Bitcoin Price to $100K or $80K as Matrixport Predicts Bulls-Bears Impasse?

Highlights

- Bitcoin price enters a rare bulls-bears impasse amid market shift.

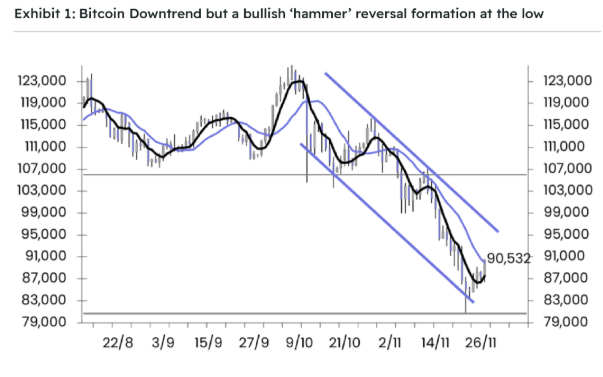

- Bullish 'hammer' reversal pattern formation and Thanksgiving lifted BTC above $91K.

- Bitcoin trend structure signals drop below $88K.

- BTC price holds above $91K after monthly options expiry.

Bitcoin price has just entered a rare zone of impasse between bulls and bears, according to crypto market expert Matrixport. Traders are noticing a stalemate between both bullish and bearish sentiments, prompting debate on whether Bitcoin price to rally towards $100K or crash to $80K.

Bitcoin Price Direction in Limbo Amid Major Market Shift

Thanksgiving sparked a rebound in Bitcoin price to above $91.8K, which typically occurs between the period until Christmas. The rebound was also supported by the formation of a bullish ‘hammer’ reversal pattern when BTC fell to $80K level, as per Matrixport.

However, Glassnode claims Bitcoin looks stuck in a range as liquidity thins and realized losses surge. Futures deleverage, options stay defensive, and demand remains weak.

Matrixport claimed a rare zone has formed where BTC positioning, investor sentiment, and macro policy are colliding. This coincides with a collapse in implied volatility and waning demand for crash protection.

Fed rate cut expectations revived inflows in spot Bitcoin ETFs and demand among investors. “This is where many traders misread wheat comes next,” Matrixport said. Bitcoin price rebound amid seasonal pattern support signals a rally towards $100K, but trend structure indicates otherwise.

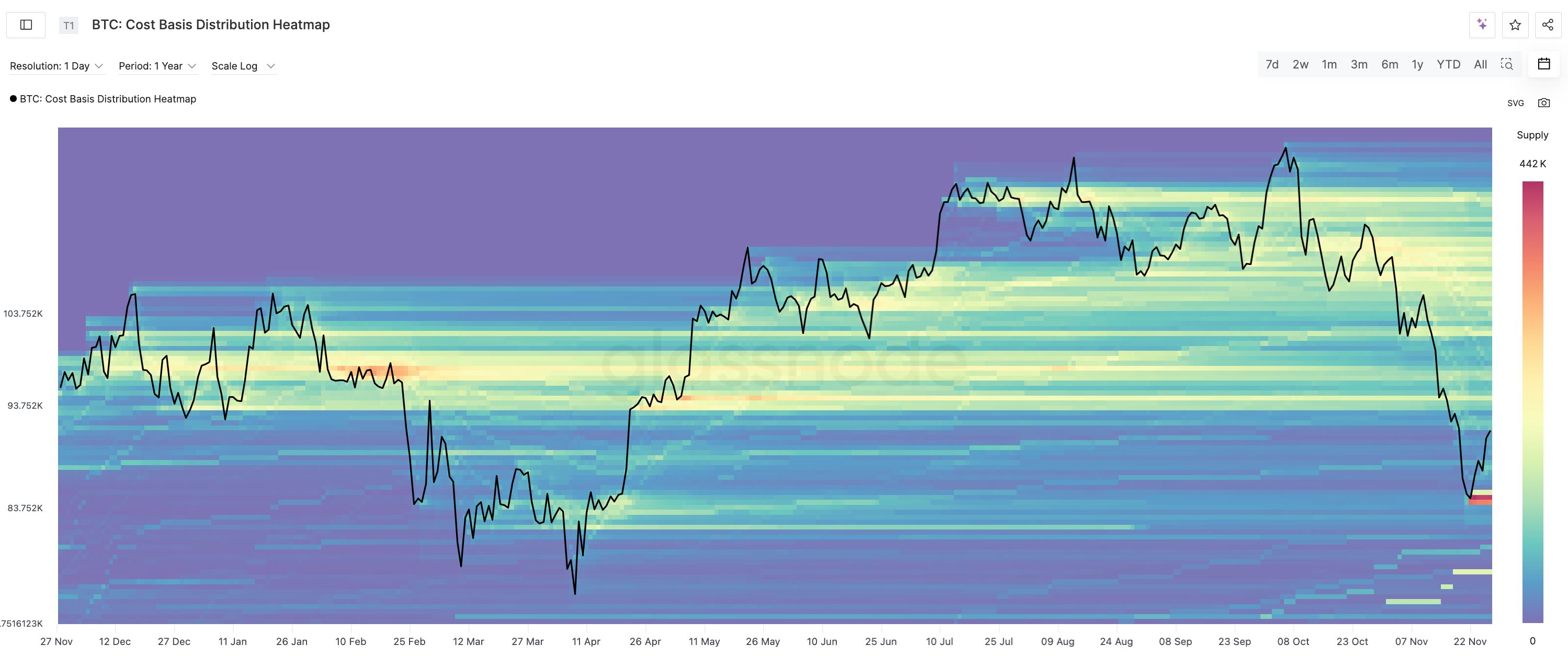

Bitcoin Cost Basis on-chain metric is in focus to drive prices further upwards. Breaking above the $93K-$96K supply cluster is a key prerequisite for upside momentum. If successful, Bitcoin price could move in the $100K-$108K range by year-end. However, some degree of resistance from recent buyers is expected.

BTC Holds Above $91K After Options Expiry

Over 147K BTC options with a notional value of $13.42 billion expired today on the largest crypto derivatives exchange Deribit. However, a balance between calls and options traders amid the stalemate kept Bitcoin price above $91K. This was anticipated as implied volatility collapsed after the recent rebound in the crypto market.

