Bitcoin Tops $16,000 In Aggressive Fight For New Yearly High, How Nigh Is The Correction?

- Bitcoin achieves new yearly highs but buyers have their eyes glued on the $20,000.

- A paralyzing breakdown might come into the picture if Bitcoin corrects beneath $16,000.

Bitcoin finalized the journey to $16,000 Thursday, proving to the world that it is in a full-blown bull cycle and is not about to stop. The flagship cryptocurrency achieved new yearly highs at $16,500 but appears to have stalled. At the time of writing, BTC/USD is changing hands at $16,400 after a minor correction.

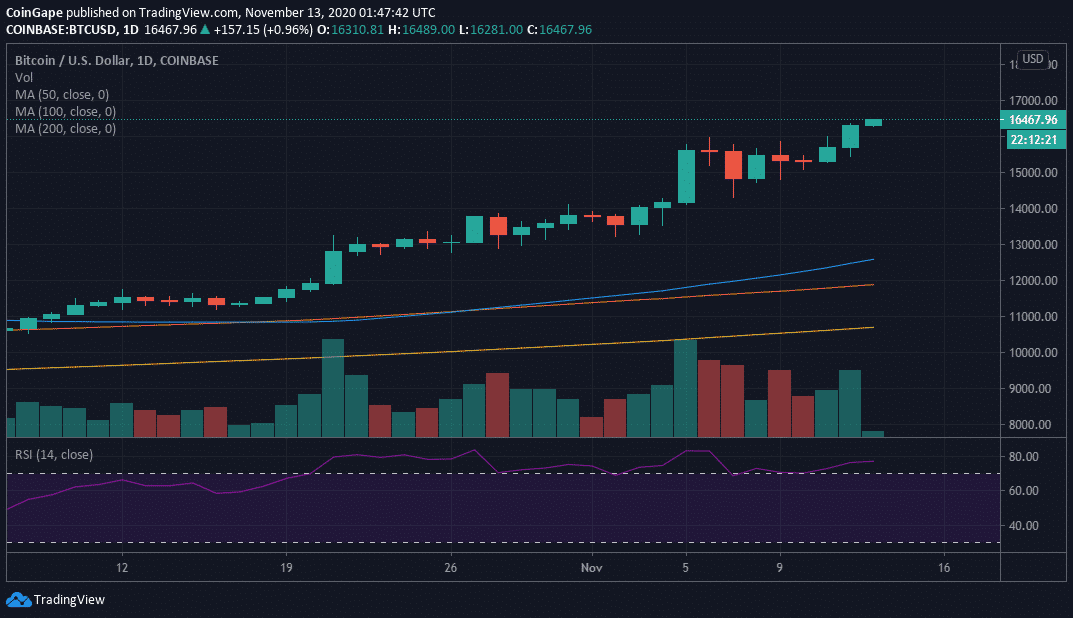

The trend is largely in the hands of the bulls despite the shallow correction. For now, all eyes are glued on $17,000, while the ultimate goal is to see Bitcoin trading above $20,000. A golden cross on the daily chart gives credence to the bullish outlook. A gold cross is formed when a short-term moving average crosses above a longer-term one.

For instance, recently the 50-day Simple Moving Average (SMA) reclaimed its position above the 100-day. Also adding credibility to the bullish narrative is the uptrend of the MAs slightly below the rallying prices.

BTC/USD daily chart

Consolidation is likely to come into the picture, allowing buyers to a hiatus before planning the next angle of attack on higher levels, starting with $17,000. The Relative Strength Index reinforces the possible consolidation following the immense created at the midline.

Price above $17,000 could be the final guarantee for Bitcoin trading above its all-time high as the fear of missing out is likely to engulf investors. An increase in buy orders might create enough volume to support Bitcoin in the run-up to new all-time highs.

It is worth noting that a correction will come into play if BTC falls under $16,000. Fear and panic may also creep into the market, causing an upsurge in sell orders and creating immense selling pressure to force a massive breakdown. Support is anticipated at $15,000, $14,000 and $13,000. Other key levels to keep in mind include the 50 SMA, the 100 SMA, and the 200 SMA.

Bitcoin Intraday Levels

Spot rate: $16,486

Relative change: 176

Percentage change: 1%

Trend: Bullish

Volatility: Low

- Breaking: SUI Price Rebounds 7% as Grayscale Amends S-1 for Sui ETF

- Bitget Targets 40% of Tokenized Stock Trading by 2030, Boosts TradFi with One-Click Access

- Trump-Linked World Liberty Targets $9T Forex Market With “World Swap” Launch

- Analysts Warn BTC Price Crash to $10K as Glassnode Flags Structural Weakness

- $1B Binance SAFU Fund Enters Top 10 Bitcoin Treasuries, Overtakes Coinbase

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown

- Ripple Price Prediction As Goldman Sachs Discloses Crypto Exposure Including XRP