Bitcoin Futures Open Interest Hits ATH Amidst Price Stagnation

Amidst the frustration of traders and investors due to the price stagnation, there has been a noticeable increase in the open interest for Bitcoin’s futures contracts, likely driven by heightened demand from institutional traders. Despite the lackluster derivatives markets, Bitcoin Futures Contracts Open Interest reached new high on Bybit, with potential implications for the market’s sentiment, as per Glassnode.

📈 #Bitcoin $BTC Futures Contracts Open Interest just reached a 16-month high of $2,816,492,332.03 on #Bybit

Previous 16-month high of $2,815,891,040.41 was observed on 14 August 2023

View metric:https://t.co/fFm13ZhEJc pic.twitter.com/7jLU0CED5f

— glassnode alerts (@glassnodealerts) August 16, 2023

A Surge in Bitcoin Futures Open Interest

Data from Glassnode shows a significant increase in the open interest of Bitcoin futures contracts, reaching a 16-month high of $2,816,492,332.03 on Bybit, surpassing the previous high of $2,815,891,040.41 just two days earlier.

BTC Futures Contracts Open Interest on Bybit, Source: Glassnode

As per Coinglass, a cryptocurrency futures trading & information platform, Bybit now ranks second in total BTC futures open interest with 96.60K BTC, only trailing behind Binance, which has 154.40K BTC.

Open interest represents the number of futures contracts market participants hold at the end of the trading day. It is calculated by adding all contracts from opened trades and subtracting them from closed trades, an indicator to gauge market sentiment and the strength of price trends.

Mixed Sentiment Among Traders

Despite the uptick in open interest, Bitcoin traders remain frustrated with the cryptocurrency’s price trends, specifically the inability to break past the $30,500 mark over the past month. This sentiment has been exacerbated by the ongoing delays and pending reviews of several spot Bitcoin exchange-traded funds (ETFs) by regulators.

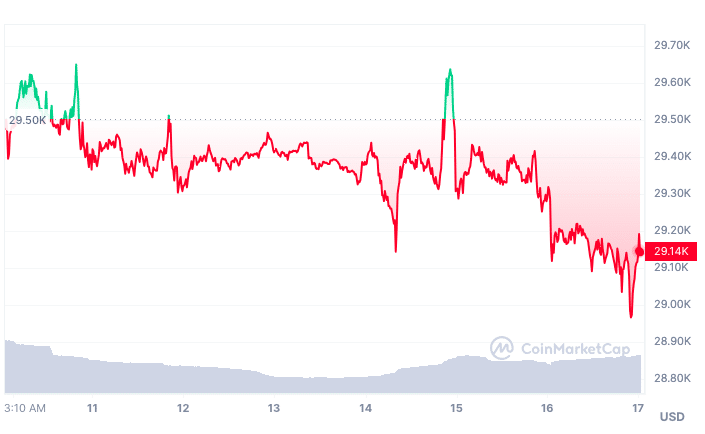

Bitcoin’s price is currently $29,024.97, with a market cap of $564,802,228,909 and a 24-hour trading volume of $14,098,065,712. It has a circulating supply of 19,459,181 BTC coins, with a maximum supply of 21,000,000 BTC coins. The present market conditions suggest a lack of momentum for trading at or above the $31,000 level, which has left investors with mixed feelings.

BTC/USD price chart, Source: CoinMarketCap

Analysts have noted bearish trends on the price charts, which have left investors pessimistic. The price action is forming a pattern favorable for sellers, as it is topping out and consolidating near trendline support. If the BTC price breaches this support and trades below this zone, sellers may gain control and potentially drive the price below the $20,000 mark, as indicated by the formation of a double-top pattern.

- Jane Street and Abu Dhabi Wealth Fund Mubadala Increase Holdings In BlackRock’s Bitcoin ETF

- FOMC Minutes Drop Tomorrow: Will Crypto Market Rally or Face Fed Shock?

- BlackRock Amends Filing For Staked Ethereum ETF, Eyes 18% of Staking Rewards From ETH Fund

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k