Bitcoin Options Expiry: How Traders Are Pricing For Bitcoin Halving

Highlights

- Over 21,162 BTC options of notional value $1.51 billion are set to expire.

- 227,785 ETH options of notional value of almost $0.81 billion are set to expire

- Max pain point below current price indicates selloff today.

Bitcoin and Ethereum prices rebounded slightly but are still under selling pressure as price momentum fades as Bitcoin and Ethereum options worth nearly $2.5 billion are set to expire today. The volatility ahead of Bitcoin halving has increased as traders are pricing low upside momentum amid headwinds such as macro and selling by whales.

Bitcoin and Ethereum Options Worth $2.5 Billion to Expire

Crypto market to remain volatile before and after Bitcoin halving as experts pointed to selling sentiments in the crypto market due to the buildup of adverse conditions like hot CPI data this week and a massive drop in volumes in the derivatives market.

Greekslive revealed that sell contracts have been the most dominant trade of the month and halving expectations appearing to be overdrawn. With the recent slowdown in ETF inflows, the “lack of new hot spots in the market and a more subdued sentiment.” They expect selling medium-term is indeed the better option, and short term is worth it due to the sentiment surrounding Bitcoin halving.

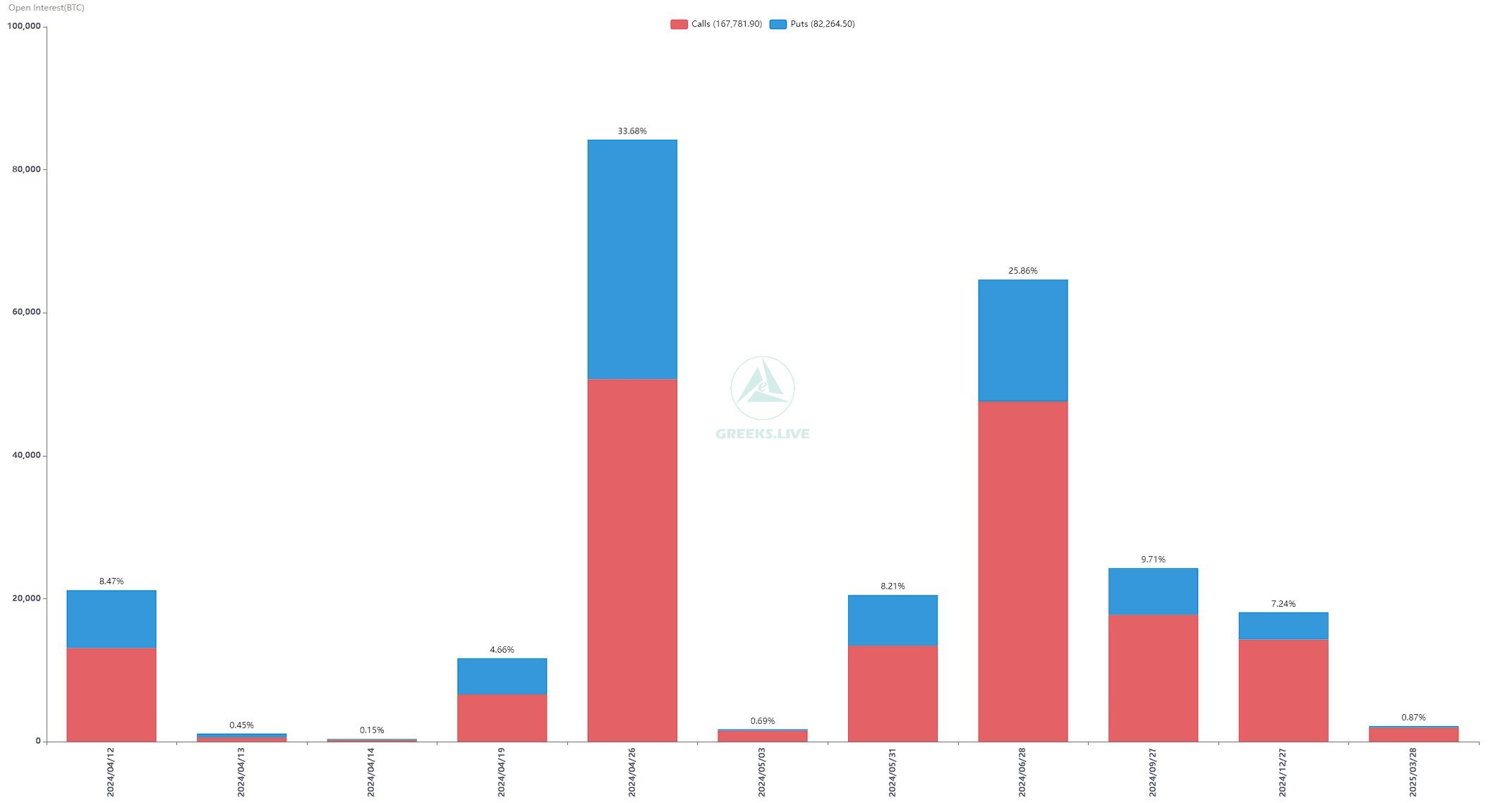

Over 21,162 BTC options of notional value $1.51 billion are set to expire, with a put-call ratio of 0.62. The max pain point is $69,000, indicating Bitcoin price remains under selling pressure as per the current price. Implied volatility (IV) witnessing significant declines across all major terms, which means volatile price movements will see BTC price tumble below $70,000.

