Bitcoin Price Prediction: BTC Falters Ahead Of A Potential Breakdown To $10,000

- Bitcoin settles above $10,800 after bouncing off $10,600 support.

- Bitcoin nurtures a sideways trend ahead of a breakdown that could revisit levels around $10,000.

The cryptocurrency market is indecisive and continues to trade horizontally. Bitcoin has impressively held above $10,800. However, gains towards $11,000 have been capped under $10,900.

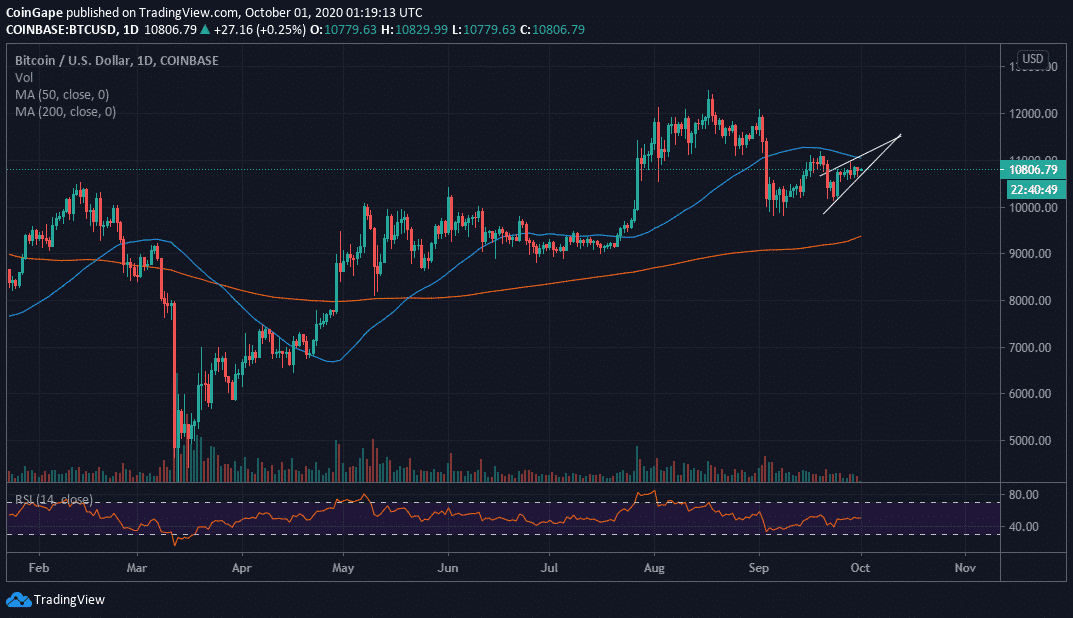

On the downside, the flagship cryptocurrency is protected at $10,600. In other words, BTC is lock-step trading in the range between $10,600 and $10,900. Meanwhile, the digital asset is valued at $10,805 at the time of writing. The Relative Strength Index (RSI) in the daily range is leveling at the midline, particularly emphasizing the sideways trading.

At the moment, it is not clear which direction BTC will take following the return and the end of the uncertainty. At the same time, the formation of a short term ascending wedge pattern in the same daily range highlights the possibility of a downtrend that could eventually send Bitcoin back to lows around $10,000.

BTC/USD daily chart

Various support zones will try to absorb the selling pressure including $10,600, $10,400 and $10,200. Bitcoin could stand to gain more with the slide to $10,000, giving investors another chance to buy the dip. The volume that would be created following the deep might give the bellwether cryptocurrency a boost past $11,000.

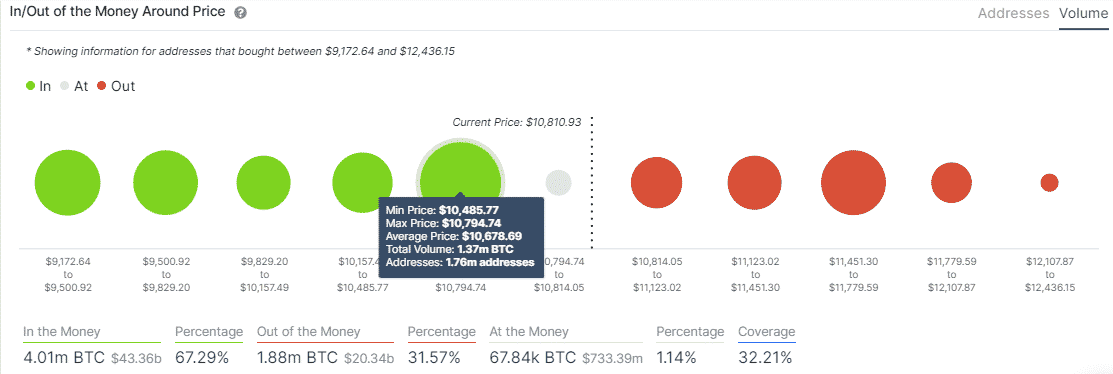

Bitcoin IOMAP model

Note that the bearish outlook could be invalidated altogether based on on-chain metrics released by IntoTheBlock. The IOMAP model shows that Bitcoin has a smoother ride to $11,000 as opposed to a breakdown. The most significant resistance lies in the zone between $11,450 and $11,800. Previously, nearly 980,000 addresses bought 761,000 BTC in the range. On the downside, BTC is seating on a region with immense support; from $10,500 to $10,800. Here, roughly 1.8 million addresses purchased 1.4 million BTC.

Bitcoin Intraday Levels

Spot rate: $10,805

Relative change: 28

Percentage change: 0.3%

Trend: Sideways trading bias

Volatility: Low

Read more: Why JP Morgan Getting Fined $1bn For Market Manipulation is Good For Bitcoin

- Bhutan Government Cuts Bitcoin Holdings as Standard Chartered Predicts BTC Price Crash To $50k

- XRP News: Binance Integrates Ripple’s RLUSD on XRPL After Ethereum Listing

- Breaking: SUI Price Rebounds 7% as Grayscale Amends S-1 for Sui ETF

- Bitget Targets 40% of Tokenized Stock Trading by 2030, Boosts TradFi with One-Click Access

- Trump-Linked World Liberty Targets $9T Forex Market With “World Swap” Launch

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown