Bitcoin Price Bullish Case At $30k: An Opportunity or Bull Trap?

Bitcoin is back in the green as bulls push to reclaim resistance at $30,000. Up 2.6% in the last 24 hours, the largest digital asset is trading at $29,595 with $18.8 billion in trading volume and $577 billion in market capitalization.

Evaluating The Bullish Scenario In Bitcoin Price

Investor interest is once gain on the rise, especially after MicroStrategy, a leading US software development company, said in its quarterly report that it intends to raise up to $750 million by selling stock, with proceeds likely going to Bitcoin purchases.

As reported, the company’s filing with the Securities and Exchange Commission on August 1, confirmed that sale agreements with three parties including Cowen and Company, Berenberg Capital, and Canaccord had been completed.

The endeavor would see MicroStrategy offload class A common stock, geared toward numerous corporate purposes including the purchase of more BTC.

MicroStrategy is currently the biggest institutional BTC holder, worth around $4.5 billion at prevailing market value. MicroStrategy added 12,333 more BTC in the second quarter on top of the 467 BTC it bought in July.

Although the crypto market is largely in consolidation, investors took advantage of the news as an assurance that Bitcoin price has the potential to rally, especially with the halving event sent to occur in 2024.

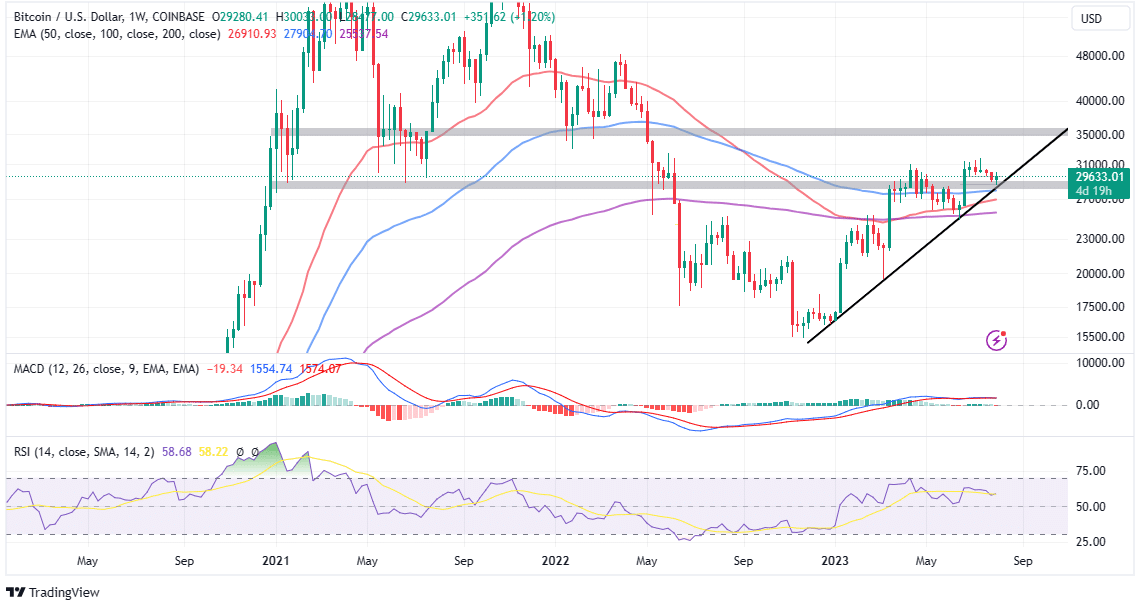

The uptick in Bitcoin price brushed shoulders with $30,000 during the Asian business hours on Wednesday. However, it had rolled back to $29,595 at the time of writing. The support in the range between $29,000 and $28,000 will continue to play a critical role in Bitcoin’s recovery.

If the Moving Average Convergence Divergence (MACD) indicator keeps the ongoing horizontal movement steady, the sideways trading is bound to last longer ahead of the next breakout.

Traders must be cautious now that the Relative Strength Index (RSI) has crossed below the moving average, implying pain before a breakout. In other words, BTC might drop to $25,000 first before rebounding sustainably above $30,0000.

Bitcoin’s Fundamental Insights

Bitcoin dominance faltered in July after growing in June mainly due to the lack of catalysts, in addition to the Ripple ruling which shifted attention to altcoins.

“What it basically did was allowed for a lot of the altcoins to catch up with where bitcoin was, and even Ethereum relative to the small-cap universe,” CoinDesk Indices Head of Research Todd Groth said on the “First Mover” TV program on Tuesday.

Bitcoin’s dominance rate dropped below 49% in July from 52% toward the end of June. According to Growth the decline “was really driven (the) computing sector, DeFi and digitalization (sectors), which have the small tokens relative to currency and smart contract platforms where Bitcoin and Ethereum reside.”

Investors should keenly follow how Bitcoin dominance behaves in August and September – the two months not for low volume seasonality resulting in underperformance. However, with MicroStrategy’s likelihood of buying more BTC, the market could present a buying opportunity, with Bitcoin price rallying to $35,000 and $38,000, respectively.

Related Articles

- Brian Armstrong And Jack Dorsey Discuss Bitcoin’s Future: A Push for Lightning Network Integration

- Sam-Bankman Fried Uses Free-Speech Card to His Defense on Fear of Jail

- After Bitcoin, Financial Giants Rush to Apply for Ethereum Futures ETFs

Recent Posts

- Crypto News

Trump Calls for Rate Cuts as Fed Chair Favorite Hassett Says U.S. Lags on Lowering Rates

Fed chair expectations moved into focus after President Donald Trump called for lower interest rates…

- Crypto News

Aave Labs vs DAO: What Investors Should Know About the AAVE Token Alignment Proposal

AAVE token holders are going through a critical stage of governance as they consider a…

- Crypto News

January Fed Rate Cut Odds Fall to New Lows After Strong U.S. Q3 GDP Report

Market participants, including crypto traders, have further pared their bets on a January Fed rate…

- Crypto News

Breaking: U.S. GDP Rises To 4.3% In Q3, BTC Price Climbs

The U.S. economy grew faster than expected in the third quarter of this year, its…

- Crypto News

Breaking: Bank of Russia Proposes Allowing Investors to Buy Bitcoin and Crypto in Major Regulatory Shift

Russia is willing to transform its approach to cryptocurrencies. According to the Bank of Russia,…

- Crypto News

Crypto ETF Issuer 21Shares Advances Dogecoin ETF Bid with Amended S-1 Filing

Crypto ETF issuer 21Shares has indicated it still intends to launch its Dogecoin ETF, as…