Bitcoin Options Puts Exceed $1.15B As Negative Bias Jumps to Oct. 11 Crypto Market Crash Levels

Highlights

- Analysts report that the Bitcoin options skew has deepened to levels last seen on October 11, crypto market crash.

- Most trades are concentrated in short-dated, out-of-the-money puts expiring this week and month.

- Bitcoin’s weakness has triggered $450 million in total liquidations, including $290 million in long positions.

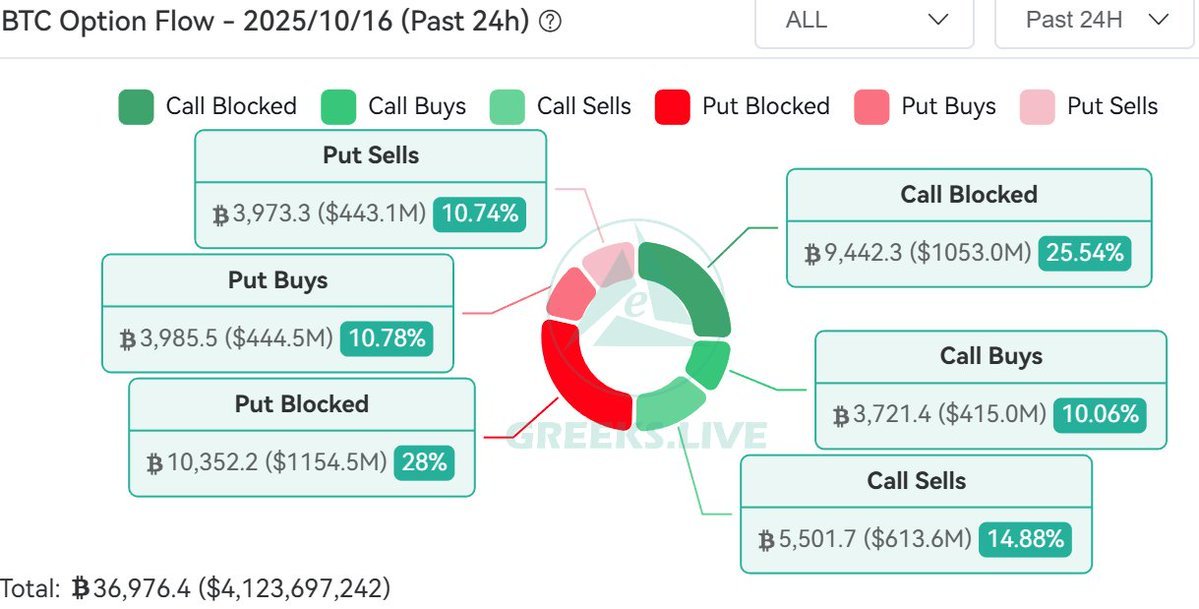

Bitcoin options market is showing the rising demand for institutional put options as the BTC price struggles to reclaim the upside. According to market data, the total value of institutional Bitcoin put transactions exceeded $1.15 billion. This represents a massive 28% of the overall market activity. This could potentially have a spillover across the broader crypto market, with risks of further downside.

Bitcoin Options Market Sees Surge in Institutional Put Activity

Following the rejection at $115,000 levels, Bitcoin price is once again facing selling pressure and flirting with the crucial support at $110,000. Furthermore, the Bitcoin options market hints at downward fear.

Most of these trades were concentrated in short-dated, out-of-the-money puts expiring this week and later this month. Analysts at Greeks.Live noted that the $10,400–$10,800 strike range is emerging as a key area of activity.

Meanwhile, market skew has turned increasingly negative, reflecting heightened concern over potential downside risks. Analysts noted that the current degree of negative skew is comparable to levels seen on October 11. This follows the last major market downturn.

The data suggests that institutional players and market makers are positioning defensively amid rising volatility. As a result, some analysts noted that buying put options for protection could be a prudent strategy in the current crypto market volatility conditions.

BTC Price Can Test the Lows of $100K Pushing Crypto Market Lower

Apart from the Bitcoin options market scenario, the waning institutional sentiment is also visible through Bitcoin ETF outflows. Popular market analyst IncomeSharks has shared a technical chart pattern for Bitcoin, which is very similar to that from early 2025, where the price crashed to the lows of $80,000, before resuming its upward journey.

As we can see from the chart below, BTC is currently testing a crucial support at $100K. Losing this could open the gates for a dip to $100K, and even below.

While sharing this chart, IncomeSharks noted: “This would only punish leverage traders, not spot holders. Have to prepare for the worst while expecting the best”.

Along with Bitcoin, the broader crypto market is also facing selling pressure. The liquidations have once again soared to $450 million, with $290 million in long liquidations, as per the Coinglass data. Friday’s Bitcoin options expiry will test how the broader market responds.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Gold ETF vs Tokenized Gold: Who Could Outperform in 2026?

- Crypto Weekly Wrap: Jane Street Targeted After Terra Suit, Vitalik’s ETH Selloffs, Regulatory Progress Feb 23-27

- Meme Coin Market Dead? Top 5 Reasons Dogecoin, Shiba Inu, and Pepe Are Crashing

- Crypto Market Crashes as U.S.-Iran Tensions Escalate With Airstrikes

- Breaking: Ethereum Price Drops Amid Israel-Iran Tensions; Machi Big Brother Liquidated Again

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs