Bitcoin Price Crash: Will BTC Sell Off Continue Ahead?

Highlights

- Bitcoin retests $99K as holders eyes key levels at $90K and $85K if $96K breached.

- LTHs selling off; Bitcoin ETFs assets surge to $37B in Dec, up from $24.23B.

- Bitcoin's potential as a national strategic reserve could boost price to $1M.

Bitcoin’s recent price correction has sparked debates among analysts and investors about its potential trajectory. After briefly retesting $99,000, Bitcoin’s price momentum has slowed, raising questions about whether this signals the start of a larger sell-off or a temporary pause in its uptrend.

Analysts Highlight BTC Price Key Levels

Crypto trader Ali Charts has put a lot of emphasis on the $96,000 level. He explained that if Bitcoin price moves below this level, the following significant points will be $90,000 and $85,000. This view is consistent with the historical Fibonacci levels of retrace commonly employed by traders to understand market reversals.

“Keeping it simple, based on the Fib, if Bitcoin loses $96,000, the next focus becomes $90,000 and $85,000,” Ali tweeted.

To this, Robert Kiyosaki, a supporter of Bitcoin, said that it is never too late to join the market. He pointed to Bitcoin’s stability and capability to generate riches, saying, “Bitcoin is designed to make everyone rich, including those who come in late. Just don’t get greedy.”

Long-Term Holders Take Profits as Short-Term Investors Step In

Using data from Glassnode, some changes have been observed in the activity of long-term Bitcoin holders (LTHs). In the two months period, the total supply held by LTHs has been decreasing from $14.23 billion to $13.31 billion.

This comes as BTC price soared from $58,000 to over $100,000 suggesting that institutional investors are booking profits at local highs.

However, these sales by the long-term holders have been taken by the short-term holders (STHs) to ensure that the prices are maintained. Glassnode analysts pointed out that “the share of wealth owned by new investors has not yet reached the levels that were seen during the previous cycle peaks” which may mean that there is still some room for growth.

Bitcoin’s Bullish Momentum Remains Intact

However, based on the correction, some analysts continue to hold the view that the price of Bitcoin is still bullish. The AVIV Ratio, which looks at unrealized profits, is at 1.81, far from the levels that are considered extremely high and which usually signify a reversal in market trends.

This means that although some traders may have taken their profits, the market has not become overly aggressive.

Meanwhile, the Titan of Crypto still has the positive outlook about Bitcoin’s future. He stressed that Bitcoin has been making higher highs and higher lows which is a positive indication that the trend remains bullish. ”BTC bullish momentum remains strong, with the next target at the 100% Fibonacci extension of $113,000,” he stated.

Institutional Demand Could Propel Bitcoin Further

The adoption of Bitcoin has remained strong, with Bitcoin ETFs hitting a top of $37 billion in assets by December 19th. This represents a sharp rise from the $24.23 billion at the beginning of November as highlighted by Farside Investors.

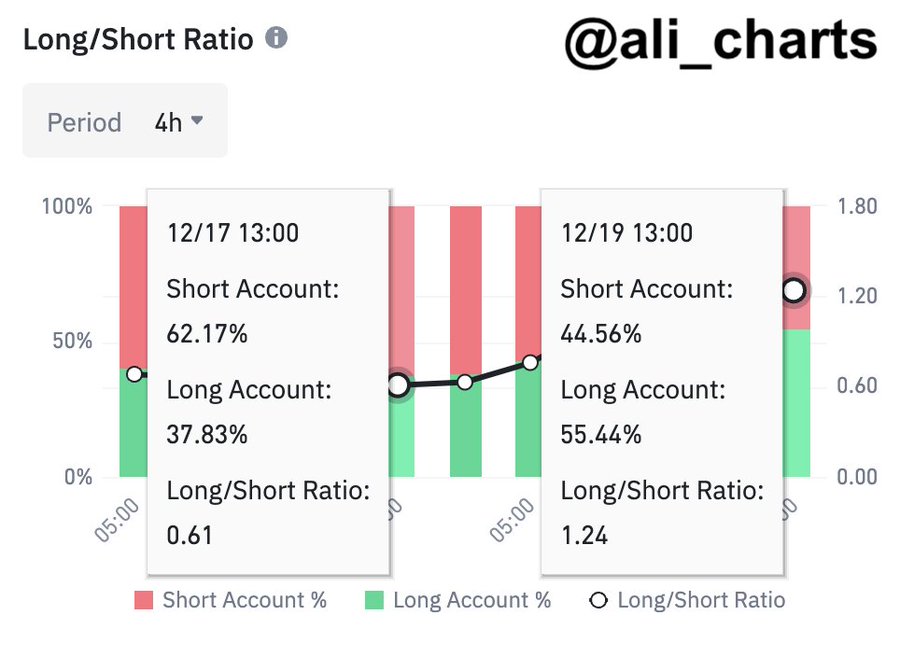

At the same time, statistics show that at the peak of Bitcoin at $108,000, 62.17% of traders had short positions, expecting the price to fall. However, as Bitcoin dropped to $96,000, the sentiment changed as 55.44% of the traders are now bullish because they anticipate a rally in the price of the cryptocurrency.

Supporting this price trend, analysts at Bitfinex believe that the price correction of Bitcoin will be relatively mild owing to the rising demand from institutional investors. They expect it to be at $145,000 by mid-2025, with a possibility of rising to $200,000 in a better environment.

Furthermore, in light of the growing talk about the potential of Bitcoin as a strategic reserve asset at the national level, experts estimate that such a decision could take Bitcoin’s price to $1 million.

- Jane Street and Abu Dhabi Wealth Fund Mubadala Increase Holdings In BlackRock’s Bitcoin ETF

- FOMC Minutes Drop Tomorrow: Will Crypto Market Rally or Face Fed Shock?

- BlackRock Amends Filing For Staked Ethereum ETF, Eyes 18% of Staking Rewards From ETH Fund

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k