Bitcoin Long-Term Holders Reach ATH, Is The Time For Quick Gains Over?

The world’s largest cryptocurrency Bitcoin has once again slipped below the $30,000 mark and the short-term holders who bought Bitcoin in the most recent bull run, have faced disappointment. Perhaps this unpredictability of Bitcoin has made investors go long-term on the coin. According to Glassnode, the total Bitcoin supply held by long-term holders has reached 14.5 million BTC, an all-time high (ATH).

No More Quick Gains From Bitcoin?

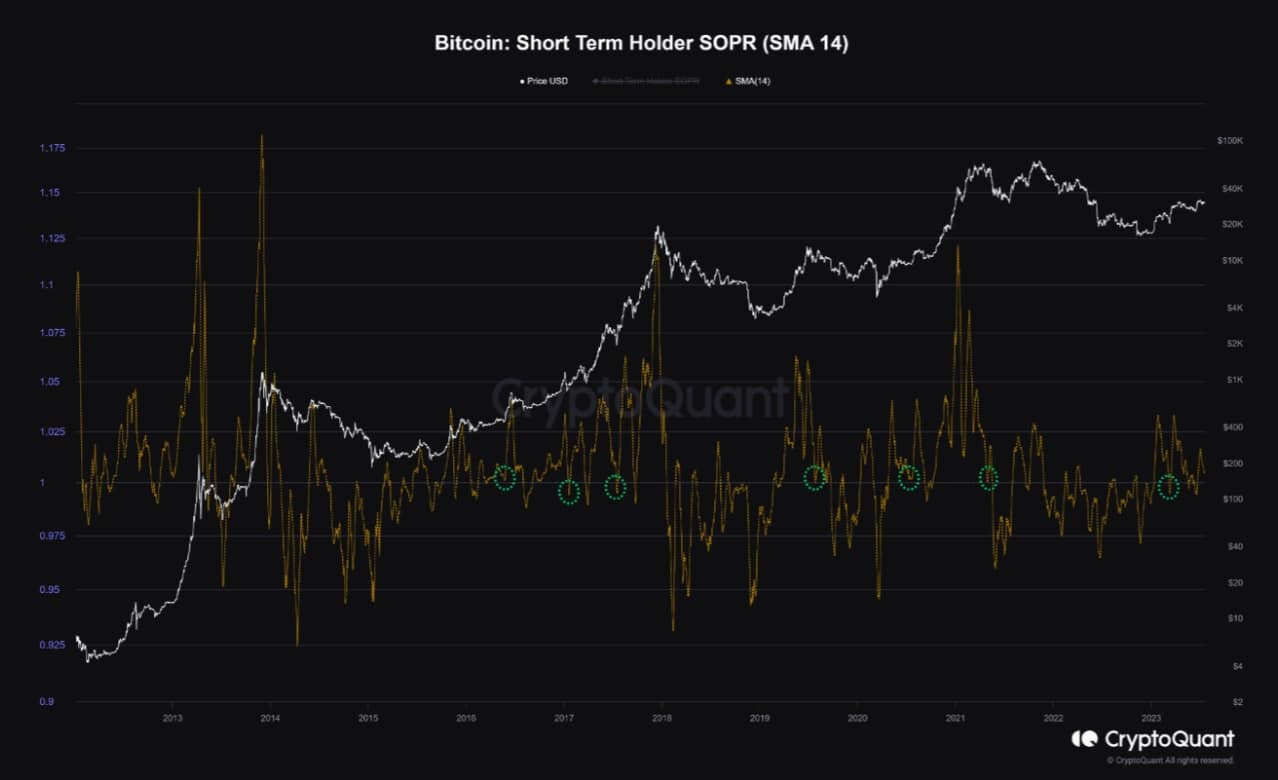

According to on-chain specialist Gustavo Faria, the Spent Output Profit Ratio (SOPR) for the STH cohort was very close to 1. Every currency that has been swapped on-chain has its realized profit and loss disclosed by SOPR. The present sellers will experience a loss if the value is less than 1. On the other side, a higher value indicates that the seller is making money.

Following the bullish BTC era, the SOPR range was meant to act as a support area. That hasn’t happened, though. A push toward 1 suggests that the majority of STH were making minimal to no progress, the financial analyst said.

The LTH has a bigger spent profit than the STH if this statistic is exceptionally high. And when this occurs, it suggests that BTC might be close to the market’s peak. However, 1.38 was a comparatively low result for the SOPR ratio. As a result, Bitcoin can be viewed as being closer to the bottom than the top.

Also Read: Dormant Bitcoin On The Move As Whales And Institutions Anticipate $100K BTC Price

Continue Holding Despite The Bears

These LTHs are the market’s “strong hands” since they typically hold their BTC for extended periods without moving, regardless of what may be happening in the larger market. During the first few months of the rally, the supply of Bitcoin LTH had been gradually increasing, suggesting that a net number of coins were developing into this category.

The indicator, however, began to fall in late February and hit a low in March. The asset’s price fell precipitously during this period, suggesting that some of the selling by the LTHs may have contributed to it.

Bitcoin moved higher on Friday in just another boring day for the cryptocurrency market before resuming its routine surroundings under $30,000. According to market capitalization, the biggest digital asset was currently trading at $29,946.

Also Read: Bankrupt Celsius Network Reaches Settlement, Agrees To Pay More To Customers

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin Price Still Risks Decline If Iran War Mirrors Ukraine War Market Reaction, JPMorgan Warns

- Bitget Unveils Upgrade For Stock, Gold Trading Alongside Crypto As Part Of Universal Exchange Push

- ChangeNOW Is Settling Crypto Swaps in Under a Minute.

- $3B Western Union Expands Into Crypto With USDPT Stablecoin Launch on Solana

- XRP News: Key Ripple Whale Indicator Turns Bullish After Months, Price Rally Ahead?

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

Buy $GGs

Buy $GGs