Bitcoin Price Pumps, but Miners are Dying – Willy Woo on How it Could Play-out

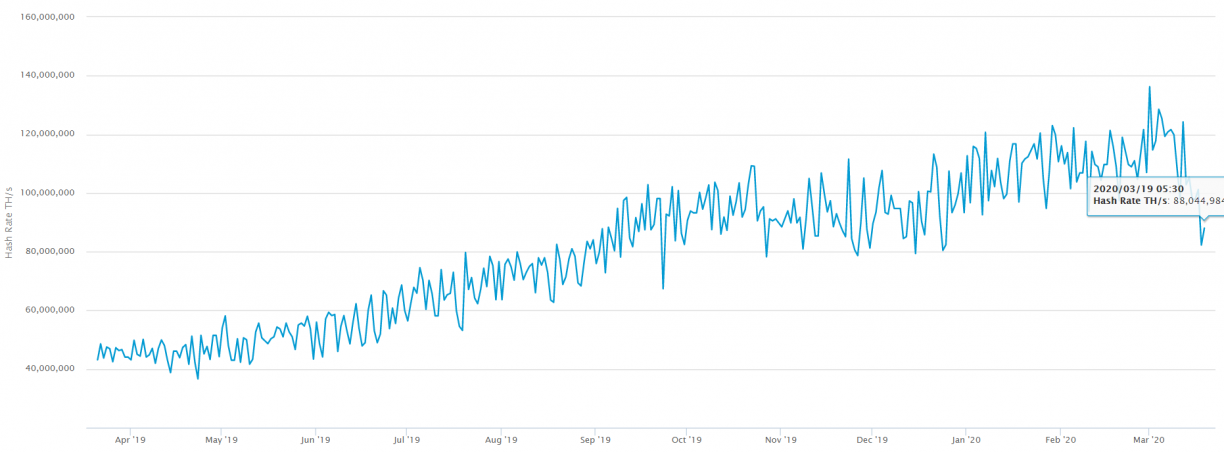

Bitcoin [BTC] price broke bullish yesterday, as the price broke above $6200 with a 14.3% rise on a daily scale. However, the total hash rate of miners is dropping sharply, now down over 35% after topping over 136,000,000 Th/s earlier this month.