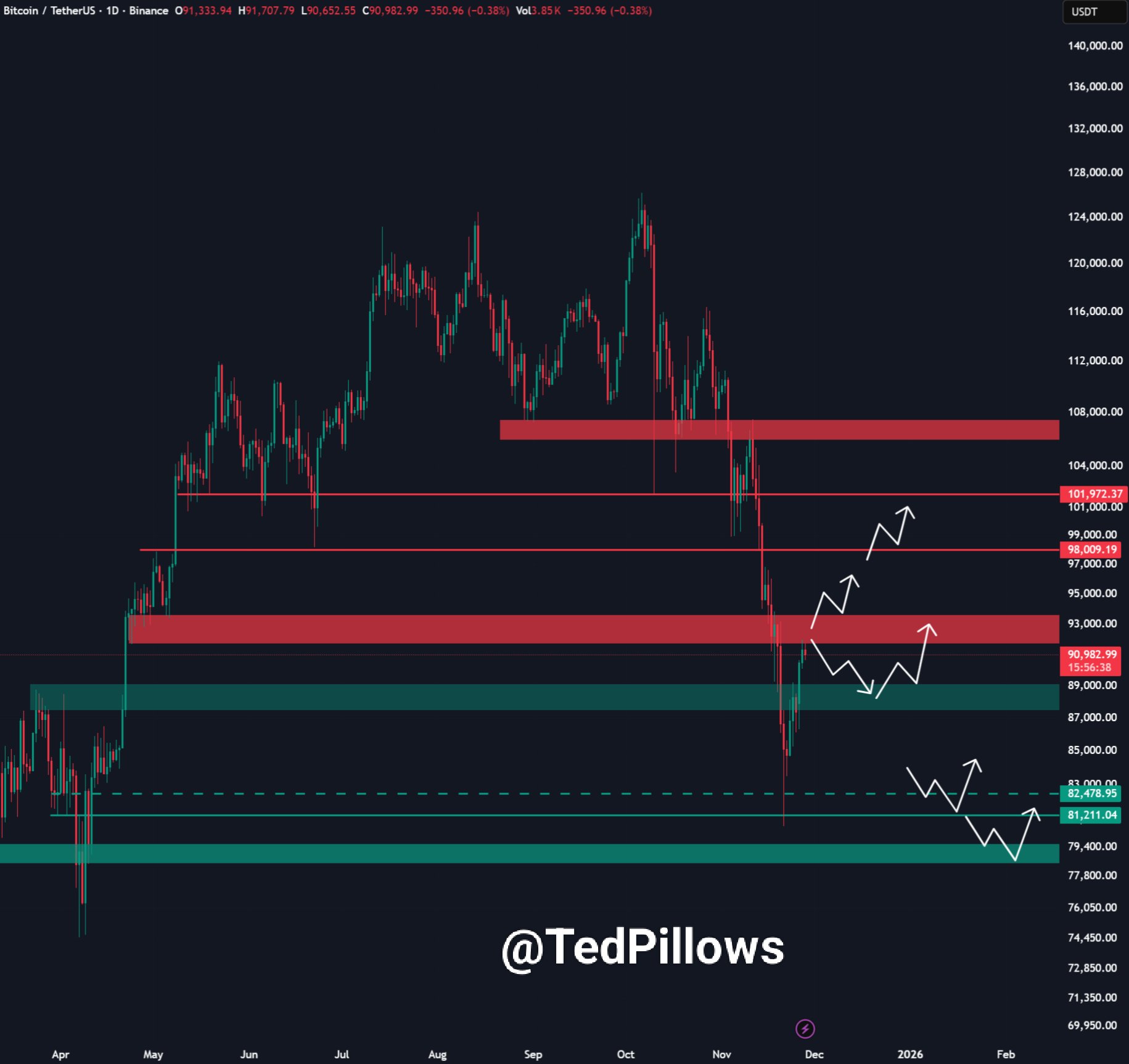

Analyst Ted Pillows pointed out strong resistance around the $92,000-$93,000 level. He predicts Bitcoin price rally to $100,000 following a successful reclaim above the resistance zone. Failing to reclaim could send BTC back below $88,000 level. Meanwhile, veteran trader Peter Brandt predicted a BTC crash to $60K.

Bitcoin price is currently trading at $91,856, with a 24-hour low and high of $90,471 and $91,829, respectively. Furthermore, trading volume has decreased by 32% over the last 24 hours, indicating a decline in interest among traders.

10X Research says, “Recent data suggests the market may be transitioning from a purely speculative regime into one increasingly driven by fundamentals and network growth.”

- Shiba Inu Launches Major Shibarium Privacy Upgrade Following New AI Gaming Deal

- Bitmine Immersion (BMNR) Buys 14,618 ETH Amid Rising Institutional Interest

- How Will Crypto Market React to Over $15B in Bitcoin, ETH, XRP Options Expiry?

- Balancer Set to Refund Investors After Recovering Funds From $128M Exploit

- Max Keiser Says New Bitcoin ATH “In Play” After Nasdaq’s IBIT Options Filing

- Solana Price Set for Upside as SOL Hits Record 99% Tokenized Stock Share

- Is XRP Price Gearing Up for a Rally as Reserves Collapse?

- Dogecoin Price Hovers Above $0.15 as Bulls Eye a Fresh Breakout

- Shiba Inu Price Could Rally As SHIB Burn Rate Surges 790% in 24H

- Binance Coin Price Faces Steep Risk as Key BSC Metric Crashes 75%

- Zcash Price Prediction — Is a Rally Ahead After Grayscale’s Bold ZEC ETF Bid?