Bitcoin Price Reconquers $31k As Blackrock Resubmits ETF Proposal – Will This Propel BTC to $38k?

The crypto market structure has improved immensely over the last few weeks. Although not explosive, the largest crypto, Bitcoin, boasts a 54.4% growth in the last 30 days, bringing its cumulative yearly gain to 63.5%.

Bitcoin’s bullish outlook, which firmly steadied in June, has continued into July, and according to market insights, it could propel BTC to $38,000.

Based on live data from CoinGape, Bitcoin price is up 1.4% on the day, but of more importance, bulls have reclaimed resistance at $31,000 and are working on closing the gap to the next hurdle at $32,000.

Bitcoin Price Triumphs As Selling Pressure Dwindles

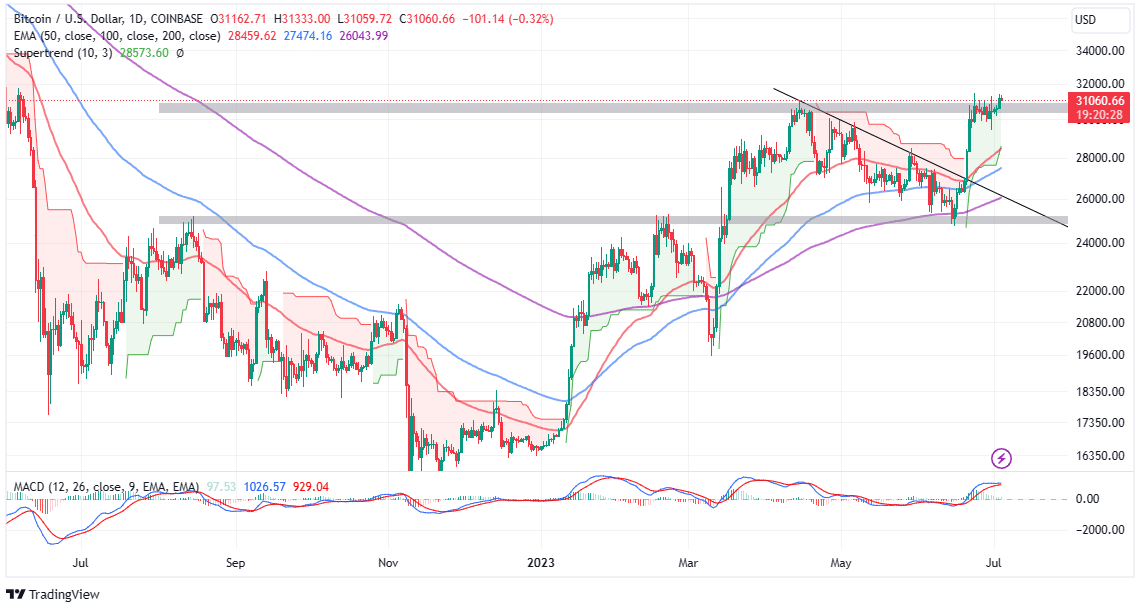

As discussed in our previous analysis, Bitcoin price was riding on a wave of several buy signals, starting with the Moving Average Convergence Divergence (MACD) indicator. In addition to flashing a buy signal in June, with the MACD line in blue crossing above the signal line in red, the momentum indicator crossed above the mean line, reinforcing the bullish outlook.

Subsequently, the SuperTrend indicator also flipped below Bitcoin price, thus validating the breakout from $25,000. This indicator overlays the chart like moving averages but goes a step further to gauge the volatility in the market by incorporating readings from the average true range (ATR).

Bitcoin will keep the uptrend intact as long as the SuperTrend indicator maintains its position below the price. Traders would anticipate an opposite reaction, with BTC cooling off if the volatility index flips above the price.

Notably, a daily close above $31,000 will go a long way to keep Bitcoin’s uptrend grounded. In other words, investors are likely to keep buying BTC if the elusive support at $31,000 obliges in the coming sessions.

On the other hand, a breakout above $32,000 would be another signal that Bitcoin price is finally on a trajectory to close the distance to two key levels: The stubborn seller congestion at $35,000 and the psychological resistance at $38,000.

On-chain insights from Santiment, a leading analytics platform, show that investor confidence has been increasing at a commendable rate, sparking interest in BTC accumulation.

However, “trader profits for BTC are a bit on the high end, which implies there could be a cooldown.”

😮 #Bitcoin is making a run at breaking $31.3k as key stakeholders show confidence and more accumulation signs. Trader profits for $BTC are a bit on the high end, which implies there could be a cooldown. #Altcoins like $UNI & $SHIB have tremendous #FUD. https://t.co/1bIwnEMpl2 pic.twitter.com/EjmyE9UG0f

— Santiment (@santimentfeed) July 3, 2023

With that in mind, it would be prudent to tread carefully while keenly watching Bitcoin’s reaction to major price points like the recently reclaimed $31,000 and the subsequent hurdle at $32,000.

A break above $32,000 could be a game changer and open the door for gains targeting $38,000. On the other hand, rolling back under $31,000 would mean that bulls are accepting defeat. This may encourage bears to double down their efforts and eventually push BTC below $30,000 with $25,000 beckoning.

Blacklock Refiles Spot Bitcoin ETF

According to a Bloomberg report, Blackrock has resubmitted its spot Bitcoin exchange-traded fund (ETF) to the US Securities and Exchange Commission (SEC) proposal via Nasdaq.

The new filings were made with the SEC on Monday, highlighting that Coinbase Global Inc. will play a pivotal role in market surveillance for the proposed ETF by the world’s most colossal asset manager.

This development came in response to the regulatory body’s previous assertion that the original filings lacked comprehensive and required details.

Companies interested in offering a BTC ETF had last week amended their proposals to provide more details, including VanEck and Fidelity Investments.

If approved, a spot Bitcoin ETF will be a gateway for institutional investors to participate in the crypto market, which many believe will fuel the next bull market.

Related Articles

- Just In: Twitter Cofounder Mocks Meta’s Threads App Ahead Of Launch

- Breaking: Meta Reveals Launch Date For Twitter Clone ‘Threads’ App

- Shiba Inu Hardware Wallets to be Delivered on this Date, SHIB Price Reacts

Recent Posts

- Crypto News

Solana Mobile’s SKR Token Launches Jan. 21: What to Know About the Seeker Airdrop

Solana Mobile has confirmed plans to introduce a new digital asset to its smartphone ecosystem.…

- Crypto News

Breaking: XRP Spot Trading Goes Live on Hyperliquid via Flare’s FXRP

Hyperliquid is currently offering XRP trading in the spot market through the Flare FXRP token.…

- Crypto News

Bitcoin Falls Despite U.S. JOLTS Job Openings Missing Expectations

Bitcoin has continued its decline today, having begun the year on a high, rising above…

- Crypto News

JPMorgan To Expand JPM Coin to Canton Network After Launch on Coinbase’s Base

JPMorgan has already indicated that it will migrate its blockchain-based deposit token, JPM Coin, on…

- Crypto News

Stablecoins Gain Infrastructure Boost as Morph Backs Startups with $150M

Morph has introduced a $150 million program to assist startups to make real-world payments on…

- Crypto News

YouTube Rival Rumble Partners With Tether to Launch Crypto Wallet; RUM Stock Rises

Video platform Rumble has announced the launch of its crypto wallet in partnership with USDT…