbase did $327 million and was closely followed by LMAX Digital with $294 million.

Upwards and Onwards?

Although the largest crypto asset has suffered a great dent in its value over the past couple of days, the traders were expecting the price to fill the trading gap on the Chicago Mercantil Exchange [CME]. Historically, this gap has been filled with the price sooner-or-later retracing back to the gap. At press time, Bitcoin was being traded at $10.218 with a market cap of $191.43 billion.

- CFTC Approves Stablecoins as New Collateral Option in U.S. Derivatives

- Fold Launches Bitcoin Credit Card with Stripe and Visa Partnership

- SEC Approves Grayscale’s Ethereum ETFs Under New Generic Listing Standards

- Breaking: Jerome Powell Cools Further Rate Cut Expectations, Bitcoin Drops

- Senate CLARITY Act Markup Delayed Amid Looming U.S. Government Shutdown

- PEPE Coin Price: Analyst Sees Breakout-Retest Pattern- Will It Surge Over 230%?

- Shiba Inu Price Eyes 25% Rally as Outflows Jump and Whales Buy 62B Coins

- XRP Price Rises on mXRP Launch, Recovery Ahead?

- Solana Price Prediction: $836M Whale Transfer Spark Fear of $200 Retest Before 62% Rebound

- Bitcoin Price Prediction: $150K in Q4 as Gold’s ATH Momentum Sets the Tone

- PUMP Price Forecast: Whale Buys 1B Tokens as Bullish Pennant Signals 65% Breakout