Bitcoin Halving 2024 News: BTC Price At $63K, Mimics 2014-2018 Move

Highlights

- The crypto market braces for heightened volatility as the BTC halving nears.

- Bitcoin price trades at the $63K mark today.

- The broader crypto market witnesses panic selling and FOMO buying in hand,

- BTC miners could potentially endure phenomenal losses.

- Bitcoin price holds steady at support.

- BTC transaction fees hit $11 million.

Bitcoin Halving 2024: The much-awaited Bitcoin halving event nears, and a dichotomy between the optimism of bullish investors and the caution of so-called ‘halving bears’ has taken the crypto world by storm. This primarily emerges as the BTC token braces for phenomenal price volatility ahead of the halving event, piquing significant investor attention.

As the event name implies, miners’ total harvestable supply of Bitcoin tokens will be halved. This means that a surge in the price of BTC is possible, as long as the market remains optimistic and the quantity of newly harvested tokens is limited. Skeptics, on the other hand, predict a collapse since miners would receive smaller payouts, which will lessen their motivation to mine Bitcoin. As evidenced by the current state of the BTC token, this market sentiment conflict frequently results in increased market volatility.

As of press time, the Bitcoin token traded at $62,190.02, with a 4.6% dip in its price over the past 24 hours. Interestingly, the token represents stages of a downturn before to a half-halving, where panic selling and FOMO purchasing occur in the market. Across the wide ocean of cryptocurrency, this occurrence created waves as investors speculated on the price movement of Bitcoin after its half. Historical data portrays that the token witnesses a dip right before the halving, whereas following an extended consolidation post-halving, the BTC price trajectory embarks upon a parabolic uptrend. Here’s an overview of some of the live market updates amid the upcoming BTC halving saga:

BTC Miners To Sustain Staggering Losses

According to the insights revealed by Barchart, a platform streamlining real-time updates on all major commodities exchanges, BTC miners could sustain annual losses of up to $10 billion post-halving.

High short interest in BTC mining stocks flags skepticism surrounding the mining firms’ future prospects, in turn stirring a whirlpool of bearish sentiments on BTC post-halving. A sense of caution underlined by ‘halving bears,’ as mentioned above, further falls in line with this data.

BREAKING 🚨: Bitcoin Miners

This week's $BTC halving could result in Bitcoin miners sustaining annual losses of up to $10 billion pic.twitter.com/s9RbbdnFPj

— Barchart (@Barchart) April 16, 2024

Bitcoin Price Holds Support

The tenacity of the token is highlighted by the fact that the Bitcoin price is maintaining above support despite selling pressure that has been applied in a shorter amount of time, as noted by prominent cryptocurrency analyst Michael van de Poppe.

The analyst believes that Bitcoin might go as low as $55K if the BTC token breaks below the present support levels. But according to the analyst, the token is stable at current prices and is about to rise gradually, sparking a frenzy as the BTC halving approaches.

#Bitcoin holding up on support here after a lower timeframe rejection.

If this is lost, we can expect $55K to come in, but overall, I think it's likely that we're holding here and start a slow grind upwards. pic.twitter.com/GK5DMNwsTp

— Michaël van de Poppe (@CryptoMichNL) April 16, 2024

Bitcoin Transaction Fees Hits $11 Mln Amid Looming Halving

Interestingly, as the halving approached, the amount that users pay for processing transactions on the Bitcoin network—known as transaction fees—reached the $11 million threshold. This extraordinary rise in transaction fees is a result of miners racing to mine as much BTC as possible before the halving.

As mining rewards taking a hit with every halving event, BTC miners continue to push for harvesting as many tokens as possible before the halving. This, in turn, also appears to have fueled a 4% surge in the network’s hash rate, compared to April, further underscoring the upsurge in BTC mining activity ahead of this year’s halving.

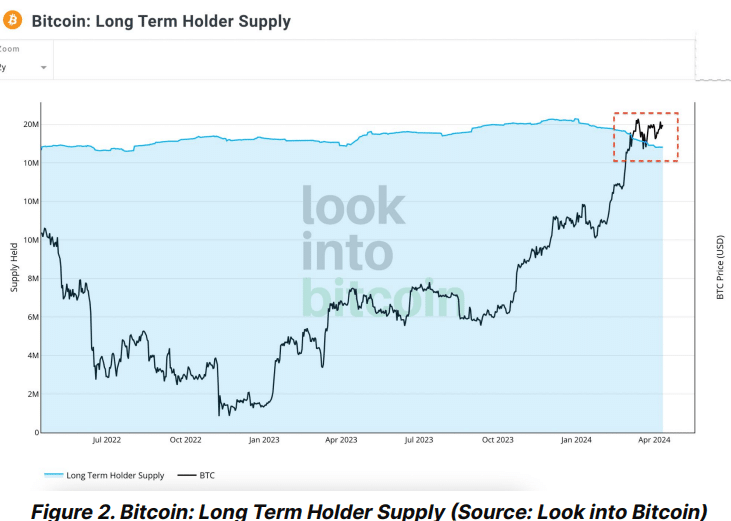

Bitcoin Halving Fuels Massive Exchange Outflows

According to Bitfinex data, as the BTC halving neared, the total number of coins that left CEXs totaled 6,767 BTC on April 12, marking the highest daily outflow since January 2023. Further, the one-year-plus inactive supply, i.e., the number of addresses that haven’t moved their BTC holdings in over a year, has plummeted, implying that the market is at a major inflection point. This signified that investors are accumulating BTC and moving their holdings to cold storage, anticipating potential price rises post-halving.

Bitcoin Price Mimics 2014-2018 Move

At present, Bitcoin’s price movement is closely mimicking the trajectory of its past 2014-2018 move. If the move remains in tandem with its past price history, the post Bitcoin halving ear is likely on track for gains. The demand and supply imbalance that is created after the halving will likely give a push to the prices.

#Bitcoin is still playing out very similarly to the 2014-2018 cycle.

Your job is to survive the halving & pre-ATH chopfest.

The best is yet to come. pic.twitter.com/Nmjj3wAmhS

— Jelle (@CryptoJelleNL) April 16, 2024

- Crypto Market Crash: Here’s Why Bitcoin, ETH, XRP, SOL, ADA Are Falling Sharply

- Missouri Joins Bitcoin Reserve Push as U.S. States Race to Accumulate BTC

- Bitcoin vs Gold Feb 2026: Which Asset Could Spike Next?

- Top 3 Reasons Why Crypto Market is Down Today (Feb. 22)

- Michael Saylor Hints at Another Strategy BTC Buy as Bitcoin Drops Below $68K

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible