Bitcoin and Gold Fear Bear Reversal as U.S. Employment Rate Improves

The negative correlation of the stock markets with gold and Bitcoin continue to its trend. As reported yesterday, the two commodities (or digital asset) began an uptrend against the negative move in stocks. While the uptrend does not seem to hold, the negative correlation is getting stronger.

Have We Hit Bottom?

The rate of unemployment in the U.S. has dipped and is now starting to show revival. The unemployment rate declined to 13.3 per cent in May from 14.7 per cent in April. Around 2.5 million people were rehired during the second half of May as the COVID-19 lockdown ended.

The news is extremely positive for the stock markets as it strengthens the outlook of the economy. SPX jumped 2% to $3185, rising above the highs in March. Hence, completely retracing the coronavirus dump.

On the other hand, Gold fell by 1.8% breaking below the support around $1690-$1700.Bitcoin dropped 1.34%, as well. However, it was two hours earlier than the announcement on employment was made. Therefore, either BTC acted as an early indicator, or the drop was completely uncorrelated to the Fed’s report.

While the employment rates of even 13% are massively high, the stocks are pushing up to reflect that the worst might be over, for now.

Will Bitcoin Give in to Selling Pressure or Continue Uncorrelated Rise?

As for Bitcoin, the market reaction in the near future will be critical. As the fears of inflation and rising employment are beginning to wash away, the fundamentals around Bitcoin investment are likely to get weaker.

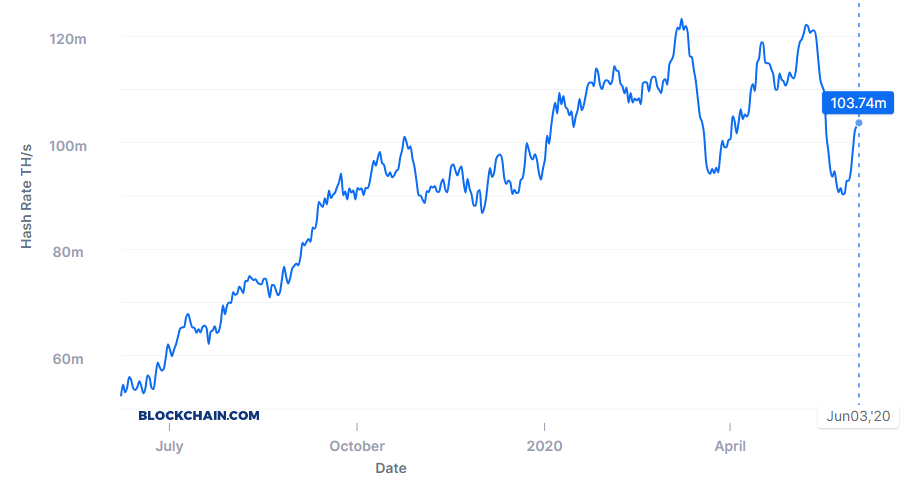

Since the halving, the price is ranging in between $9450-$10,200, as bulls and bear tug of continues. The network difficulty has restored to pre-halving levels, with the total hash-rate recovering around 14.4% from the lows post-halving.

The fear and greed index is presently neutral with the squeeze indicator of the markets indecisive as well. Nevertheless, as reported earlier, the institutional and retail interest has been on a massive rise. Even last week, the BTC purchases made by Grayscale alone were greater about 150% than the amount generated.

Would the Bitcoin bulls have to wait for a rally or accumulation will lead to a rise? Please share your views with us.

- Bhutan Gov. Dumps More Bitcoin Amid $410M Institutional Sell-Off in BTC ETFs

- Crypto Market in Panic Mode Ahead of Bitcoin, ETH, XRP, SOL Options Expiry & US CPI Today

- Digital Assets Are Fixed In The Future Of Traditional Finance

- U.S. CFTC Committee Appoint Ripple, Coinbase, Robinhood CEOs to Boost Crypto Regulation

- What Will Spark the Next Bitcoin Bull Market? Bitwise CIO Names 4 Factors

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter