Bitcoin [BTC] Myth Buster: Volatility Now Lower Than Multiple Stocks

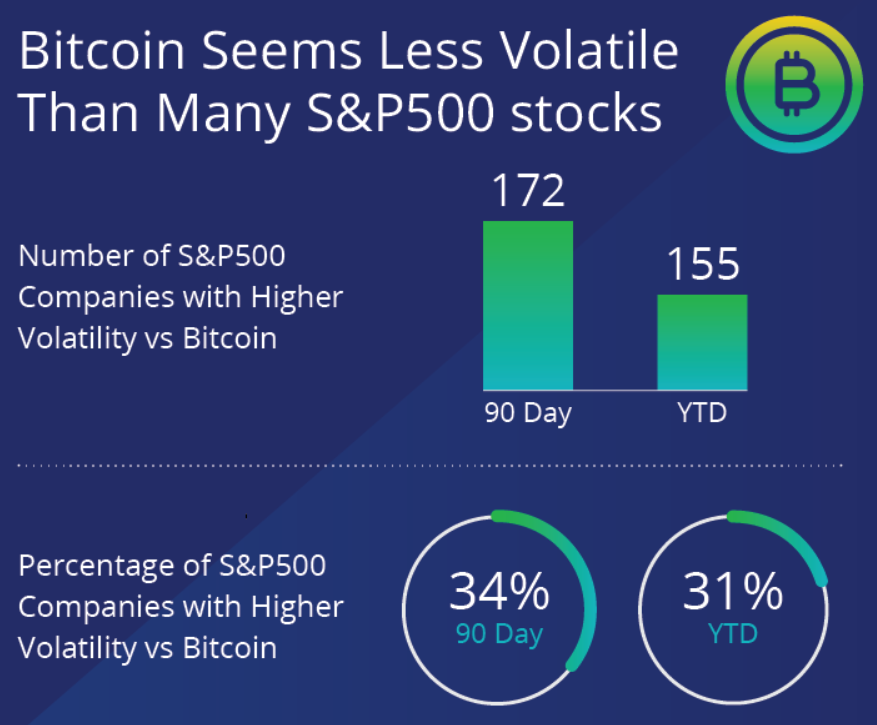

Research around Bitcoins volatility in comparison with the equities included in the S&P 500 index reveals that Bitcoin’s realized volatility from the beginning of the year and a 90-day period is better than many stocks. The research finds,

… bitcoin has exhibited lower volatility than 172 stocks of the S&P 500 in a 90 day period and 155 stocks YTD

Gabor Gurbacs, the Director Digital Asset at VanEck who led the research tweeted,

#Bitcoinoften gets criticized for its volatility. Our research indicates that a significant number of established publicly traded stocks in the #SP500 have been more volatile than Bitcoin.

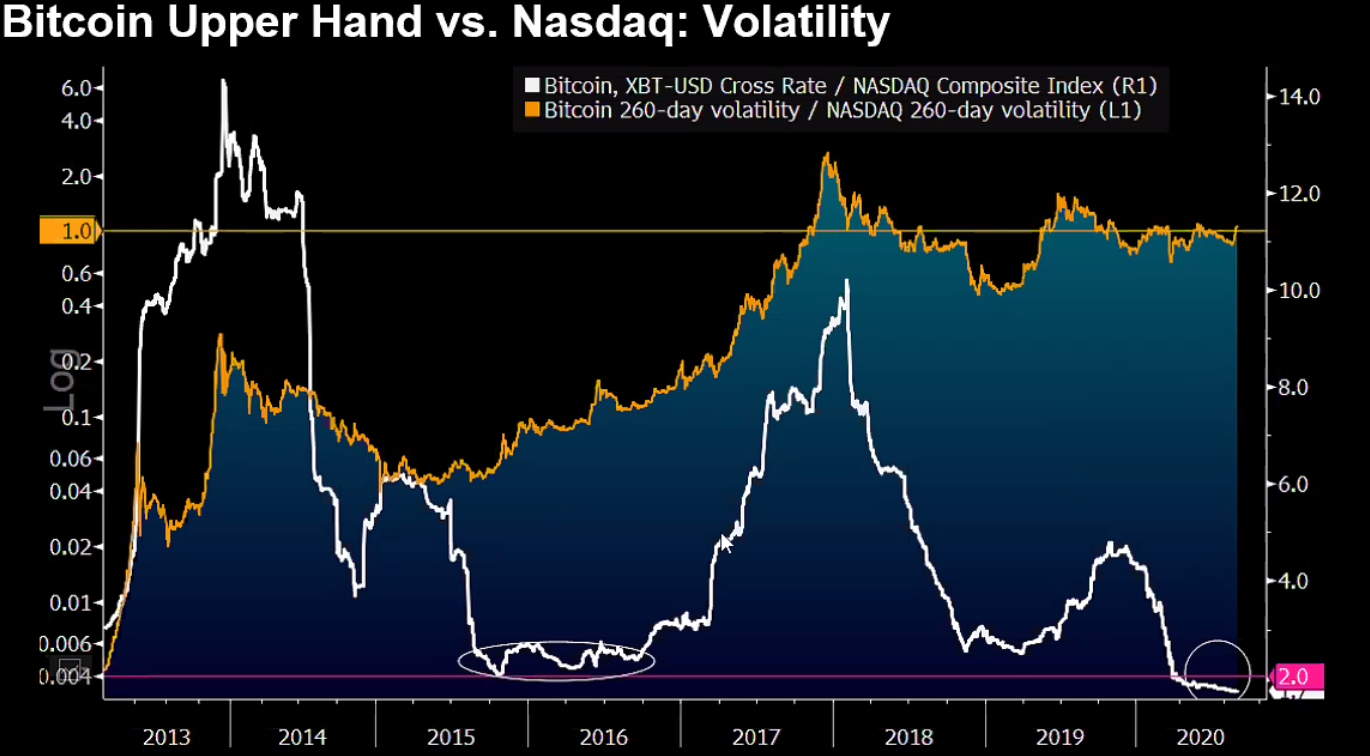

While 30% of stocks is a huge number, there are other things to consider in this regards. It is the distribution of stocks in the S&P 500 index. Like crypto markets, NASDAQ and S&P 500 index distribution is skewed towards major indices; top 5-10 stocks account for the majority of the dominance. Hence, there are many low stocks with lower liquidity and market capitalisation. Moreover, the COVID-19 effect on the economy is also an outlier causing massive swings in price. Nevertheless, the narration even confirms with stocks included in the NASDAQ index. Mati Greenspan, the founder of Quantum Economics, noted on the drop in realised volatility compared to Nasdaq. He tweeted,

Bitcoin volatility way lower than the Nasdaq by historic measures.

The measure of Implied Volatility

The massive open interest (OI) across the options market is calling for tremendous volatility in Bitcoin. Deribit Exchange Market Insights tweeted last night,

$BTC 11k gravitational pull. With July31 11k Calls Open interest at 4.5k (Puts OI 1k) and Implied Vol 50%, longs have a short 24hour window to hope for escape velocity.

Even with the expiration of options and futures contracts today, due to roll-over of contracts, the OI can be expected to remain high. Bitcoin is currently trading at $11,307, 1.62% higher on a daily scale.

Do you think a massive break-out is probable in this weekend as well? Please share your views with us.

- Bitcoin Shows Greater Weakness Than Post-LUNA Crash; Is a Crash Below $60K Next?

- XRP Tops BTC, ETH in Institutional Flows As Standard Chartered Lowers 2026 Forecasts

- Bitcoin vs. Gold: Expert Predicts BTC’s Underperformance as Options Traders Price in $20K Gold Target

- CLARITY Act: White House to Hold Another Meeting as Crypto and Banks Stall on Stablecoin Yield Deal

- Bitcoin as ‘Neutral Global Collateral’? Expert Reveals How BTC Price Could Reach $50M

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?