Bitcoin Price Stuck In Consolidation: Why Hope For Trading Above $10,000 Is Still Alive

- Volatility starts to make a comeback into the crypto market following a weekend session dominated by consolidation.

- BTC/USD bulls are focused on breaking the resistance at $9,300; a move that would pave the way for gains above $9,400.

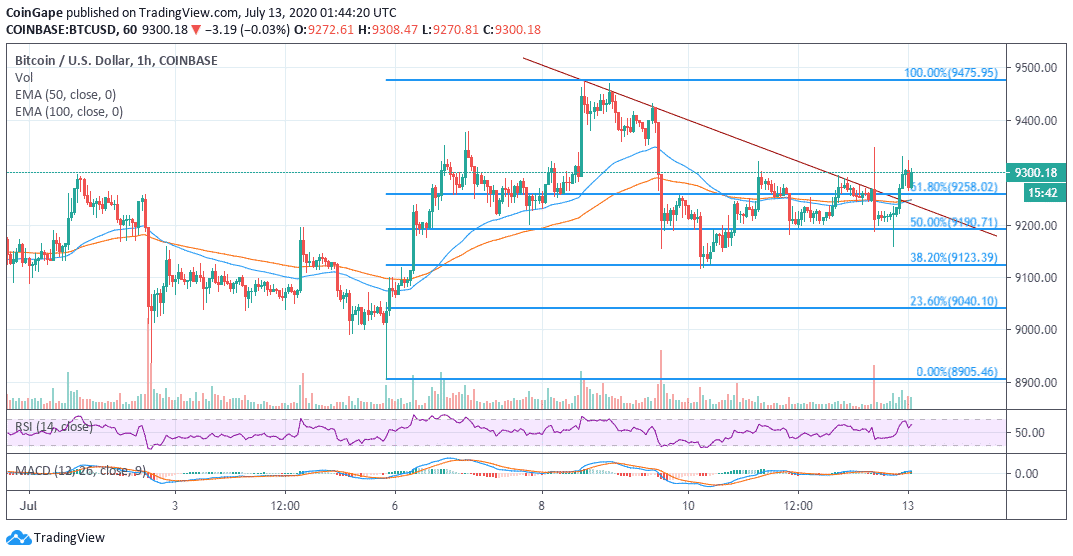

Bitcoin price has refused to budge and remains in consolidation in spite of a breakout above descending trendline resistance. The breakout saw Bitcoin climb past the 61.8% Fibonacci level taken between the last swing high of $9,475 to a swing low of $8,905. The gains extended above $9,300 but the weekend bullish action culminated at $9,330 (resistance). BTC/USD adjusted lower and confirmed the support at $9,200.

Read more: Bitcoin Technical Analysis: XBT/USD Fake Breakout Sabotages Rally To $10,000

Meanwhile, BTC/USD is dancing at $9,292 amid a bullish picture. Gains above $9,300 are likely in the ongoing Asian session but higher volatility is anticipated during the European session.

BTC/USD 1-hour chart

The Relative Strength Index (RSI) hints that buyers have begun to gain traction against the bulls. The indicator is pointing upwards after bouncing off support at the midline. The bullish picture is highlighted by the MACD. This indicator is holding the ground above the midline in addition to featuring a positive divergence. In other words, the trend is in the favor of the bulls and if the situation remain unchanged, Bitcoin would continue to grind north.

Related content: Huobi Launching Bitcoin Options, VP Bodes Positive News for Huobi Token [HT]

Resistance is anticipated at $9,400, $9,450 and $9,600. If Bitcoin brings down the seller congestion in these areas, there is a chance a new path to $10,000 would be created. For now, all the attention should go towards overcoming the hurdle at $9,300 and defending support at $9,200. Losses under $9,200 are likely to seek support at $9,000 and $8,900 respectively.

Bitcoin Intraday Key Levels

Spot rate: $9,292

Relative change: -5.96

Percentage change: -0.06%

Trend: Bullish

Volatility: Expanding

- ‘XRP Treasury’ VivoPower Abandons Crypto Strategy Amid Market Crash, Stock Price Dumps

- Bitcoin Crashes to $67K as Crypto Market Erases $2T in Market Cap Since October Record High

- Trump’s World Liberty Financial Dumps Bitcoin as BTC Falls Back to 2021 ATH

- CLARITY Act Markup Still On Course as Senate Puts Crypto Bill on Schedule, Lummis Assures

- Fed Rate Cut Odds Climb Following Weak Jobless Claims, JOLTS Job Openings Data

- BTC and XRP Price Prediction As Treasury Secretary Bessent Warns “US Won’t Bail Out Bitcoin”

- Ethereum Price Prediction As Vitalik Continues to Dump More ETH Amid Crypto Crash

- Why XRP Price Struggles With Recovery?

- Dogecoin Price Prediction After SpaceX Dogecoin-Funded Mission Launch in 2027

- Solana Price Crashes Below $95 for the First Time Since 2024: How Low Will SOL Go Next?

- Ethereum Price Eyes a Rebound to $3,000 as Vitalik Buterin Issues a Warning on Layer-2s