Compression Force

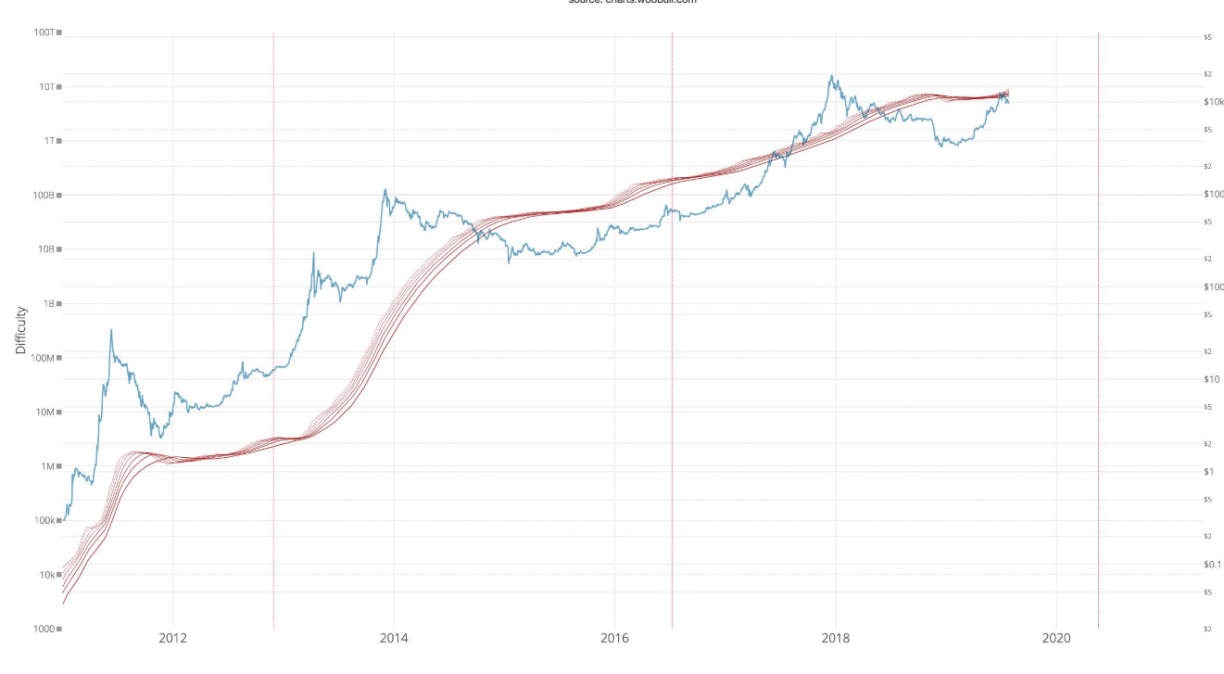

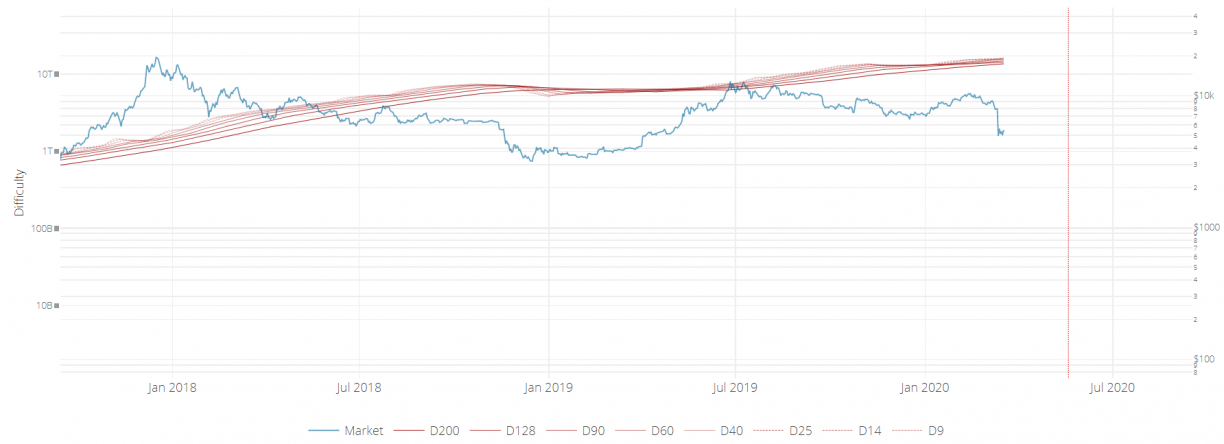

We will now beginning to see a compression in the difficulty ribbon. During the previous bear market in 2018-2019, the compression, following accumulation ended with the price becoming bullish. Willy Woo, leading on-chain analyst and partner of Adaptive fund tweeted in the past,

As price moves downwards, weak miners go out of business. This happened when we went $6k->$3k (in 2018), the bottom happened when weak miners were dead and no longer dumping onto the market. The market bottoms afterwards.

Nevertheless, this is an isolated incident, the sudden price drop by about 50% is equivalent to halving. We are witnessing an early miner capitulation with around 53 days to halving. Woo has also explained this situation in the past,

Miners capitulate in bears, but also during block reward halvening events when suddenly only half the coins are mined for the same costs and the market price has yet to catch up to pay for it. See the compression after each halvening (marked as vertical lines) as miners die off.

Momentary Bounce or Beginning of a Bull run?

During bull markets, the decompression of the difficulty bands and an uptrend occurs after accumulation on both charts. We are likely to see the beginning of accumulation phase after this severe capitulation.

Moreover, when suddenly many miners are going out of business, the smaller miners hodl their existing Bitcoins. Hence, the selling pressure is reduced at once, causing a pump. Moreover, the large scale miners have less incentives to sell, this creates bullish pressures.

The current price move of Bitcoin (from $5,500 to $6,200) as the hash rate continues to dip is reminiscent of this fact. We can expect the market to look for another bottom or the beginning of accumulation.

However, these have been bullish times in the past. Currently, we are not in a bull market as the previous times. The Coronavirus scare has caused a pandemonium in the investment asset markets. The price needs to build support above the 200-Day weekly average to re-establish the bull views again.

How do you think the halving and coronavirus scare is going to play-out this time? Please share your views with us.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Bitget Rolls Out Group-Based Maker Rates to Boost Liquidity Across Spot and Futures

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

Buy $GGs

Buy $GGs