Bitcoin Miners Are Dumping Tokens, How Will Prices React?

Bitcoin miners have begun selling their holdings on the open market, as a price crash pressured their finances.

A report by Bitcoin miner Compass Mining shows that several U.S.-based miners have begun offloading their holdings on the open market.

Coupled with a decline in Bitcoin prices, miners are also dealing with rising difficulty in mining. This is reducing the profitability of mining.

Data from Bitinfo shows that Bitcoin mining profitability has sunk to its lowest level since mid-2020, with Bitcoin prices hovering around similar lows.

Why are miners offloading Bitcoin?

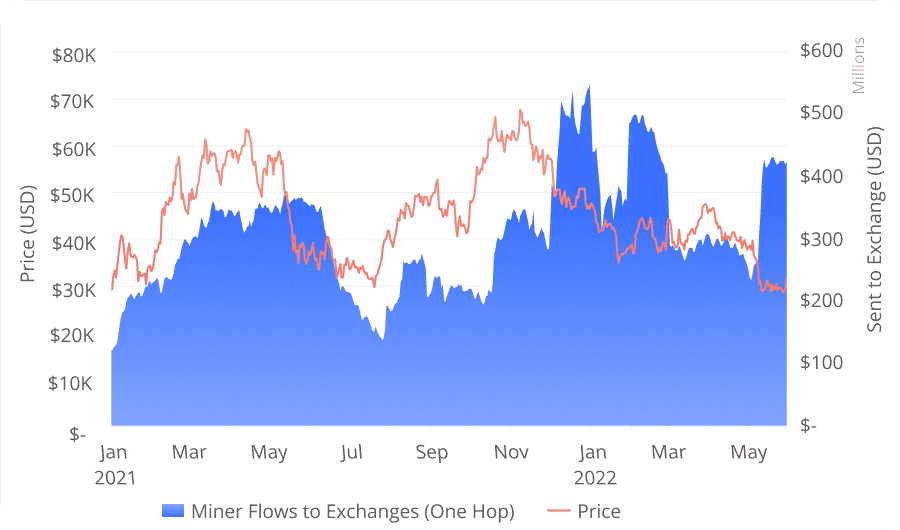

Compass, citing Coinmetrics data, said miner flows to exchanges reached their highest level since January. The selling had preceded a major dump in Bitcoin prices over the next month, before some relief in March.

Canadian miner Cathedra is the most recent miner to sell the token. In its recent earnings report, the miner said it had sold 235 tokens- almost all of its holdings- in May for total proceeds of $8.8 million.

The company said the sales were to “insulate itself” from additional declines in prices. It now holds about 3.7 tokens.

Miners may begin to sell hodl’d Bitcoin into the open market. At the very least they are feeling the pain after the last major dip in price. Couple this with a downwards difficulty adjustment – indicating miners powering off – and it seems miners may be hitting a wall in profitability.

-Compass Mining Analyst Mitch Klee

No recovery in sight

With Bitcoin now erasing a recent relief rally, sentiment has largely soured towards the crypto market. The token has struggled to break past $30,000 for nearly a month.

While a recent report suggests that markets may have found a bottom, they will also face great difficulty in recovering. With policy tightening by the Federal Reserve, rising inflation and the Russia-Ukraine war, Bitcoin is likely to face a steep climb back to previous highs.

Still, with Ethereum shifting to a proof-of-stake model this year, Bitcoin may see an influx of miners from the former.

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act