Bitcoin Price Can Hit $50,000 Next Week, Predicts Popular Crypto Analysts

The rising spot Bitcoin ETF speculation coupled with other factors including the dovish U.S. Federal Reserve triggered an over 22% rally in Bitcoin price in a month. Popular analysts pointed out spot bids from the key support level at $43,000 retail investors take buy-the-dip opportunity after an institutional investors-led rally. Will BTC price hit $50,000 next week?

Can Bitcoin Price Hit $50,000 Despite Pullback?

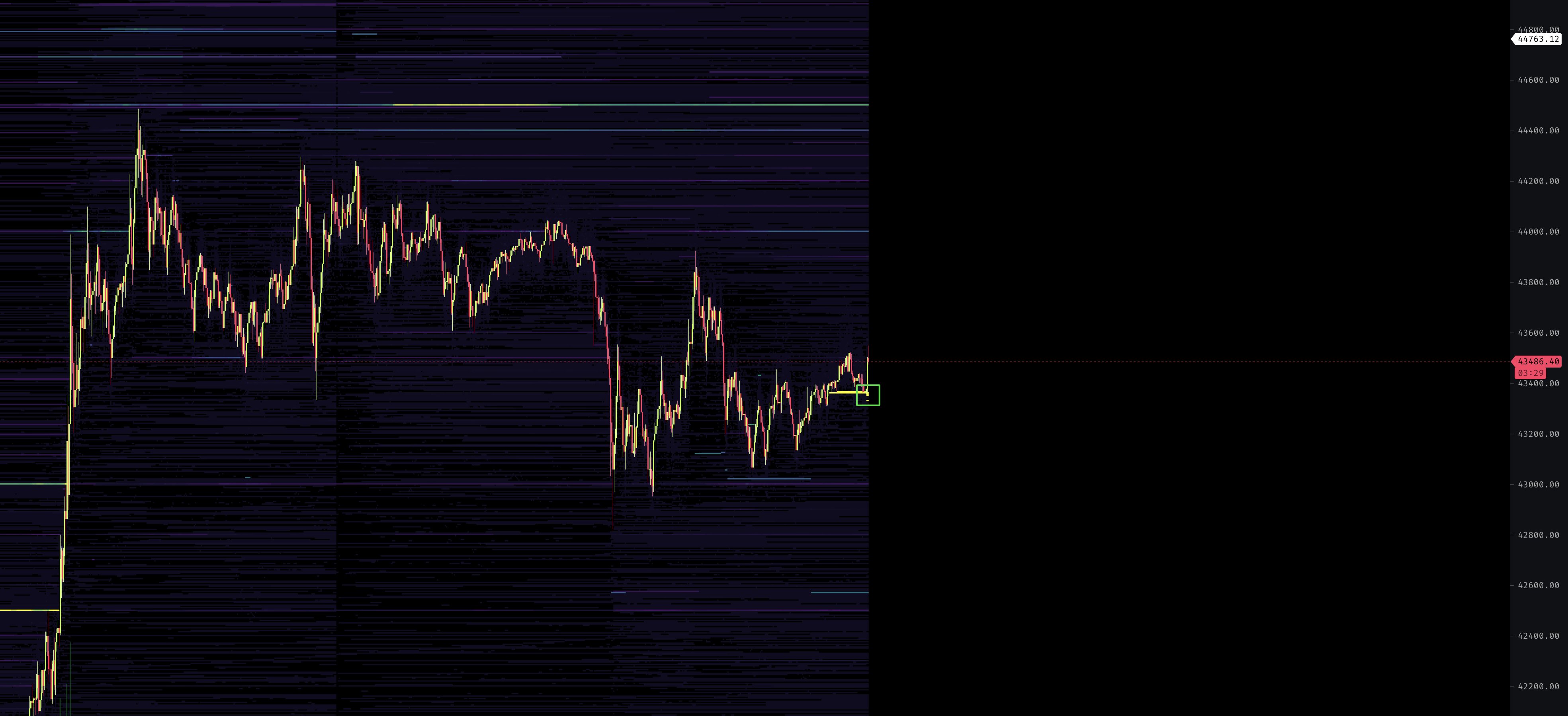

Popular analyst CredibleCrypto in a latest post on X revealed that 30 million in spot bids have popped up from near support levels. He earlier predicted that Bitcoin could sweep below local BTC lows.

However, the rising bids from below suggest massive bullish sentiment. He believes BTC price can even hit $50,000 next week if spot BTC buying continues.

Another popular analyst Skew said “bids sold into and filled it seems” on Binance Spot. Despite open interests wiped on Binance and Bybit, bids chase the price higher. Traders must look for confirmations such as RSI bouncing from 50 & price holding 4H 21EMA.

CoinGape earlier reported that top analysts Michael van de Poppe, John Bollinger, and Ali Martinez have predicted Bitcoin’s rally toward the $50,000 mark. The analysts are confident about a strong upside momentum and BTC price closing the year on a strong note.

Also Read: Fidelity Spot Bitcoin ETF Added To Active ETF And Pre-Launch List

Miners Hold Onto Their BTCs

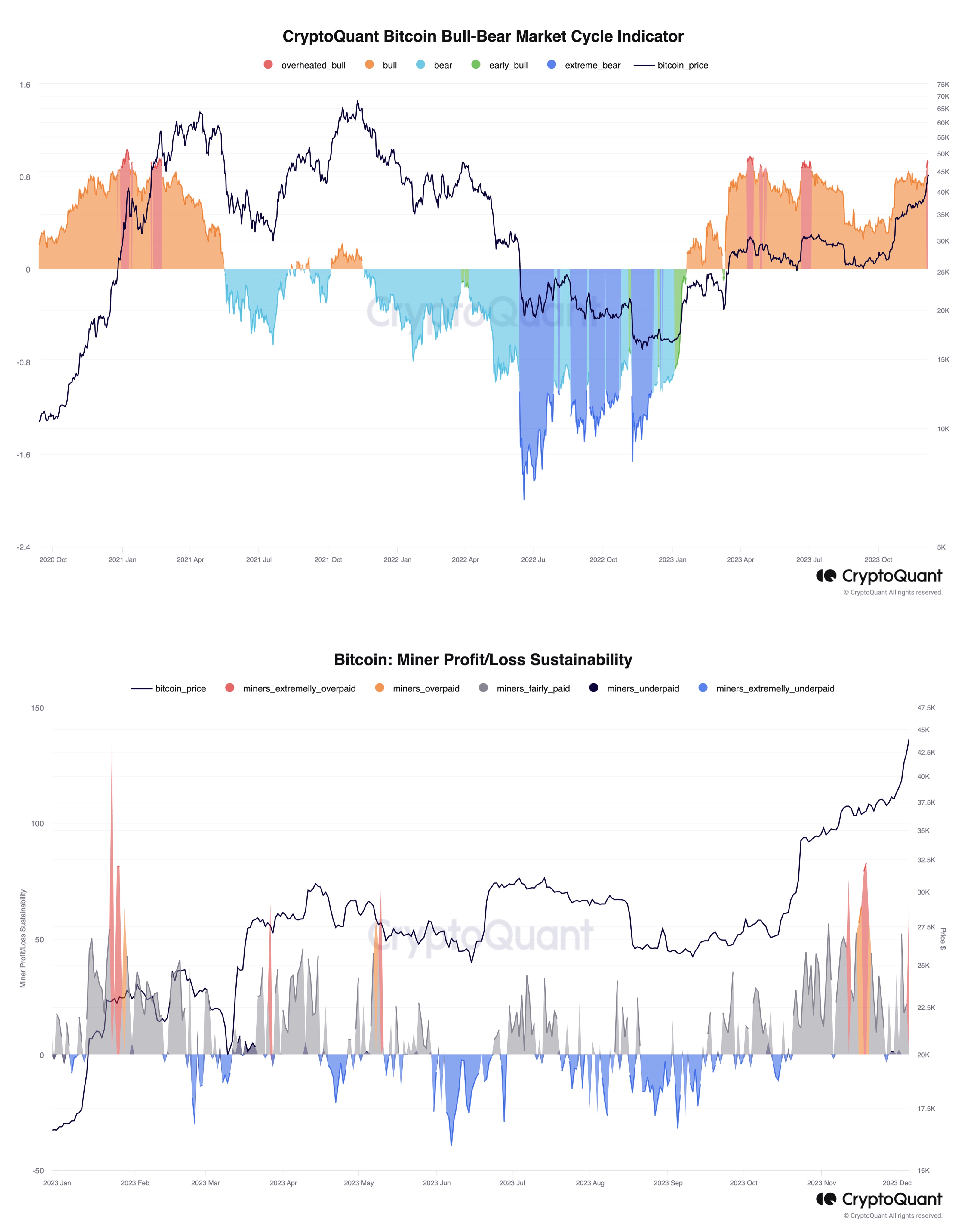

CryptoQuant head of research Julio Moreno warned that some on-chain metrics indicate that BTC price is “overheating” after the recent rally.

The Bull-Bear Market Cycle Indicator shows overheated bull phase for the first time since July. In addition, Miner Profit/Loss Sustainability indicates block reward growing much faster than mining difficulty.

However, these overheated bull phase and rising miners’ profit are due to inscriptions on Bitcoin blockchain. Miners are holding onto their BTC holdings.

BTC price currently trading at $43,200, paring earlier gains due to CME gap at $39,700. The 24-hour low and high are $42,880 and $43,951, respectively. Furthermore, the trading volume has increased slightly in the last 24 hours.

Also Read: XRP Lawyer Reacts As Uphold Head Of Research Predicts Price Bitcoin To Cross $200k

- $1B Binance SAFU Fund Enters Top 10 Bitcoin Treasuries, Overtakes Coinbase

- Breaking: ABA Tells OCC to Delay Charter Review for Ripple, Coinbase, Circle

- Brian Armstrong Offloads $101M in Coinbase Stock Amid COIN’s Steep Decline

- MSTR Stock in Focus After CEO Phong Le Signals More BTC Buys

- Cardano Founder Sets March Launch for Midnight as Expert Predicts BTC Shift to Privacy Coins

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown

- Ripple Price Prediction As Goldman Sachs Discloses Crypto Exposure Including XRP

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit