Is Bitcoin Price Really In Bull Market? Glassnode Data Suggest Otherwise

Bitcoin bulls are waning and bearish sentiment is picking up in the crypto market. The fear and greed index clearly indicates investors’ sentiment falling from a May high of 65 (greed) to 48 today.

Macro factors remain the primary reason behind that weakening Bitcoin price rally to $30,000 this month. Also, US Fed Chair Jerome Powell’s speech on Friday fails to give a clear direction and rate hike possibilities in the future. While President Joe Biden and Republicans are hopeful about avoiding the debt ceiling crisis, other issues continue to exist.

CME FedWatch Tool indicates a probability of a 25 bps rate hike in June, while DXY rises and the jobs market stays tight.

Also Read: US Fed, ECB, BOE Officials Calls For More Rate Hikes, Bitcoin Price To Fall?

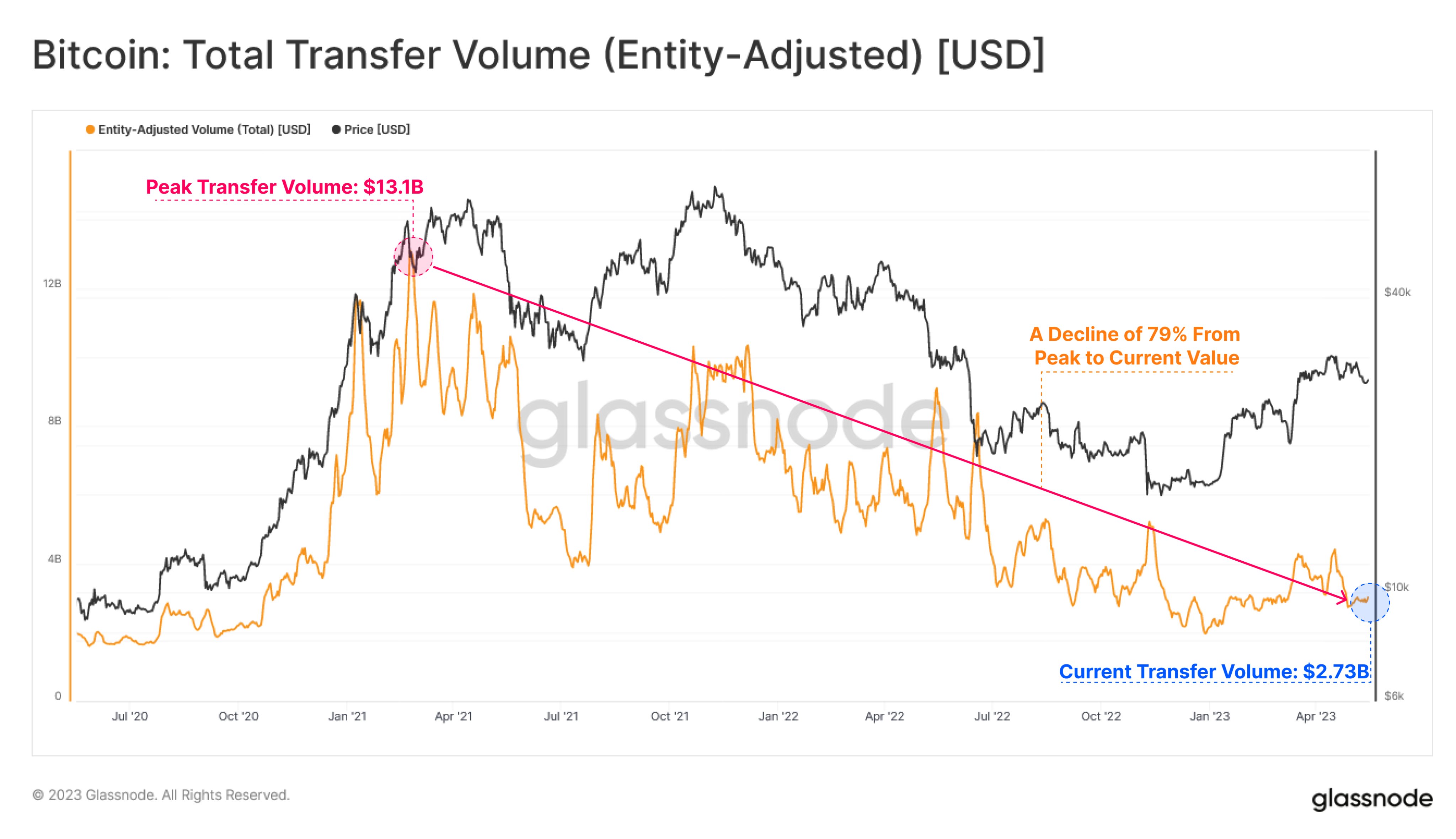

Despite Bitcoin price recovering 75% this year, the bull market conditions remain weak. According to Glassnode, the total transfer volume moved on the Bitcoin network has declined to a current value of $2.73 billion per day. The network throughput fell 79% from its peak of $13.1 billion during the bull market in 2021.

The question now is whether the recent consolidation we’re seeing will end up in a new low, which may suggest lower prices. Experts predict a drop well below the 200-WMA to the crucial support of $24,800.

Also Read: Bitcoin (BTC) Price At “Inflection Point”, Big Move Happening In Cardano (ADA)

Will Bitcoin Price Breakout From Consolidation

In an earlier report by CoinGape Media, we detailed how whales and miners are selling their holdings amid a recent turn of events. This will put additional selling pressure on BTC price.

Popular analysts CredibleCrypto and Michael van de Poppe predict the consolidation is most likely over and BTC price should move higher. However, it’s important to consider the 50-moving average and Bollinger bands indicating a weak chart pattern.

Bitcoin is range bound, with $27,640 as resistance and $26,340 as support. The direction of the BTC trend will only be determined by a clear close outside this area.

Also Read: Ledger Co-Founder Clarifies On Backdoor and Security Risk In Open Source

- Trump’s Truth Social Files For Bitcoin, Ethereum, Cronos Crypto ETFs Amid Institutional Outflows

- Trump Tariffs: U.S. Supreme Court Sets February 20 for Potential Tariff Ruling

- Brazil Targets 1M BTC Strategic Reserve to Rival U.S. Bitcoin Stockpile

- Breaking: U.S. CPI Inflation Falls To 4-Year Low Of 2.4%, Bitcoin Rises

- Bitget Launches Gracy AI For Market Insights Amid Crypto Platforms Push For AI Integration

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15