Bitcoin Price Is Falling While Whales Grow – What Does It Mean for BTC at $30k?

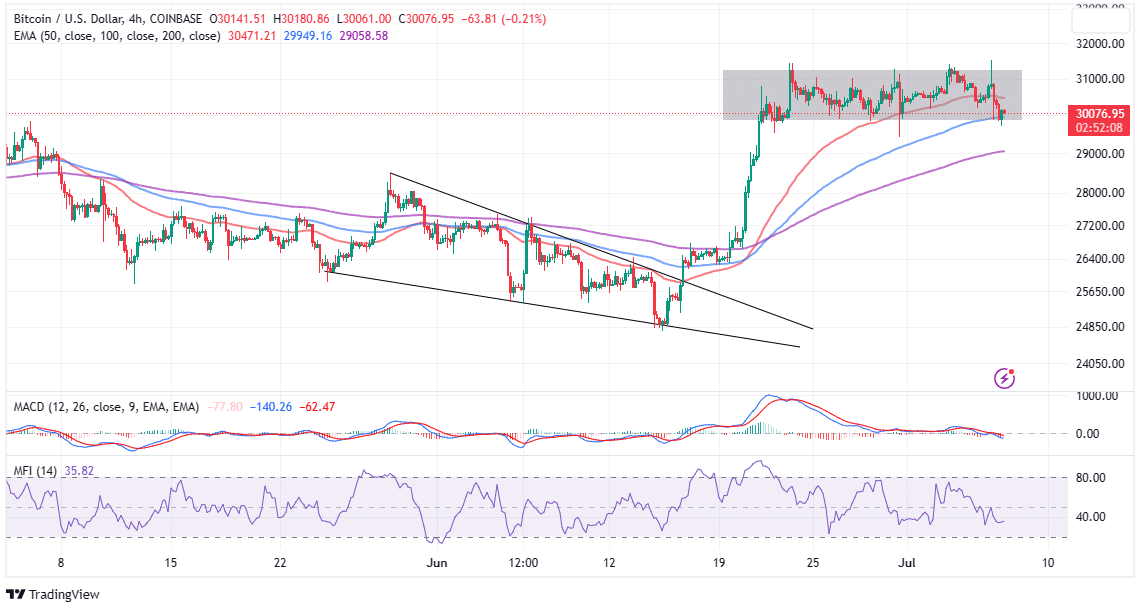

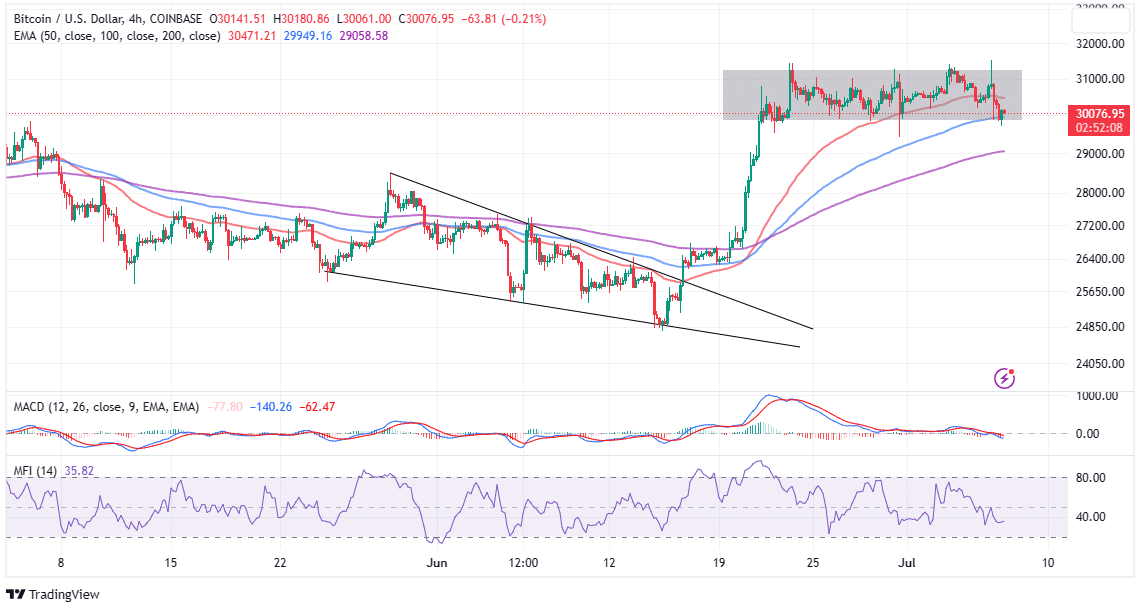

Bitcoin price has delivered a 12.2% upside in the last 30 days after factoring in the correction from its 12-month high milestone of slightly above $31,500. However, the same upside is starting to come under increasing pressure, especially if the immediate support at $30,000 crumbles, letting bears through.

The Paradox of Increasing Whales and a Struggling Bitcoin Price

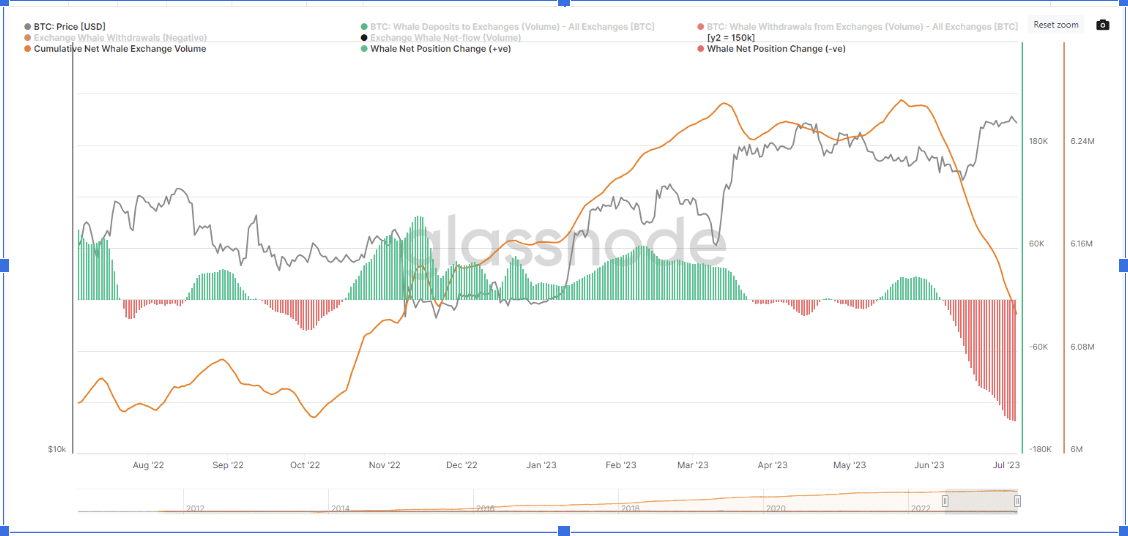

Glassnode, a blockchain data analytics firm, has revealed that large Bitcoin holders, colloquially known as ‘whales,’ are increasing their holdings despite Bitcoin’s struggle to resume its upward trend.

Moreover, the same whales are hesitant about moving their assets to exchanges, with cold wallet storage standing out as the most preferred option. CoinDesk believes that investors are wary of the risk associated with leaving digital assets on exchanges, in addition to regulatory hindrances or both.

If the trend continues and we see less and less of the Bitcoin supply making it to exchanges as whales increase, this would be a bullish gesture.

What’s Holding Bitcoin Price Back?

Despite the growing interest among whales, the largest cryptocurrency has been bombarded with several economic data reports: The Federal Open Market Committee (FOMC) minutes on Wednesday and the Jobs and Services reports on Thursday.

The FOMC minutes reaffirmed the Fed Chair, Jerome Powell June’s remarks on why investors should expect more rate hikes in the second half of 2023.

Bitcoin and Ethereum did not take the ADP report well, which showed that the private sector added 497,00 jobs. On top of this, the ISM sector Index climbed to 53.9 in June, dwarfing market estimates of 51.2 and 50.3 in May.

The report serves as a new catalyst for the U.S. Federal Reserve to justify further rate cuts as it grapples with the task of reining in inflation.

This hawkish stance typically exerts substantial pressure on cryptocurrency and other risk asset markets, as there is widespread concern that the Fed’s actions could plunge the economy into a severe recession.

Can Bitcoin Price Beat The Odds?

Bitcoin price is mainly grounded in its position above $30,000, thanks to enhanced investor interest, bolstered by multiple spot BTC ETF applications, including one from the largest asset manager, Blackrock.

Investors believe this time; the SEC will break the norm of rejecting proposals, especially with Larry Fink, Blackrock’s CEO, promising to work hand in hand with regulators.

Meanwhile, BTC is fighting increasing overhead pressure, with more and more investors giving up on the wait for Bitcoin to weaken resistance at $31,000 and resume the uptrend bound for $35,000 and $38,000 in the short term.

Although Bitcoin price slipped to $29,745 on Thursday, it has since regained ground above $30,000 and is trading at $30,088 toward the end of the Asian session on Friday. Support at $30,000 has been reinforced by the presence of the 100-day Exponential Moving Average (EMA) (line in blue).

According to Captain Faibik, a rising crypto analyst with 62k followers on Twitter, Bitcoin price is forming a rectangle on the daily timeframe chart. Although a bullish pattern, bulls must, according to Faibik, clear the hurdle at $31,125 to confirm a breakout.

$BTC forming Bullish Rectangle on the Daily timeframe Chart..!!

Bulls need to Clear the 31,125 Resistance to Confirm the Breakout.#Crypto #Bitcoin #BTC pic.twitter.com/8TezfsJWGi

— Captain Faibik (@CryptoFaibik) July 7, 2023

A confirmed bullish breakout would mean Bitcoin price rises and holds above the rectangle resistance. A sudden spike in volume would further validate the bullish move, with traders betting on BTC to close the gap to $35,000.

Related Articles

- Top Executives Leaving Binance.US A Month After SEC Lawsuit, Market Under Pressure

- Multichain Suspends Operations After Fantom Bridge Sees $122 Million Outflows

- Breaking: FBI Raids Home Of Kraken Ex-CEO Jesse Powell

- Crypto Market Weekly Recap: Crypto Bill White House Meeting, Binance Buys $1B BTC, and More (9- Feb 13)

- TRUMP Coin Pumps 5% as Canary Capital Amends ETF Filing With New Details

- Crypto Prices Surge Today: BTC, ETH, XRP, SOL Soar Despite US Government Shutdown

- CLARITY Act: Crypto Group Challenges Banks Proposal With Its Own Bill Suggestions

- Trump’s Truth Social Files For Bitcoin, Ethereum, Cronos Crypto ETFs Amid Institutional Outflows

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?