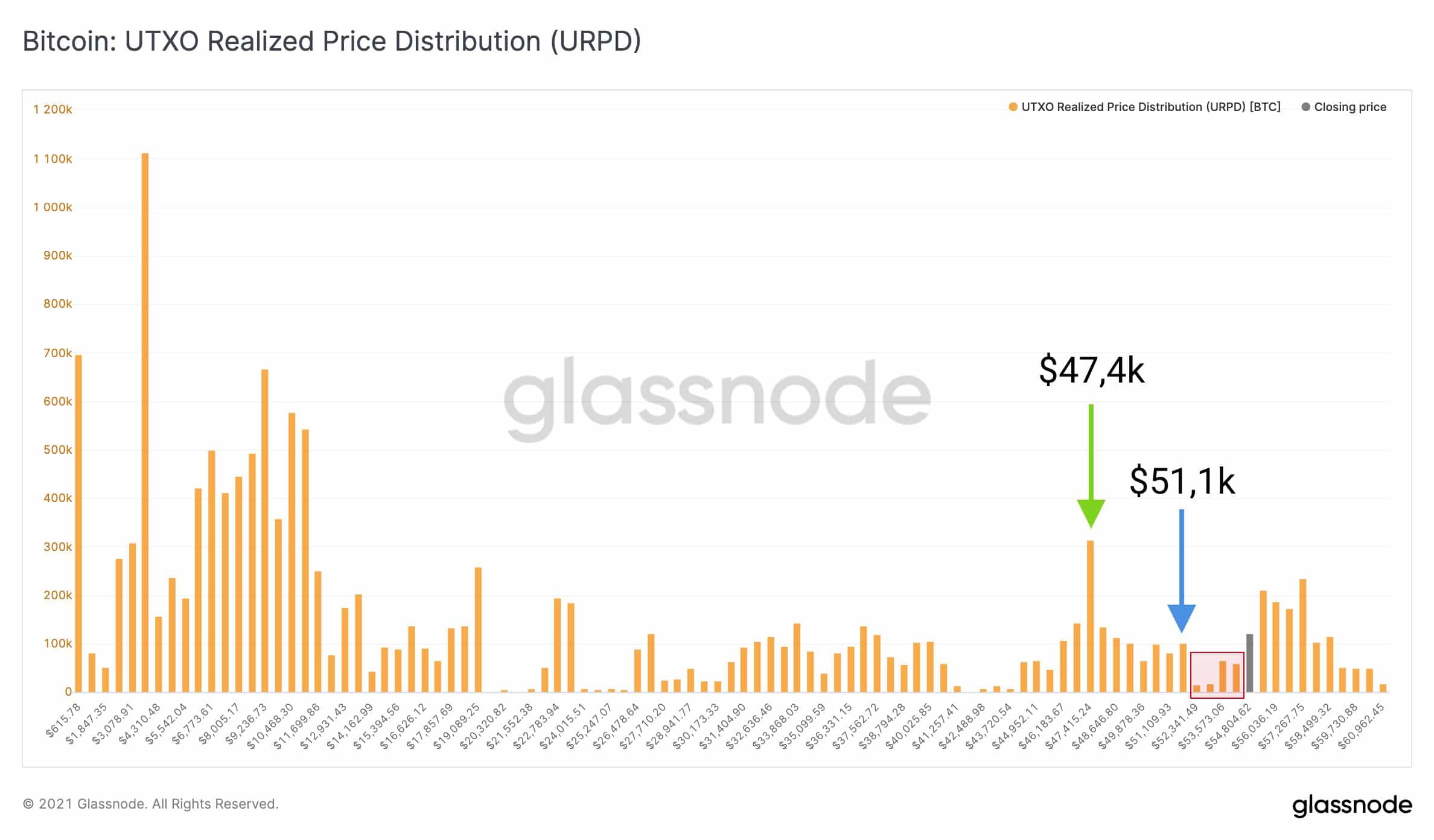

Bitcoin Realized Price Distribution Predicts $47K as Strongest Support Amid Price Correction

Bitcoin price correction of $5K today could indicate a possible further downside in price as the strongest on-chain support for the top cryptocurrency stands at $47,400. The Bitcoin realized price distribution suggests that there is not much price realization until $51K. The realized price of Bitcoin is at around $16.1K

Bitcoin realized price is the average price at which each Bitcoin moved the last time in the network. It is the average value that investors have assigned to BTC (according to their last on-chain movement).