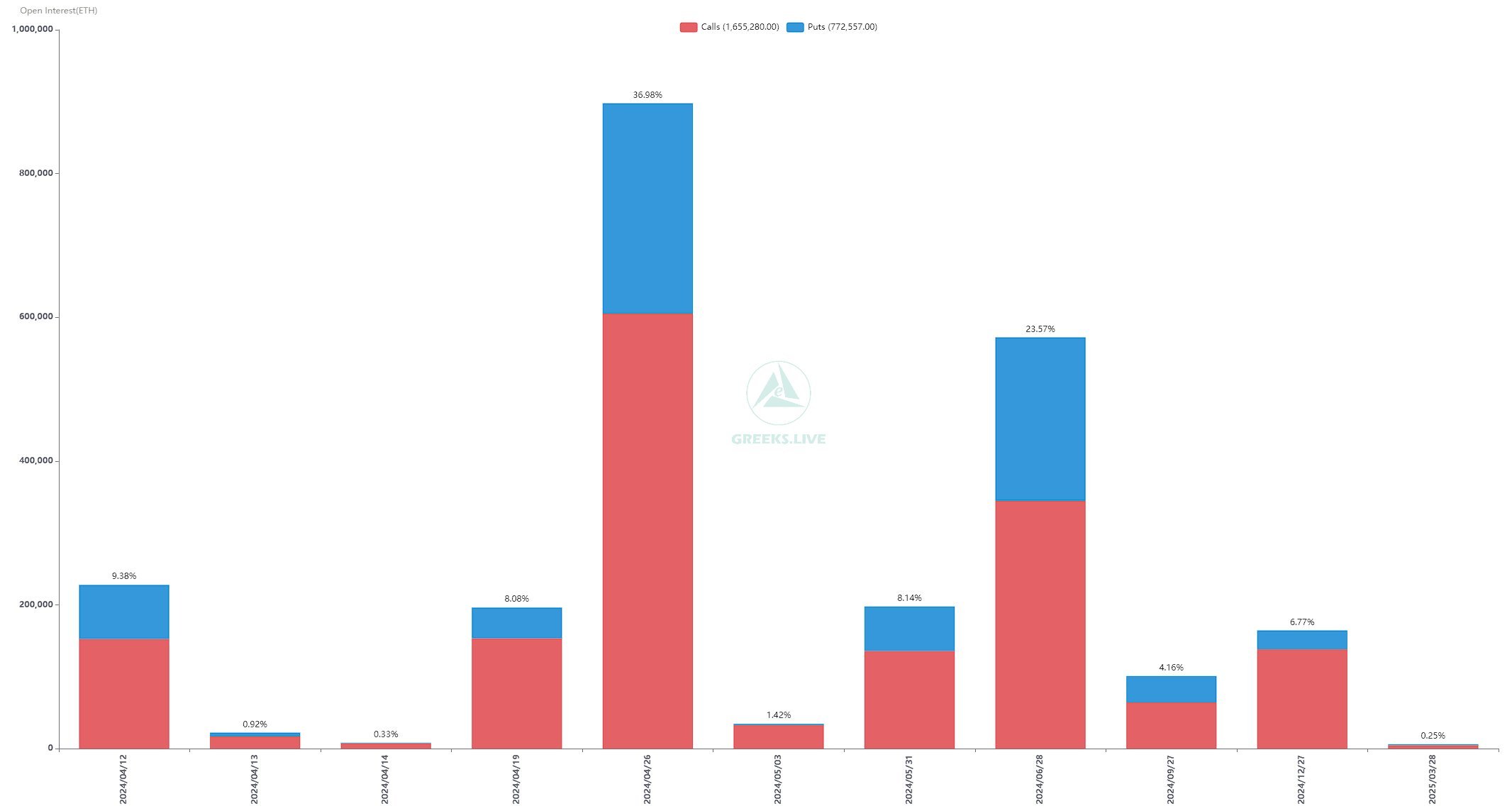

Meanwhile, 227,785 ETH options of notional value of almost $0.81 billion are set to expire, with a put-call ratio of 0.49. The max pain point is $3,425, which is also lower than the current price of $3,535. This indicates traders still have opportunities to trade the price lower. Keeping an eye on trading volumes is required for further guidance on directions in ETH price.

Also Read: Pepe Meme Coin Futures Launch on Coinbase, Price Climbs 5%

BTC Futures OI Stays Strong But Volatile

BTC price currently trades at $70,888, up just 0.50% in the last 24 hours. The 24-hour low and high are 24-high of $69,571 and $71,256. However, trading volumes has declined over 22% in the last 24 hours, indicating lack of interest among traders.

Total BTC Futures Open Interest has increased by 2% in the last 4 hours, but shows volatility in the last hour. CME BTC futures OI fell 1% in the last hour.

Whereas, ETH price is trading at $3,539, dropping 0.80% in the last 24 hours. The 24-hour low and high are $3,477 and $3,616. Moreover, trading volume has declined by over 16% in the last 24 hours, indicating a lack of interest among traders.

Total ETH Futures Open Interest fell 2% in the last 24 hours, but rose 1% in the last 4 hours. The futures trading activity remains volatile ahead of options expiry.

Also Read: 3 Altcoins Whales Are Buying To Make Millions

- Jane Street and Abu Dhabi Wealth Fund Mubadala Increase Holdings In BlackRock’s Bitcoin ETF

- FOMC Minutes Drop Tomorrow: Will Crypto Market Rally or Face Fed Shock?

- BlackRock Amends Filing For Staked Ethereum ETF, Eyes 18% of Staking Rewards From ETH Fund

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k