Bitcoin [BTC] Miners Recording Massive BTC Outflows, Will Bulls Survive?

Just a day ago Bitcoin was seen lounging above 10K. However, in just a day’s time, the price of the coin plummeted back to the 9K zone. As per CoinMarketCap, Bitcoin witnessed a 5.91% drop in its price over the past 24-hours, at press time.

Bitcoin’s New York Minute

Merely 24-hours ago, the crypto community were rejoicing Bitcoin’s breach of the 10K zone. Several prominent members of the crypto community even went on to soothsay that there was no turning back for the king coin. While the community thought that the Halycon Days were here, Bitcoin’s price went crashing back to 9K. At the time of writing, Bitcoin’s price was down to $9,527 after reaching a high of $10,178.75, just yesterday.

The Bitcoin blockchain underwent its third halving on 11 May 2020, where the block reward for miners lessened to 6.25 BTC from 12.5 BTC. The crypto industry expected the price of Bitcoin to ascend soon after the halving and it did as expected. However, the reason behind the price drop is still under speculation.

While several hypothesized that this might be the last time Bitcoin would be in the 9K zone, a few others like Ki Young Ju, the CEO of an on-chain analysis platform, Crypto Quant dug deep into the matter. He tweeted,

Significant outflows from the unknown miner before the dip. They're CAPITULATING.https://t.co/WVdBy1t17E pic.twitter.com/1LQeLYpY6X

— Ki Young Ju (@ki_young_ju) June 2, 2020

Further explaining the same, Ki Young Ju suggested that these unknown miners conventionally sell Bitcoin when the coin is around 10K. According to him selling it at 10K is “too soon in terms of mining profitability.”

The same kind of trend took place back in May as well, when the coin was proximate to hitting 10K.

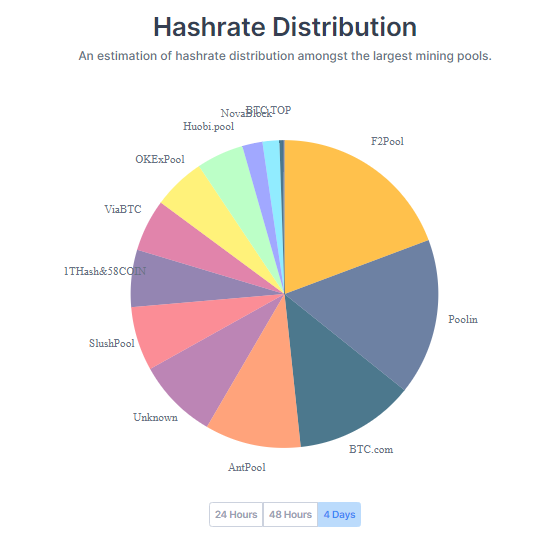

Ki Young Ju went on to explain that this “Unknown mining pool” currently has the 5th largest hash rate with about 48 mined blocks.

Another crypto-related Twitter account, Whale also highlighted that the outflows of the unknown mining pool stood at 2,293.74. The tweet read,

“I was right. I said after the halving that miners would capitulate.

There is a HUGE outflow of #Bitcoin from old miners.

Would they be doing this before a bull run? Certainly not.”

Amidst Bitcoin’s recent price drop, almost every prominent altcoin is spiraling downwards, further pointing out their correlation with Bitcoin. Just yesterday, Bitcoin Cash was exhibiting notable price change, however, at the time of writing, the coin was trading at $248.62 with 5.06% drop in its price over the last 24 hours.

- Trump’s Truth Social Files For Bitcoin, Ethereum, Cronos Crypto ETFs Amid Institutional Outflows

- Trump Tariffs: U.S. Supreme Court Sets February 20 for Potential Tariff Ruling

- Brazil Targets 1M BTC Strategic Reserve to Rival U.S. Bitcoin Stockpile

- Breaking: U.S. CPI Inflation Falls To 4-Year Low Of 2.4%, Bitcoin Rises

- Bitget Launches Gracy AI For Market Insights Amid Crypto Platforms Push For AI Integration

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15