What is Lowest Break-even Cost for Bitcoin Mining? Here’s Where S17 Miners Stand

With less than 50 days to halving, the miners are likely losing confidence in profitable operations in 2020. As recently reported on CoinGape, the S9 miners are now becoming less and less cost effective to the point of large-scale shutdowns.

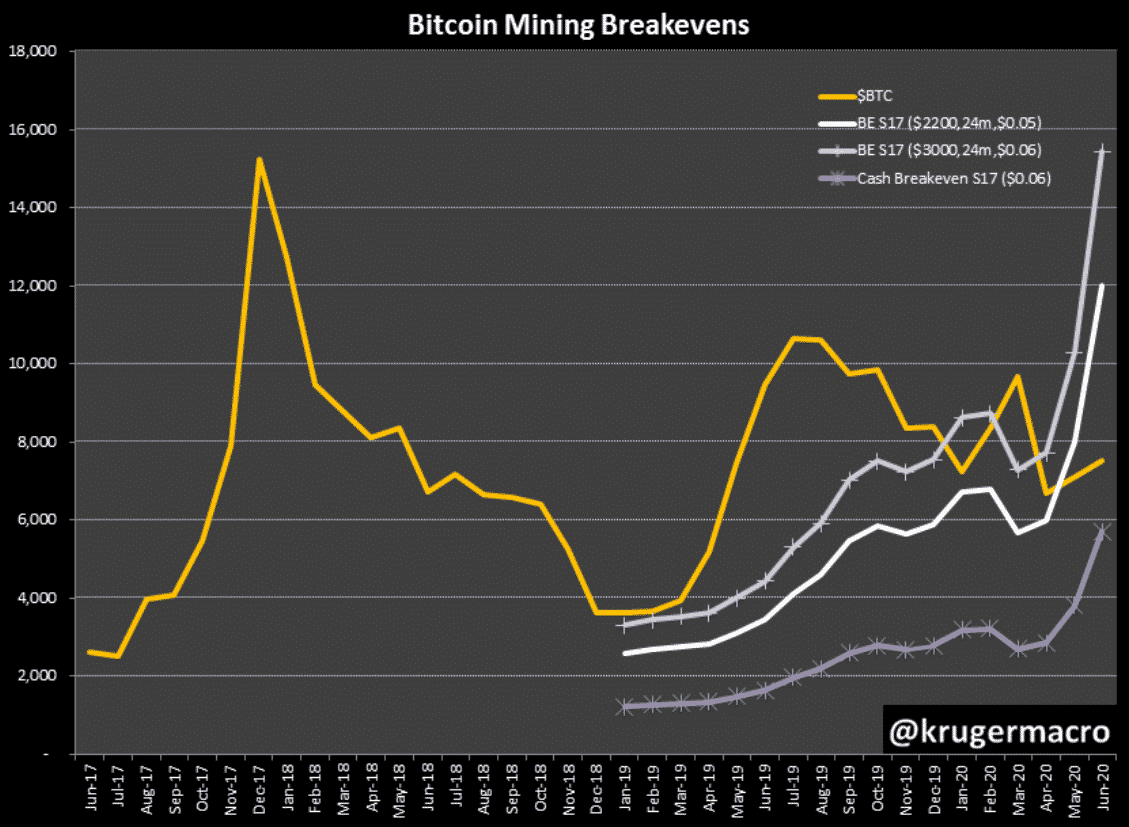

While the new age 7 nm chips powered S17 miners are profitable for now, the prospects for profitability on the present year’s financial statement seems unlikely. Alex Kruger, a crypto analyst tweeted,

Their profitability would get squeezed come the halving (turning in net operating losses), yet miners would remain cash flow positive (see “Cash Breakevens”). For as long as cash flow positive, miners may stay in the game

Nevertheless, the cash break-even of the variable cost of electricity is likely to be covered after halving as well. Currently, $2600 is the ideal break-even cost for S17 miners. In the chart given below as well, it shows that the break-even cost is below $6000 (double of current price) post halving.

The net operation losses will comprise of the depreciated amount for the cost of S17 miners, rent/lease for the space, maintenance cost and other miscellaneous expenses.

As Kruger mentions that they ‘may’ stay in the game, a temporary shutdown post halving is can also be witnessed across the entire industry. However, the giving up of capital in terms of hardware and space will be still a matter for the future.

However, the average amortization period (loan repayment) for miners is usually 2-4 years. Given that the last generation of mining hardware (S9 models with 16 nm chips) have been in existence for around 4 years , as well, and are now starting to become extinct, the miners will be looking to generate profits soon.

On Bitcoin’s Death

Some miners might continue benefit from the economies of scale by setting up larger farms, entering into credit facilities, and delaying payments. Adam Back, the Co-founder and CEO of Blockstream quotes Samson Mow saying,

@Blockstream mining operations costs are low enough that we can outlast most miners and be the last ones standing

…like discounted dollar cost averaging, where you mid-term HODL the mined coins. our claim is macro-volatility actually is *good* for mining return as you mine more coins and hold.

Hence, the death of Bitcoin due to a downfall in price a highly unlikely event. Furthermore, the difficulty adjustments every 2 weeks, will start to favor the remaining players in the game as the rest quit. If the bear-market induced by Coronavirus lasts the mid-term, the industry can expect net profitable return soon.

How long do you think the tension due to coronavirus will last? Please share your views with us.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs