Bitcoin Holdings Shift: Institutions Accumulate BTC as Exchange Balances Plummet

According to renowned crypto analyst Miles Deutscher, the recent filing by BlackRock for a spot Bitcoin ETF has triggered a significant increase in Bitcoin holdings by institutional funds. While there is skepticism regarding the impact of ETF approval on the crypto market, positive indicators such as recent inflows and the support of influential figures like Larry Fink suggest a promising outlook for Bitcoin’s price and future.

Institutional Bitcoin Holdings Surge

Deutscher suggests that this uptick is just the beginning of a wider trend of institutional accumulation of Bitcoin, as approximately 20,000 BTC have been added by institutions.

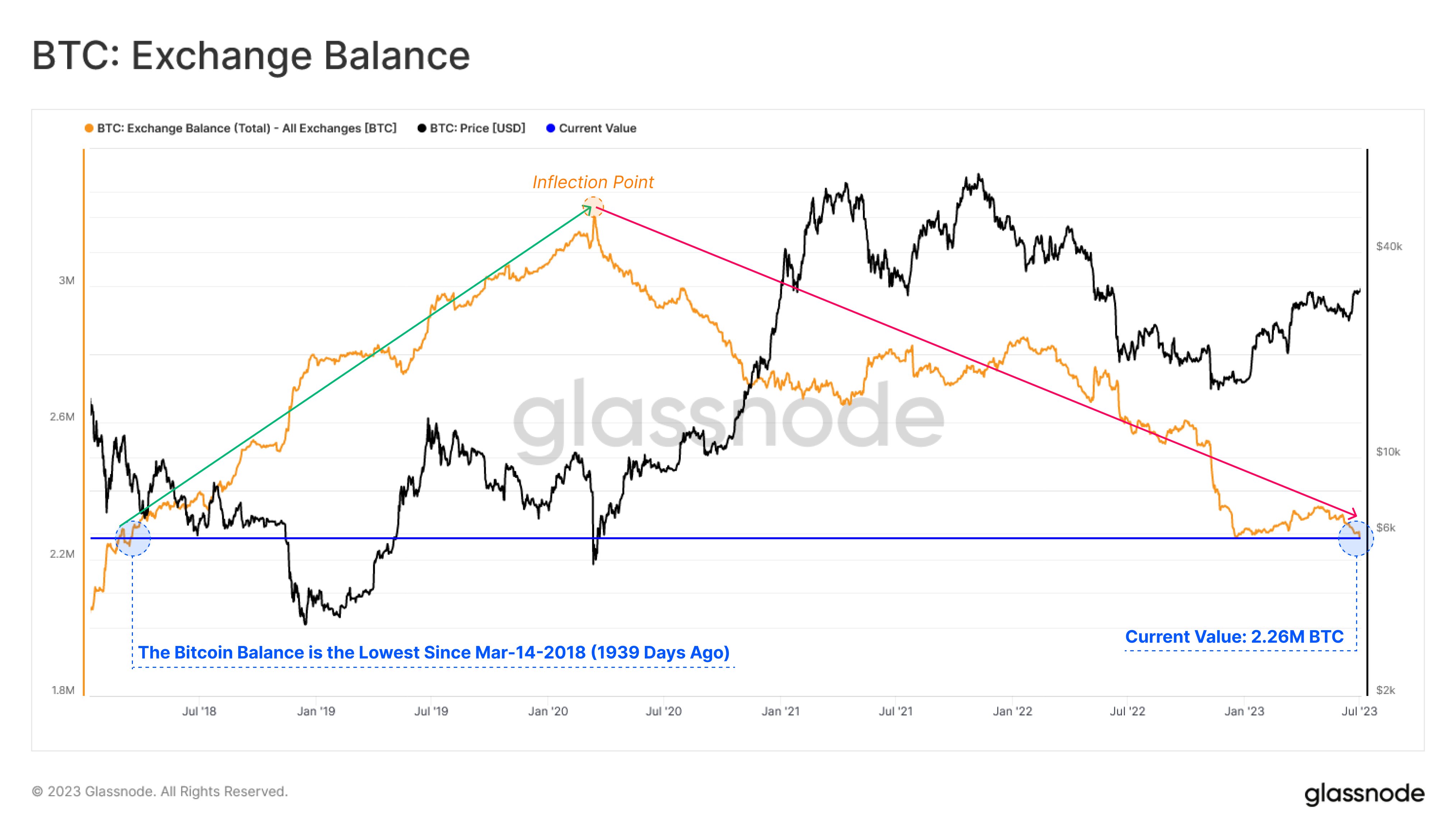

Simultaneously, Glassnode data reveals a noteworthy trend in the balance of Bitcoin held on exchange addresses. The balance has been steadily decreasing and recently reached its lowest point since March 14, 2018, at 2.26 million BTC, indicating a decline of exchange-held Bitcoin over the past 1,939 days.

BlackRock’s filing of a spot Bitcoin ETF in the previous month caused a stir in the crypto community, leading to a price rally that pushed BTC to $31,000. Following suit, other major players like Fidelity and WisdomTree have also submitted their applications to the US Securities and Exchange Commission (SEC) for similar ETFs. However, analysts at JPMorgan, including Nikolaos Panigirtzoglou, believe that spot Bitcoin ETFs have failed to attract significant investor interest outside the US in regions like Canada and Europe.

Also Read: XRP Price Predicted to Surge 600% Amidst Ripple’s Class Action Lawsuit

Positive Outlook for BTC Price?

Despite this, crypto funds, including both futures-based and physically backed funds, have struggled to gain investor attention since the second quarter of 2021, even with outflows from gold ETFs over the past year. The US jobs data released on Thursday caused a dip in the crypto market, and analysts anticipate a similar reaction on Friday due to the tight labor market in the US.

CoinGape reported recent inflows into crypto assets and the monthly Moving Average Convergence Divergence (MACD) turning green as indicators of a positive outlook for BTC’s price. Over the last two weeks, crypto funds have recorded a total inflow of $334 million, with $199 million and $125 million inflows in previous weeks.

Also Read: Can Bitcoin Price Still Hit $35000?

Larry Fink, the CEO of BlackRock, the world’s largest asset manager with over $9 trillion in assets under management (AUM), shares a similar sentiment. Fink believes that the floodgates are opening for Bitcoin, with over 70% of all circulating BTC held by long-term holders, indicating strong conviction. Bitcoin Price (BTC) at the press time has dipped 2% to $30,109.24.

- Crypto Prices Surge Today: BTC, ETH, XRP, SOL Soar Despite US Government Shutdown

- CLARITY Act: Crypto Group Challenges Banks Proposal With Its Own Bill Suggestions

- Trump’s Truth Social Files For Bitcoin, Ethereum, Cronos Crypto ETFs Amid Institutional Outflows

- Trump Tariffs: U.S. Supreme Court Sets February 20 for Potential Tariff Ruling

- Brazil Targets 1M BTC Strategic Reserve to Rival U.S. Bitcoin Stockpile

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

BTC/USD

BTC/USD