Bitcoin Technical Analysis: BTC Retreat Imminent After Hitting Barrier At $10,800

- Bitcoins bullish momentum loses steam on encountering the 50-day EMA resistance.

- Declines linger as long as BTC cannot climb above the 50% Fibonacci level.

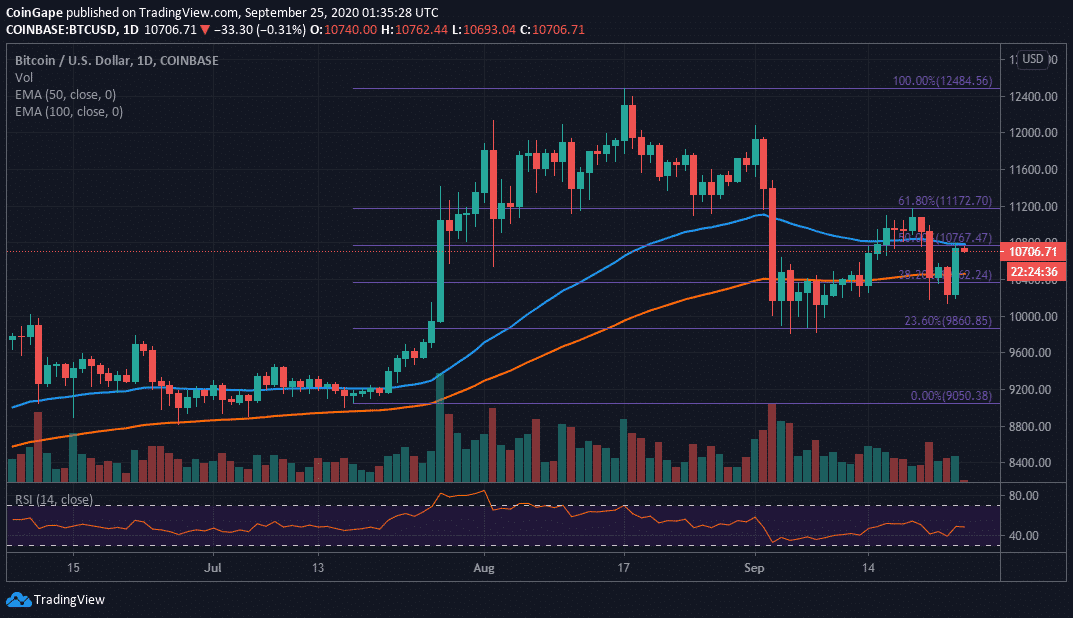

Bitcoin explored levels in the key support range between $10,000 and $10,200 earlier this week. The last few days have been used by the bulls to correct the retracement from the resistance at $11,200. Initially a hurdle at $10,600 sent buyers back to the drawing board. However, Bitcoin sprung upwards once again on Thursday. This time the hurdle at $10,600 was easily pushed into the rearview. Unfortunately, bulls seem to be struggling with the resistance at the 50% Fibonacci taken between the last swing high of $12,484 and a swing low of $9,050.

The Relative Strength Index (RSI) has recovered from levels closer to the oversold but is holding ground at the midline. A sideways movement suggests that bulls are getting exhausted. It is essential that the resistance at $10,788, a confluence formed by the 50-day Exponential Moving Average (EMA) and the 50% Fibonacci level is overcome.

Read also: Bitcoin Price Prediction: BTC Upward Momentum Stalls Under $10,600 But Bulls Eye $11,000

BTC/USD daily chart

The movement to the north will give the flagship cryptocurrency energy to bring down the resistance at $10,800. Buyers will also get an opportunity to shift their focus to $11,000 and $11,200, respectively.

It is worth mentioning that the failure to rise above the immediate resistance at the confluence could culminate in Bitcoin settling for a retreat in order to create demand at lower levels. On the downside, support is envisaged at the 100-day EMA. If declines overshoot this zone, the support range at the beginning of the week will come in handy. Note that, September’s primary support at $9,800 remains intact and the last resort that could be used to halt declines eyeing $9,500 and $9,000.

Bitcoin Intraday Levels

Spot rate: $10,706

Percentage change: -0.32%

Relative change: -0.34

Trend: Short term bearish bias

Volatility: Low

Read more: Four Things to Know About Purchasing Bitcoin Safely

- Is a Bitcoin Bull Run Possible in 2026? Here’s Why Arthur Hayes Thinks Yes

- Trump’s World Liberty Bank Charter Advances as OCC Rejects Senator Warren Criticism

- Gemini Lawsuit Dismissed: SEC Drops Case After Full Investor Recovery

- Crypto Market Bill Markup Now Uncertain As Senate Cancels Monday Sessions

- CLARITY Act: Gillibrand Sees Path Forward for Crypto Bill as Democrats Clash Over Presidential Ban

- Binance Coin Price Outlook As Grayscale Files S-1 for BNB

- Solana Price Prediction as SOL ETF Inflows Outpace BTC and ETH Together

- Bitcoin and Gold Outlook 2026: Warsh, Rieder Gain Traction in Trump’s Fed Pick

- PEPE Coin Price Eyes 45% Rebound as Buyers Regain Control on Spot Markets

- Pi Network Price Prediction: Will PI Coin Hold Steady at $0.18 Retrace Lower?

- Dogecoin Price Prediction as 21Shares Announces DOGE ETF