Bitcoin Futures Open Interest Dips to a 5-Month Low Amid August Sell-Off

The cryptocurrency market is showing weariness, as indicated by the dwindling open interest in Bitcoin’s perpetual futures contracts. On Binance, the world’s largest cryptocurrency exchange by trading volume, open interest dipped to a 5-month low of $2,796,429,005.85, per a recent Glassnode report.

This contraction in futures activity is leaving traders and investors puzzled, particularly as the digital asset struggles to push past the $ 27,000 price point.

Grayscale’s Win Sparks Glimmer of Hope

While the overall trend may be gloomy, there was a ray of sunshine when Grayscale triumphed over the SEC on August 29, providing a morale boost across the market. Despite the ongoing struggles in the spot market, this regulatory win might signal a pivot in sentiment.

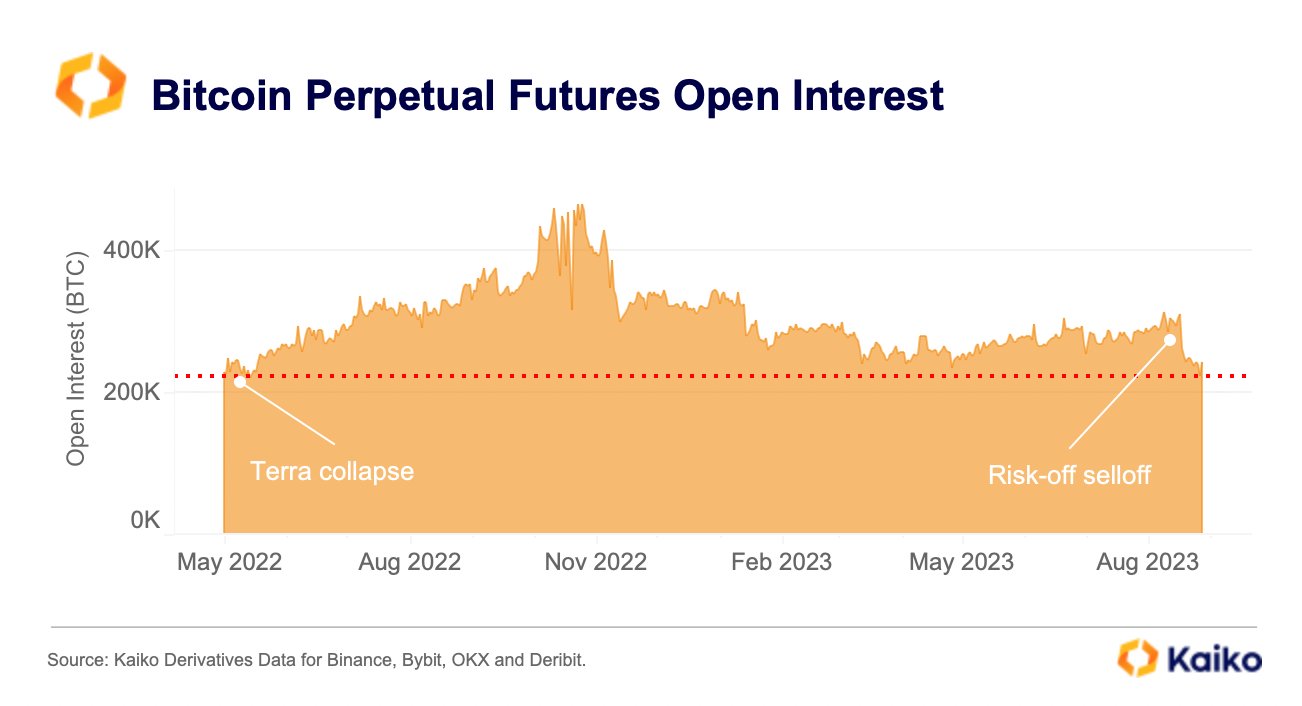

Subsequently, the open interest in Bitcoin futures contracts began to creep upwards. The on-chain data tracking platform Kaiko reported that this key metric had declined for some time, even plummeting to levels last seen following the Terra network collapse in May 2022.

Traders and analysts closely monitor these fluctuations in futures open interest, seeing them as a crucial barometer of market sentiment. With Bitcoin price currently at $25,824.25 and a 24-hour trading volume of nearly $12 billion, it maintains its first-place ranking on CoinMarketCap, boasting a market cap of approximately $503 billion.

The drop in open interest could signify a shift in investment strategy, as institutional traders might be reassessing their positions in light of these developments. According to experts, the buzz generated by the Grayscale win is an encouraging sign. Still, unless other positive triggers emerge, like the long-awaited approval of a Bitcoin ETF, the market may be dictated by caution and hesitancy. As the leading digital asset pivots on these key indicators, the world watches to see if this dip in future open interest is a temporary blip or a precursor to more significant market movements.

A Stalemate in Spot Market Keeps Traders On Edge

Bitcoin has had a tumultuous few weeks, unable to break through the $25,970.28 resistance level that traders have been eyeing. This stagnation is causing frustration among retail investors because regulators seem to be dragging their feet on approving spot Bitcoin exchange-traded funds (ETFs). Pending applications for these financial instruments could offer a more secure and accessible way for retail investors to get into Bitcoin. Still, regulatory hesitancy keeps the market in a state of limbo.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Why BTC Price is Rising Today? (March 9, 2026)

- Wall Street Expert Warns 35% Crypto Stock Market Crash Amid U.S- Iran War Tensions

- Why Crypto Market Is Falling Today (March 8, 2026)

- Michael Saylor Hints at Another Strategy Bitcoin Buy Despite BTC and Broader Market Weakness

- How Low Could Shiba Inu, Pepe Coin and Dogecoin Fall? Key Support Levels and Liquidation Risks to Watch

- Is It a Good Time to Buy XRP As Price Falls 64% From All-time High

- Will Crypto Market Crash This Week? Analysts Predict Timeline for Volatility

- Gold Price Prediction Ahead of March 18 FOMC Meeting

- Dogecoin, Pepe coin, and Shiba Inu Price Prediction As BTC Crashes Below $70k

- Here’s Why Cardano Price Has Not Reclaimed $0.30

- Will XRP Price Crash as U.S. Nonfarm Payrolls Fell by 92,000 in February?

Buy $GGs

Buy $GGs