Bitcoin hits pause amid the emergence of coronavirus vaccine

- Bitcoin consolidates between $15,500 and $15,000 as pharma giant Pfizer announces a coronavirus vaccine.

- BTC/USD must hold above $15,000 to avert potential losses to $14,500.

Bitcoin has remained stable amid the announcement of a COVID-19 vaccine, which is 90% effective. The rally from the crash in March has mostly been attributed to instability in global markets like stocks. Last week BTC/USD sprung to new yearly highs close to $16,000. A reversal occurred with the bellwether digital asset refreshing the support at 14,500.

BTC/USD did not, however, stay down for long as a recovery came into the picture, lifting Bitcoin above $15,000. Price action on the upside has been limited under $15,500. Meanwhile, stability has encroached, bring calm in a market that was extremely bullish last week.

The emergence of the COVID-19 vaccine means that the stock market could start to rally. The influx of money into Bitcoin and other cryptocurrencies may go down, negatively impacting the buying pressure.

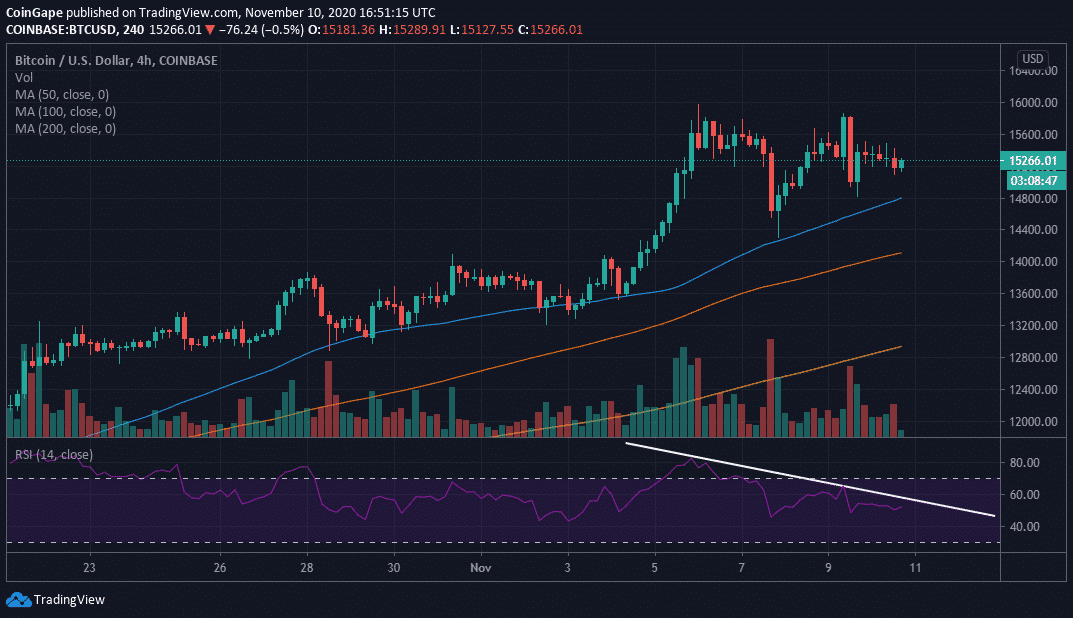

For now, BTC is dancing at $15,270 amid consolidation. As mentioned, resistance at $15,500 is delaying the anticipated breakout to $16,000. A broader look at the 4-hour chart brings into the picture possibility for a reversal taking precedence in the near term. A divergence formed by the Relative Strength Index adds credibility to the bearish outlook.

BTC/USD 4-hour chart

It worth mentioning that Bitcoin will resume the uptrend if the hurdle at $15,500 is broken. The lift-off to highs above $16,000 might ride on the fear of missing out (FOMO). Many analysts believe that Bitcoin is in a bull market and likely to jumpstart the rally.

On the downside, support is expected at the 50 Simple Moving Average in the 4-hour range. Last week’s support at $14,500 will come in handy, while extended losses will seek refuge at the 100 SMA as bulls fight to prevent losses under $14,000.

Bitcoin Intraday Levels

Spot rate: $15,280.

Relative change: -60

Percentage change: -0.4%

Trend: Consolidation

Volatility: Low

- Bitget Targets 40% of Tokenized Stock Trading by 2030, Boosts TradFi with One-Click Access

- Trump-Linked World Liberty Targets $9T Forex Market With “World Swap” Launch

- Analysts Warn BTC Price Crash to $10K as Glassnode Flags Structural Weakness

- $1B Binance SAFU Fund Enters Top 10 Bitcoin Treasuries, Overtakes Coinbase

- Breaking: ABA Tells OCC to Delay Charter Review for Ripple, Coinbase, Circle

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown

- Ripple Price Prediction As Goldman Sachs Discloses Crypto Exposure Including XRP