Bitcoin [BTC] Post Halving Gain Model Predicts the Top at $387,000

According to the prediction model using the superimposition of average gains post halving, the price is on a similar bullish track, as it was in the last two times. It’s been more than three months since the 3rd Bitcoin halving took place, and the market is starting to confirm its positive positive effect.

Miner Selling Pressure Reduced

The fundamentals are strongly in favour of the bulls with the reduction in the rate of supply or inflation. On-chain analyst, Willy Woo, also points that that halving acts an impulse which leads to bullish forthcomings. Not only that, but it also controls the long-term bull and bear cycle.

Currently, the miners are in a profitable position. Charles Edwards tweeted,

A simple indicator of a Bitcoin bull cycle. The first period of positive momentum following each Halving has historically been the most rewarding.

Bitcoin mining is once again profitable. pic.twitter.com/FTAinTKzcP

— Charles Edwards (@caprioleio) August 10, 2020

Moreover, as Bitcoin mining is becoming profitable again, the selling pressure is further reduced in the market as the percentage of holding by miners increases.

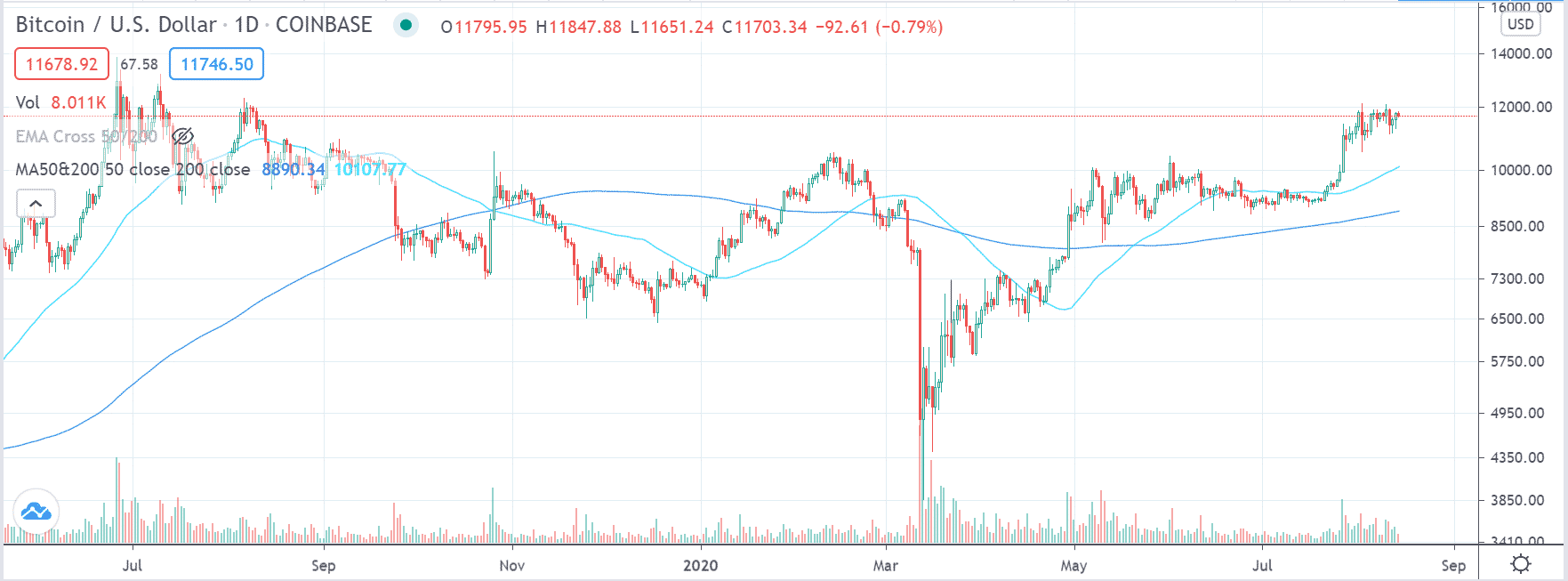

Apart from positive indicators from the supply side, on the market front, the simple lead of 50-Day MA (Moving Average) over the 200 seems sufficient to keep the momentum as it did the previous times as well.

Average Post-Halving Gains

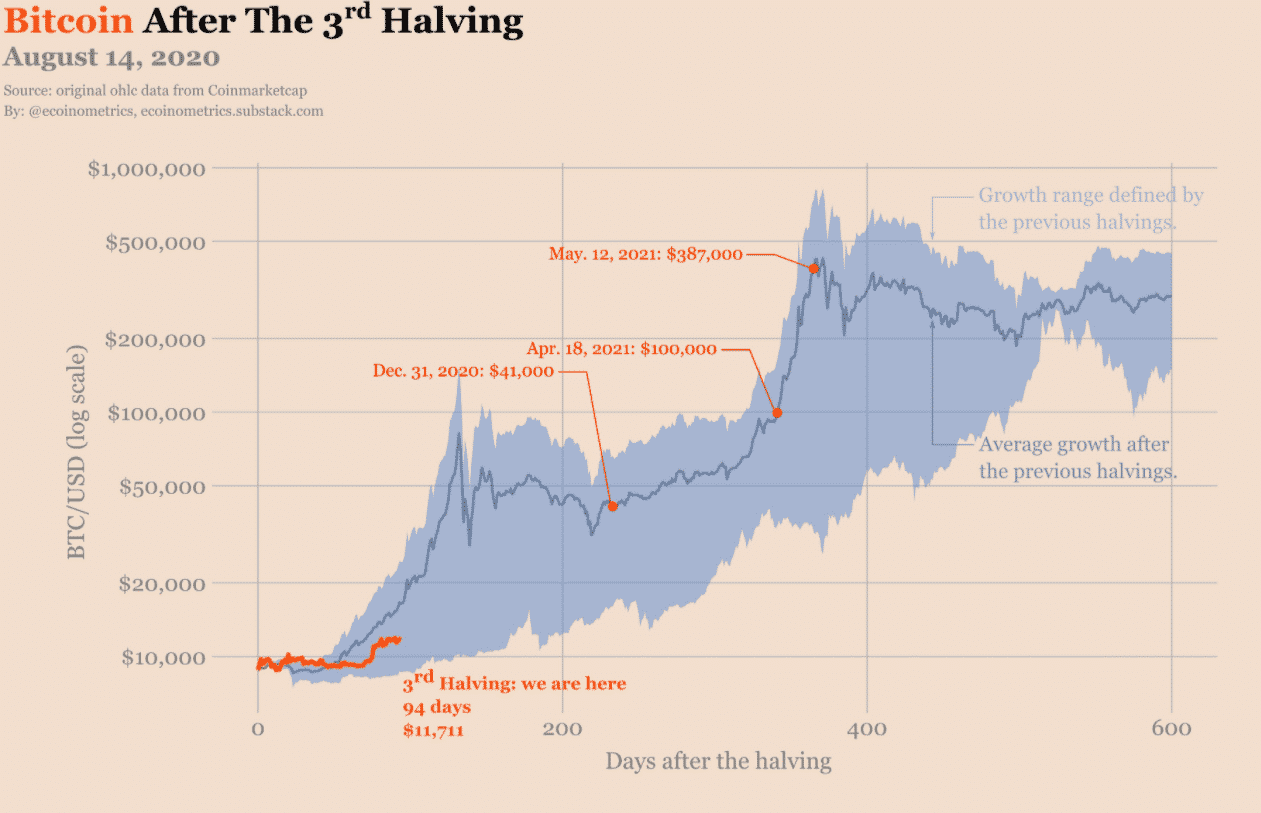

An economic model built by superimposing the average gains from the previous two halvings on times-scale shows where we are potentially in another post-halving bull cycle.

The model replicating the average gains in Bitcoin price in the previous two times suggest that the next Bitcoin top will be on May 12th, 2021. Moreover, nearly 100 days after the last halving, the model also predicts the beginning of a massive bull run.

The year-end prediction according to the same model is at $41,000. However, the prediction model uses a simplistic view based on only two instances. Furthermore, Willy Woo suggests that the strength of the impulse of the bullish strength is decreasing every cycle. He tweeted,

As the sell pressure reduction from each halvening cycle reduces, the impulse has less strength. Eventually the scale of halvenings become insignificant, Bitcoin’s 4 year cycle will start to transition into the resonance of traditional markets (~10 years).

What do you think will be the new high in Bitcoin? Please share your views with us.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs