Bitcoin Still Undervalued, JPMorgan Forecasts Rally to $165,000

Highlights

- According to JPMorgan, Bitcoin price might go to $165,000, claiming it is currently undervalued compared to gold.

- Bitcoin ETFs raise in $675.8 million daily, strengthening Bitcoin’s mainstream adoption.

- The difference in value highlights Bitcoin’s growing role as digital gold.

JPMorgan says Bitcoin (BTC) is undervalued compared to gold and could rise to $165,000, giving it a potential 42% upside. The bank highlighted that BTC’s volatility relative to gold has dropped below 2.0, making it increasingly attractive to investors. Analysts argue that the recent surge in gold prices has widened the valuation gap, suggesting Bitcoin’s fair value should be much higher.

JPMorgan Highlights Bitcoin’s Undervaluation As ETF Inflows Hit $675.8 Million

According to the JPMorgan analysis shared by Matthew Sigel, a VanEck executive, Bitcoin currently consumes only 1.85 times more risk capital than gold. On this basis, they estimate that BTC’s market capitalization of $2.3 trillion would need to expand by close to $1 trillion.

That would bring its valuation closer to $3.3 trillion and set BTC price at $165,000. BTC price is currently $119,000 remains about 34.5% below JPMorgan’s projected fair value target of $160,000.

The estimate is based on aligning Bitcoin’s risk-adjusted value with the roughly $6 trillion invested in gold through bars, coins, and ETFs.

It states in the note that the rise in the price of gold makes it more costly to use as a safety net. Hence, Bitcoin is less costly. Due to this fact, Bitcoin has a comparative advantage, as investors might transfer funds from gold to digital assets. This view contrasts with gold advocate Peter Schiff, who recently criticized Bitcoin’s performance following gold’s rally.

JPMorgan stressed that the calculation is mechanical and based purely on volatility-adjusted comparisons, but the conclusion still signals a strong upside for Bitcoin.

At the same time, BTC ETFs are showing historic strength. Data from SoSoValue reveals that U.S. spot Bitcoin ETFs recorded $675.8 million in daily inflows. With nearly $156 billion now locked in ETF holdings, Bitcoin’s financial footprint is already comparable to some gold-backed funds.

Valuation Gap Highlight BTC’s Growing Credibility As Digital Gold Rival

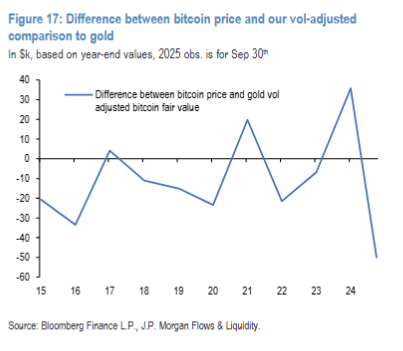

The bank also noted that the difference between BTC price and its fair value. According to them, when adjusted for gold’s volatility, this has reached historic lows. In fact, a number of major institutions are echoing bullish sentiment. Citigroup recently predicted Bitcoin price could climb to $231,000 within 12 months.

A chart included in the report shows that Bitcoin is undervalued by more than $50,000 relative to its fair value model. This gap highlights how much BTC would need to climb to restore equilibrium with gold. By linking BTC’s fair value to gold, JPMorgan gives investors a benchmark that could guide their investments in the future.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senator Elizabeth Warren Targets Trump-Affiliated World Liberty Financial Over Bank Charter Bid

- JPMorgan Projects Bullish Crypto Market in H2 Following CLARITY Act Approval

- Hong Kong Moves Closer to Crypto Tax Cuts Amid Stablecoin Regulatory Framework

- Popular Analyst Willy Woo Predicts Major Bitcoin Price Crash, Bear Market Bottom Timeline

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs