Bitcoin Price Calm As $31k Roadblock Holds – How To Keep Your BTC Positions Profitable?

Bitcoin price stepped above $31,000 on Tuesday, although briefly. The extended weekend in the US left the crypto market quiet apart from the ongoing rout in the NFT space, which has seen many assets fall to extremely low floor prices.

Toward the end of the Asian trading session, Bitcoin price is down 1% to $30,845. Similarly, Ethereum is down 1% to $1,938. Considering the 1% dip in the total market cap to $1.25 trillion, the crypto market performance is expected to stay relatively depressed going into the weekend.

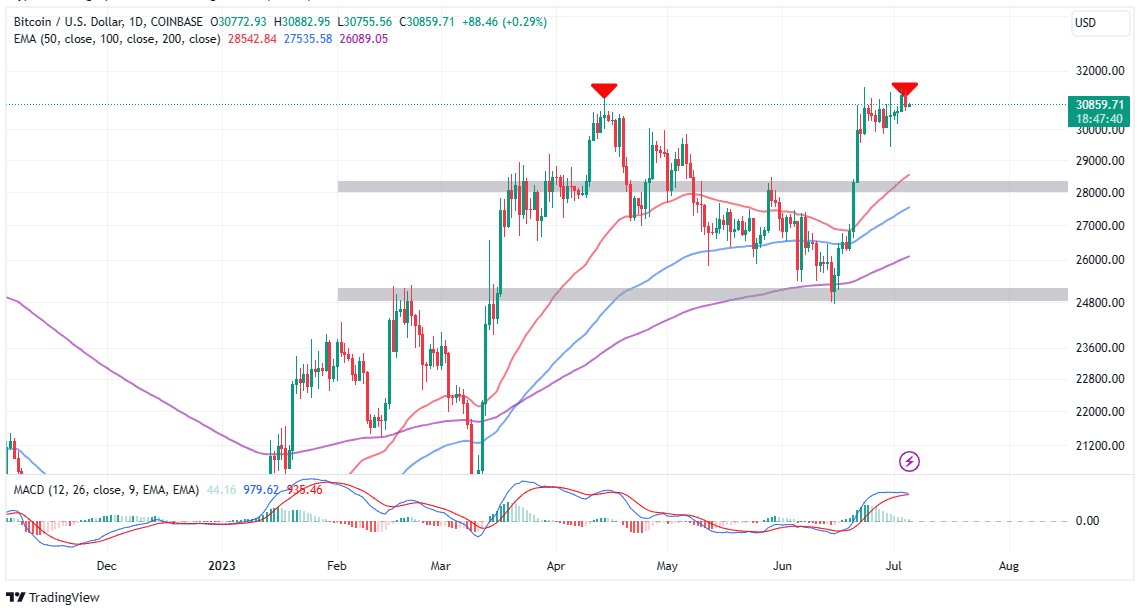

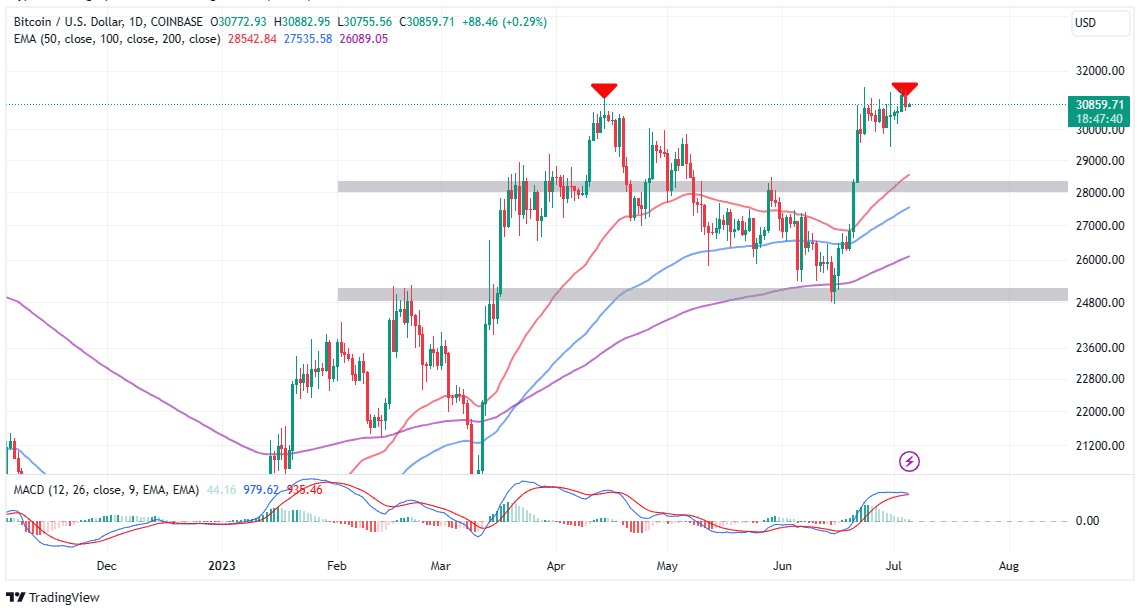

How to Navigate Bitcoin Price Technical Outlook

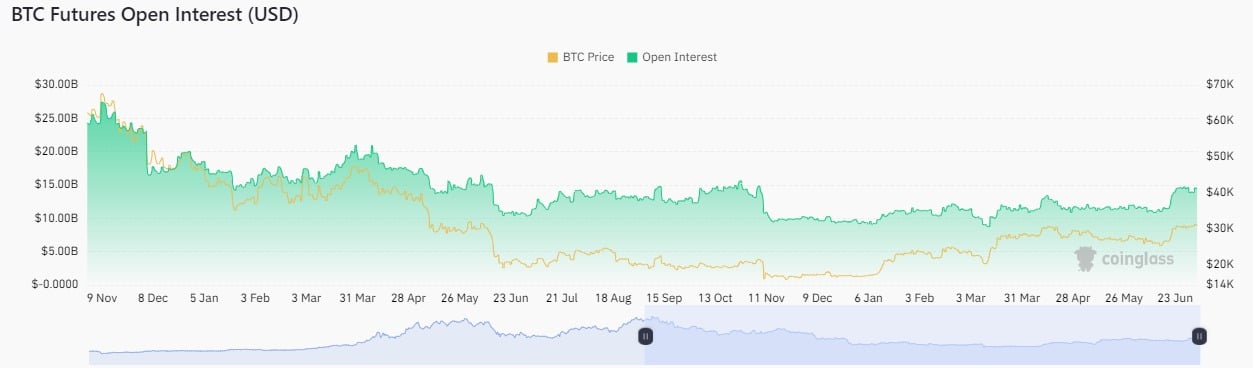

As investors step into the market from the long weekend, they’ll quickly realize that trading volume is down across the board. According to data from CoinGlass, all major exchanges continue to report sharp drops in volume in the range of 15-20%.

This significant drop in volume impacted the number of liquidations, summing to $47.67 million in the last 24 hours.

Intriguingly, the market has managed to sustain open interest at $14.50 billion, with the long/short ratio revealing that long traders have a slight upper hand over short traders.

On the other hand, trader sentiment is still a cause for worry, with a large portion of neutral traders equalizing the bearish and bullish crowd.

Where Is Bitcoin Price Heading?

The liquidity crunch in the market, according to CoinDesk, is a long-standing factor and cannot be wished away, considering it stems from fiat. Crypto and other risk assets, such as tech stocks, are the most affected.

However, given the influx of significant economic data slated for release this week, traders must be prepared to proactively respond as circumstances dictate.

Meanwhile, Bitcoin price is dealing with the stubborn resistance at $31,000, with its downside seemingly protected at $30,500. The largest cryptocurrency’s options are narrowing each passing day that it doesn’t uphold the upward trajectory beyond the $31,000 mark.

This means that overhead pressure will likely keep weakening support, especially the buyer congestion at $30,000. A confirmed break below this price point would imply a defeated bullish front.

On the other hand, it may trigger an aggressive bearish front, with investors likely to sell to protect accrued profits following the uptick from $25,000 to $31,500.

Pressure is likely to shoot up if short traders capitalize on an incoming sell signal from the Moving Average Convergence Divergence (MACD) indicator. This call to sell BTC would manifest when the MACD line in blue crosses below the signal line in red.

Generally, the movement of the momentum indicator as it drops toward the mean line (0.00) and possibly the negative region would tighten the bearish grip—a move likely to trigger a selloff below $30,000.

Some of the key levels that traders must keep in mind are the resistance at $31,000 and support at $30,000. Notably, a break and hold above $31,000 would encourage more investors to join the bandwagon, targeting a breakout to $35,000 and $38,000.

Bitcoin may be in grave danger of dropping to $25,000 in the event support at $30,000 crumbles. Traders must consider the tentative buyer congestion at $28,000, which might allow Bitcoin to sweep through fresh liquidity ahead of a kneejerk bullish reaction.

Related Articles

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- XRP News: Ripple Prime to Move Post-Trade Activity to XRPL via NSCC Link

- Fed Rate Cut at Risk: Janet Yellen Flags Inflation Concerns Amid US-Iran War

- Senate Eyes CLARITY Act Markup This Month as Banks, Crypto Continue Stablecoin Yield Talks

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs