Bitcoin Price Crosses $30,000 Amid Fears of Privacy Coin Delisting In US

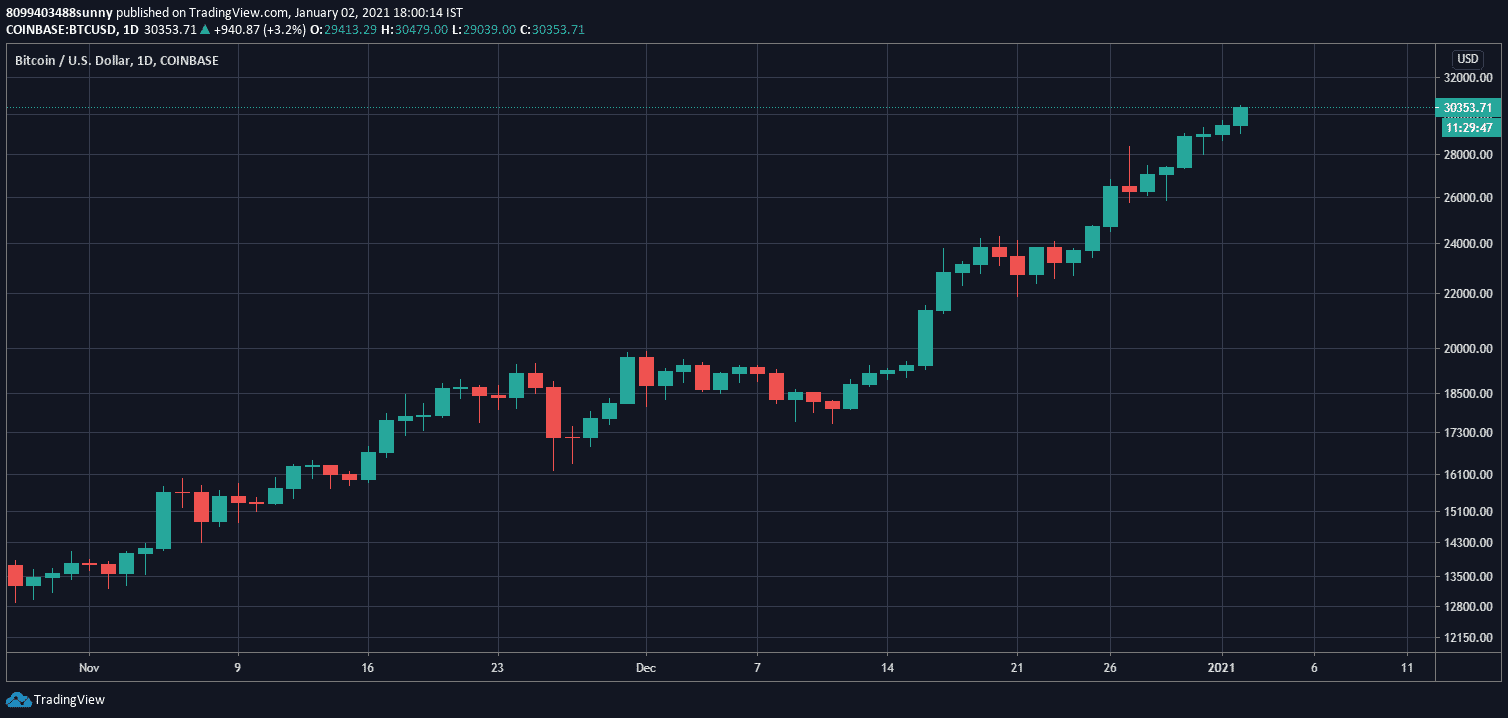

Bitcoin finally broke the $30,000 barrier on early Saturday after struggling to cross the key resistance for the past couple of days. There was a big selling wall at $30,000 across exchanges making many to believe that the top cryptocurrency might register a retrace from the $30,000 mark, however as has been the case throughout this bull season, bitcoin managed to break that barrier and currently trading at $30,353 with over 4% gains in the past 24 hours.

Bitcoin on its way to a new all-time high of $30,656 broke past the massive sell orders placed at $30,000 showing the massive bullish momentum behind the top cryptocurrency. The fact that it managed to broke past the resistance on a weekend only affirms the growing influx of retail players in the market.

Bitcoin Shorts Get REKT!

Many market pundits have predicted a market correction and retrace owing to the massive surge of the top cryptocurrency, however, most of the traders who have tried shorting bitcoin this bull season have lost it against the best performing asset of 2020. This time was no different and as BTC ate through massive sell walls, almost $100 million worth of shorts got wrecked in the past hour.

$100 million worth of shorts wrecked in the past hour.

A classic $BTC short squeeze at a key resistance area.

— Joseph Young (@iamjosephyoung) January 2, 2021

The top cryptocurrency this bull run has surpassed many expectations and building a momentum never seen before, After breaching the key resistance of $20,000 many expected the top cryptocurrency to correct before bursting to new price highs, however, BTC has not stopped ever since. The top cryptocurrency’s momentum has been so strong that it has easily made up for the $2000 to $3,000 price crashes within 24 hours of the price drop.

What is Fueling the Price?

The current bitcoin rally is predominantly headed by institutional investors who are currently buying more bitcoin than being mined every day. The likes of grayscale, PayPal, and MicroStrategy have shown the world that bitcoin would play multiple roles such as a hedging asset, a treasury asset as well as a new store of value.

Another factor that might be fuelling bitcoin price is the recent Bittrex delisting of privacy coins raising the speculation that the regulatory body might ban the privacy coins next. Many South Korean, Japanese, and Australian exchanges last year started delisting privacy coins because of the new FATF AML guidelines and it seems the regulatory body in the US has started pressurizing exchanges to do the same. If other crypto exchanges follow on the same path, we might observe mas-delisting of privacy tokens across exchanges.

Many in the crypto space expressed their displeasure with the move and criticized the government for cracking down on something that comes under their fundamental rights i.e Privacy.

Privacy is illegal in the United States of America https://t.co/RXjJarXMNo

— KING CO฿IE ???? (@CryptoCobain) January 1, 2021

- What Will Spark the Next Bitcoin Bull Market? Bitwise CIO Names 4 Factors

- U.S. CPI Release: Wall Street Predicts Soft Inflation Reading as Crypto Market Holds Steady

- Bhutan Government Cuts Bitcoin Holdings as Standard Chartered Predicts BTC Price Crash To $50k

- XRP News: Binance Integrates Ripple’s RLUSD on XRPL After Ethereum Listing

- Breaking: SUI Price Rebounds 7% as Grayscale Amends S-1 for Sui ETF

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter