Bitcoin Price Prediction: BTC Pieces $13,200, Hitting New Yearly Highs

- Bitcoin price paces upwards, trading new 2020 highs above $13,000.

- BTC/USD bullish outlook has the potential to continue especially without a formidable hurdle ahead.

Bitcoin had a smooth sailing in the past few days, first bringing down the resistance at $11,800. The bullish momentum paced upwards, allowing the bulls to smash through the crucial $12,000 level as discussed on Wednesday. The bullish leg did not stop here, but soared to trade new yearly highs at $13,237.

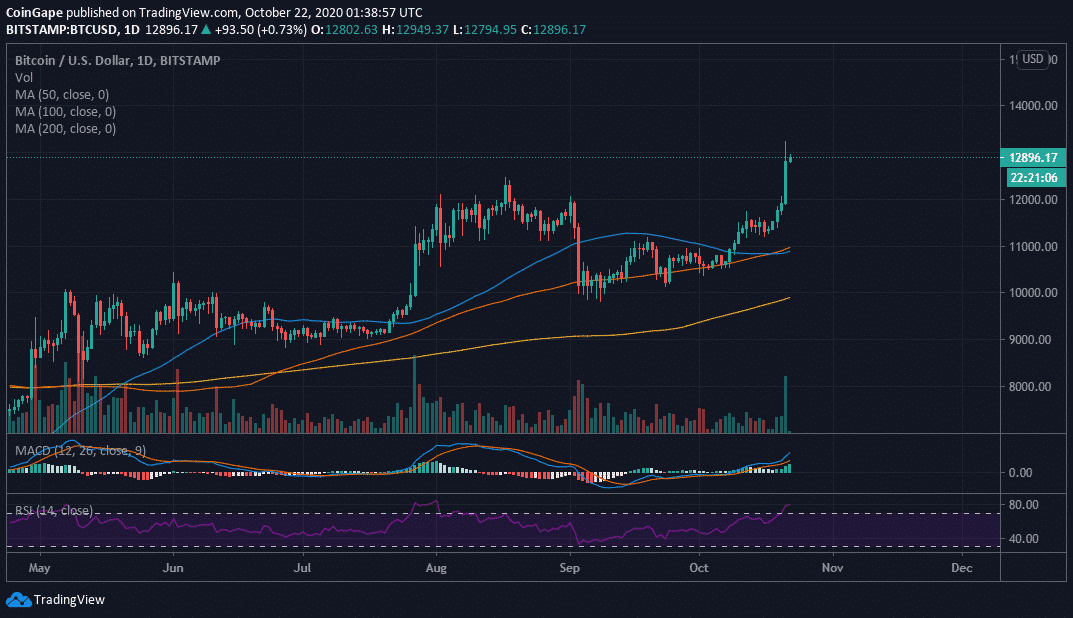

Meanwhile a minor retreat has seen the flagship retreat under $13,000. BTC/USD is doddering at $12,900 amid a building bullish momentum. Looking at the Moving Average Convergence Divergence (MACD), buyers appear to be comfortably sitting in the cockpit, ready to push the throttle forward.

BTC/USD daily chart

A bullish divergence above the MACD shines a light on the massive influence bulls have on the. The Relative Strength Index (RSI) confirms the bullish narrative as it settles in the overbought area.

According to IntoTheBlock’s IOMAP model, Bitcoin has no substantial resistance that could seriously hamper movement beyond $13,000. However, the minor seller congestion in the region between $13,286 and $13,672 must come down, to bring gains to $14,000 into the picture. Here, nearly 120,000 addresses previously purchased almost 67,000 BTC.

Bitcoin IOMAP chart

On the downside support gradually intensifies towards $11,000. On the other hand, the most robust anchor zone runs from $11,335 to $11,722. Here, approximately 2.5 million addresses previously purchased around 1.2 million BTC.

It is worth mentioning that overbought conditions tend so signal a potential reversal for a given asset. Therefore, it is essential that traders are aware of a possible retreat. Besides, bullish markets always have pulldowns.

Bitcoin Intraday Levels

Spot rate: $12,900

Relative change: 90

Percentage change: 0.72%

Trend: Bullish

Volume: High

Recent Posts

- Crypto News

PENGU Rises Despite Crypto Market Downtrend as Pudgy Penguins Appear on Las Vegas Sphere

PENGU price went up slightly even though the entire crypto market was on the decline…

- Crypto News

Binance Lists First Nation–Backed Stablecoin; CZ Reacts

Kyrgyz President Sadyr Zhaparov has announced a major launch tied to his country’s national currency.…

- Crypto News

U.S. Initial Jobless Claims Fall To 214,000; BTC Price Drops

The U.S. initial jobless claims fell last week, way below expectations, suggesting that the labor…

- Crypto News

BlackRock Deposits Millions in Bitcoin and Ethereum as CryptoQuant Flags Growing Bear Market Risk

Asset manager BlackRock has transferred millions of dollars in Bitcoin and Ethereum to the crypto…

- Mining

NiceHash Review: Trade HashRate and effectively manage your POW mining facility

Hashrates are essential in POW mining. They determine profitability and contribute to network security. Running…

- Crypto News

US SEC Deliberates Nasdaq Bitcoin Index Options Approval amid Rising Derivatives Demand

The US Securities and Exchange Commission (SEC) is moving forward with its review of a…