The 2015 -> 2017 bull market

"Making a name"Density map of the coin supply at the price they last moved. #Bitcoin pic.twitter.com/IKgr7pVKLS

— Willy Woo (@woonomic) March 23, 2021

Bitcoin’s realized market cap which is the realized price divided by total circulation supply has seen a significant increase in 2021 alone rising from $170 billion at the start of the year to its current cap of 313 billion. This rise is primarily due to the influx of institutions and Fortune 500 companies like MicroStrategy who have moved Bitcoin worth millions at every major dip and even above $50K.

Bitcoin realized price breached $10K only this January and looking at Glassnode’s UTXO Realized Price Distribution not much bitcoin was moved since the price touched $51K with the strongest on-chain support at $47.4K.

Would Bitcoin Price Retrace to Sub $50K Levels?

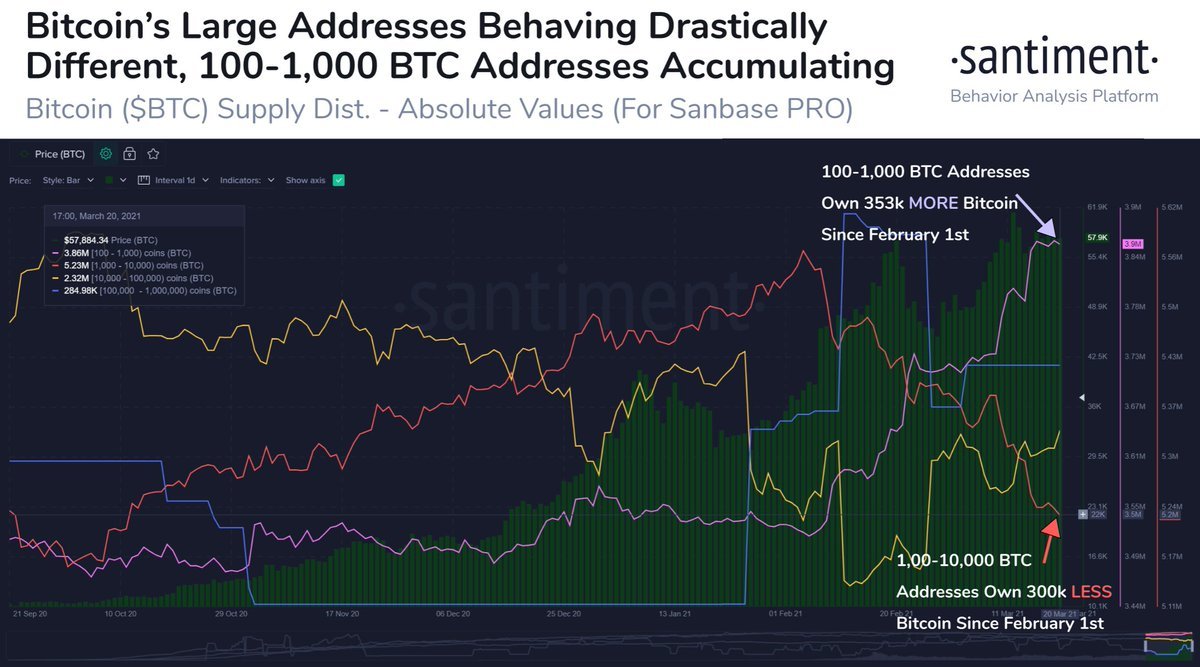

On-chain metrics such as exchange flow and net flow suggest there is not much movement of Bitcoin on Exchanges and a significant portion of the Bitcoin transactions are occurring through OTC desks. The larger whales have continued accumulating bitcoin while smaller whales continue to take profit. Bitcoin price has also registered around 20% correction after each new ATH in the previous two months. Taking these factors into consideration, Bitcoin could see a further downside below $50K and enter another consolidation phase before moving up.

On-chain indicators along with growing market awareness as well as traditional banking giants joining the Bitcoin league this month combined suggest that there is still a lot of demand for Bitcoin in the market. Many believe the weak hands would move out every ATH and the ongoing bull run is mimicking the 2016 price movement rather than 2017 as Bitcoin price has tripled 2017 high and also continued climbing up while consolidating on previous gains.

- Will Bitcoin & Gold Fall Today as Trump Issues Warning to Iran Before Key Nuclear Talks?

- Epstein File Reveals Crypto Controversy: 2018 Emails Reference Gary Gensler Talks

- Wintermute Expands Into Tokenized Gold Trading, Forecasts $15B Market in 2026

- Bitcoin Shows Greater Weakness Than Post-LUNA Crash; Is a Crash Below $60K Next?

- XRP Tops BTC, ETH in Institutional Flows As Standard Chartered Lowers 2026 Forecasts

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?