Bitcoin Price Bulls Take Charge: Is a $42,000 Breakout Imminent?

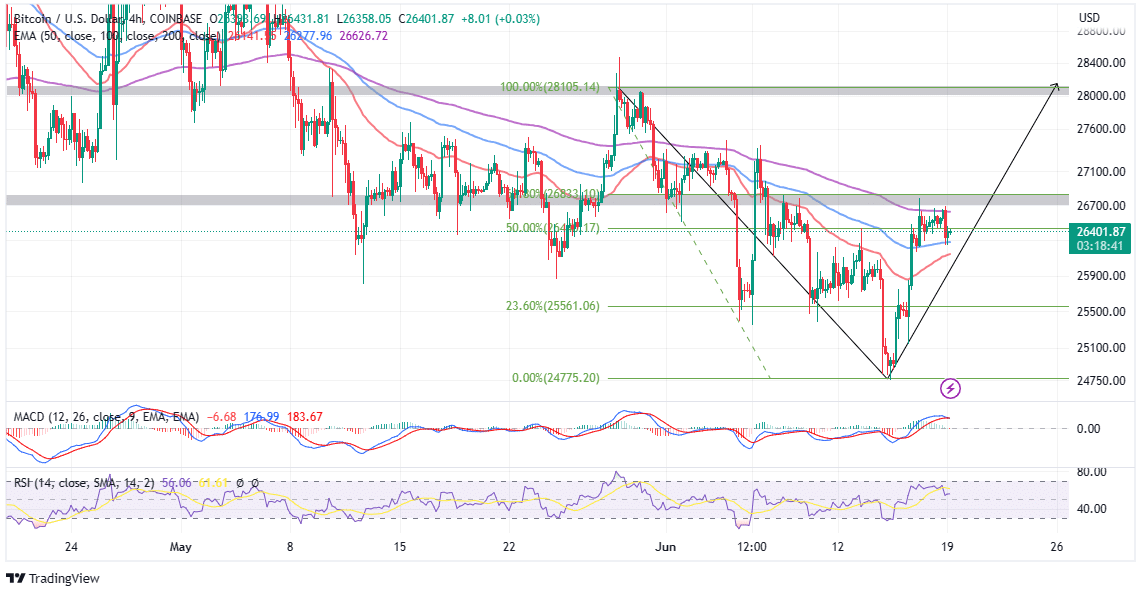

BTC, the coin powering the world’s most valuable cryptocurrency network, performed spectacularly over the weekend, where it almost breached the $27,000 resistance. Although still bullish, the failure to weaken the seller congestion, culminated in a brief retracement to $26,278. Bitcoin price trades at $26,408 at the time of writing, as investors and traders alike stream in to find new opportunities in the wake of last week’s dip to $24,775.

Investors Reconsider Potential Opportunities in the Fed Interest Rate Decision

Bitcoin price unexpectedly plunged following the United States Federal Reserve decision to pause interest rate hikes last week. While this was exactly what market watchers expected, the news was overshadowed by the bank’s Chair Jerome Powell’s remarks.

Powell implied that investors should expect rate hikes to resume, as the regulator pushes inflation to 2%. Despite the initial disappointment, investors appear to be reconsidering the short-term opportunities that may have come with leaving “interest rates unchanged.”

“With Fed having left interest rates unchanged, the environment appears supportive for crypto assets to start rallying again.” Crypto fund manager BitBull Capital’s CEO, Joe DiPasquale, said in a written statement to CoinDesk. “However, the Fed went ahead to add that rate cuts were not on the horizon in the near-term, which saw the market struggling.”

Bitcoin and other leading altcoins struggled last week but according to DiPasquale, they held firmly in reference to the mounting regulatory scrutiny in the US. He, however, cautions that Bitcoin will from now on, take center stage, especially with its dominance rising.

“For now, however, all eyes are going to be on Bitcoin, especially as its dominance has been on the rise due to selling pressure in altcoins,” he added. “As long as the market leader maintains the range between $20k – $22k, bulls shouldn’t be overly concerned.”

Bitcoin Price Nurtures V-shaped Recovery – $42,000 Insight?

Bitcoin price kicked off trading this week, losing 0.5% in the Asian session. The pullback over the weekend bounced off support provided by the 100-day Exponential Moving Average (EMA) (in blue) at $26,278. This support would be relevant throughout the day and may determine if BTC price drops further or closes the gap to $27,000.

Bulls are facing a stubborn resistance slightly above BTC’s current market value, as highlighted by the 50% Fibonacci retracement level. A break and hold above this short-term hurdle are required before bears capitalize on an incoming sell signal.

A careful examination of the Moving Average Convergence Divergence (MACD) indicator reveals the development of a sell signal. Usually, overhead pressure starts to increase as the MACD line in blue flips below the signal line in red.

If bulls make good on the v-Shaped recovery, Bitcoin price may kill two birds with one stone – that is deal with resistance at $27,000 and subsequently close the gap to $28,000.

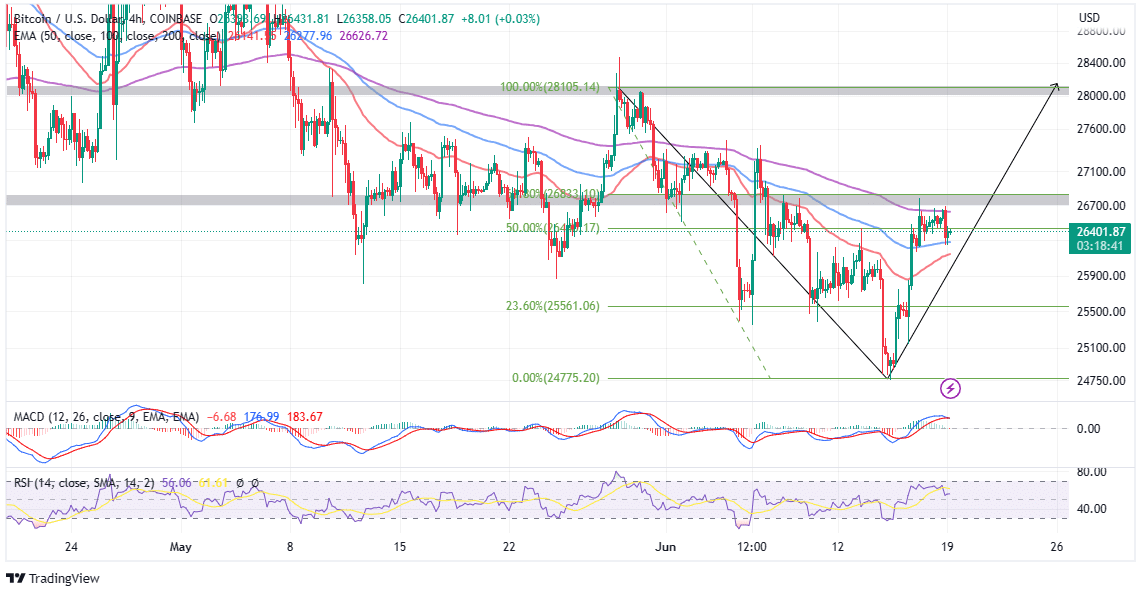

According to a related forecast by Captain Faibik, who boasts 61,000 followers on Twitter, Bitcoin price is gearing up for a massive breakout to $42,000. He based his technical outlook on a cup and handle pattern formed on the weekly chart.

$BTC Cup & Handle Formation on the Weekly TF Chart..!!

Expecting Breakout Soon..📈🚀#Crypto #Bitcoin #BTC pic.twitter.com/JM4fgywpOc

— Captain Faibik (@CryptoFaibik) June 19, 2023

For now, bulls have the upper hand and are in a position to control the narrative. However, traders must watch for potential reversal’s especially if the 100-day EMA support weakens, paving the way for more losses below $25,000. An opposite reaction is expected if resistance at $27,000 gives way to the ultimate breakout to $42,000.

Related Articles

- Ethereum Addresses in Profit Tops 59% as Price Slip Deepens

- Ripple Secures BitGo CEO’s Support in Ongoing Lawsuit with SEC

- Breaking: Elon Musk Refutes Owning Pump-Dump “Dogecoin Wallets” [FUD Alert]

- What Will Spark the Next Bitcoin Bull Market? Bitwise CIO Names 4 Factors

- U.S. CPI Release: Wall Street Predicts Soft Inflation Reading as Crypto Market Holds Steady

- Bhutan Government Cuts Bitcoin Holdings as Standard Chartered Predicts BTC Price Crash To $50k

- XRP News: Binance Integrates Ripple’s RLUSD on XRPL After Ethereum Listing

- Breaking: SUI Price Rebounds 7% as Grayscale Amends S-1 for Sui ETF

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter