Bitcoin Halving In Full Swing, OKEx And Binance Record Highest Daily Spot Trading Volumes

In Volumes is an important variable that influence price action. On April 30, 2020, the day when Bitcoin prices broke above the $8,000 resistance level before galloping towards $9,000, record volumes were registered on Binance, OkEx, and Coinbase. These ramps are popular and are three of the world’s leading cryptocurrency exchanges.

Specifically, Binance and OkEx printed $3.2 billion and $2.5 billion, respectively, in trading volumes while the US-based Coinbase had 818 million. Interestingly, this was roughly a week before the Bitcoin halving event where traders are angling to profit from the expected re-pricing that could see BTC rally.

Bitcoin Halving Soars Volumes at P2P Platforms and CME Bitcoin Options

Meanwhile, BTC trading volumes from peer-to-peer trading platforms is now above 2017 highs according to data published by Useful Tulips. At the same time, the flow from institution continues to pick up as CME Bitcoin Options volumes soared to a new all-time high on May 5.

202 CME bitcoin options contracts traded yesterday, a new record in terms of $ notional

May20 10k and 11.5k calls traded in 100 lots, equivalent to 500 bitcoin options each pic.twitter.com/zBgTgTVWDe

— skew (@skewdotcom) May 6, 2020

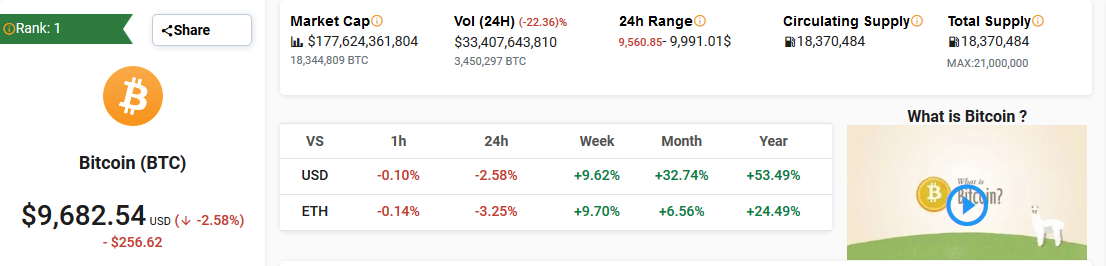

The Bitcoin price is currently hovering around the $9,700 level, $300 from $10,000, an important psychological mark.

Volume Is a Measure of Investor Interest

There are several variables that determine price. Given how unique cryptocurrencies are, other than price action and hype, trading volumes can be used as a metric to test popularity and therefore liquidity.

The higher the trading volumes, the higher the liquidity and depending on price action, the surge can indicate entry of bears or bulls.

In April, @binance and @OKEx saw the highest daily spot volumes.

On the 30th, Binance and OKEx traded $3.6bn and $2.5bn respectively while the next largest exchange (Coinbase) traded $818mn.

Where will volumes be after the #Bitcoin halving? pic.twitter.com/YQW7YMWMd4

— CryptoCompare (@CryptoCompare) May 9, 2020

In April, prices, as aforementioned, surged past $8,000 in a breakout pattern confirming the double-bar bullish reversal pattern of April 15 and 16 and most importantly reversing losses of Mar 12’s Black Thursday.

On Mar 12, Bitcoin prices plunged from around the $8,000 mark, temporarily sinking to lows of $3,800 as the global markets were thrown to disarray because of coronavirus which continues to claim lives and force restrictive measures from governments around the world.

Halving Draws Interest, Hedge Fund to Invest in Bitcoin Futures

Even though volumes have dropped slightly, there is interest from the trading community. While participation is in pulses, fluctuating between highs and shrinking depending on supply or demand, the upcoming halving event is drawing capital to Bitcoin.

Binance's #Bitcoin spot trading volumes hit record highs recently as the space saw accelerated volatility. pic.twitter.com/gz35SYFJFG

— TradeBlock (@TradeBlock) May 6, 2020

The digital asset outperformed gold, a safe haven asset, year-to-date and has been described as the fastest horse by a billionaire hedge fund manager Paul Tudor Jones.

His hedge fund has been authorized to allocate part of the $38 billion under management in Bitcoin futures, a derivative product whose index tracks the real-time price of Bitcoin.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Vitalik Buterin Exceeds Planned Ethereum Sales as Total Liquidations Hit $35M

- Circle Stock Jumps 35% on Stablecoin Boom, USDC Supply Soars 72%

- Democrats Convene US Senate Crypto Bill Meeting as a16z Briefs Republicans on CLARITY Act & AI

- After 820% Gains: Privacy Coins Evolve into Payment Rails

- Bitcoin Price Rebounds as Jane Street “10 am Dump” Pattern Stops Amid Lawsuit

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

Buy Presale

Buy Presale